Until now, consumer fintech has been all the rage, but recent funding rounds and exits including Plaid’s US$5.3 billion sale to Visa, Social Finance (SoFi)’s US$1.2 billion acquisition of Galileo, and nCino’s initial public offering (IPO), might very well indicate that 2020 will be the year of business-to-business (B2B) fintech, according to Patricia Kemp, co-founder and managing partner at venture growth equity fund Oak HC/FT.

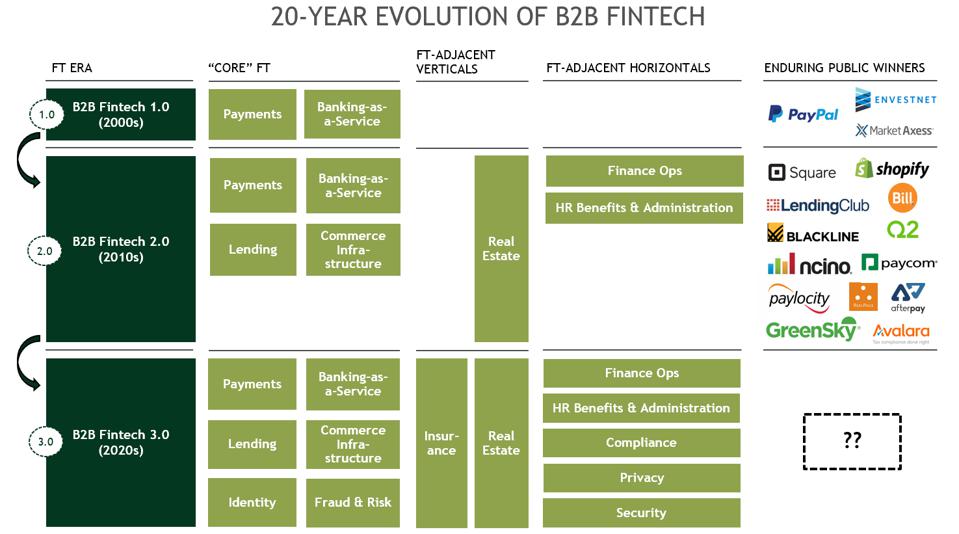

Modern B2B fintech has evolved and matured since it first started in the early 2000s with companies mainly focused on payments and banking-as-a-service such as PayPal and MarketAxess. In the 2020s, the market will see fresh winners emerge in adjacent horizontals and verticals, including insurtech, compliance, privacy and security, Kemp wrote in a Forbes piece.

20-year evolution of B2B fintech, Source: Patricia Kemp via Forbes

“The 2020s are going to be an incredibly exciting time to be building and investing in B2B fintech,” Kemp wrote. She estimates that within the next ten years, the number of B2B fintechs going public will triple, generating well over US$1 trillion in total aggregate value.

Looking at current fintech funding trends, it’s apparent that a shift from consumer fintech to B2B fintech is happening. According to an analysis by advisory firm Cornerstone Advisors, 21% of all fintech funding of the past year has gone towards firms building fintech to support financial institutions and other fintechs, showcasing that investors’ focus is beginning to move away from business-to-consumer (B2C) fintech.

2020 YTD Fintech Funding by Category, September 1, 2020, Source: Ron Shevlin via Forbes

COVID-19 puts the spotlight on fintech enablers

One driver behind this shift is the ongoing COVID-19 pandemic, which has significantly accelerated banks’ digital transformation initiatives.

Data from McKinsey show that consumer and business digital adoption has vaulted five years forward in matter of around eight weeks. In Switzerland, banks are witnessing a substantial shift in consumer behavior amid the health crisis, with rapid increases in digital opening of new relationships (up over 70%), registration and usage of mobile pay applications (up over 80%), and usage of contactless payments (up over 30%), Karin Oertli, COO of Personal and Corporate Banking and Switzerland at UBS, wrote in a post on the World Economic Forum last month.

These new consumer behavior habits will force incumbents to turn to so-called fintech enablers to help them not only gain in efficiency but also serve customers better, experts and industry observers have said.

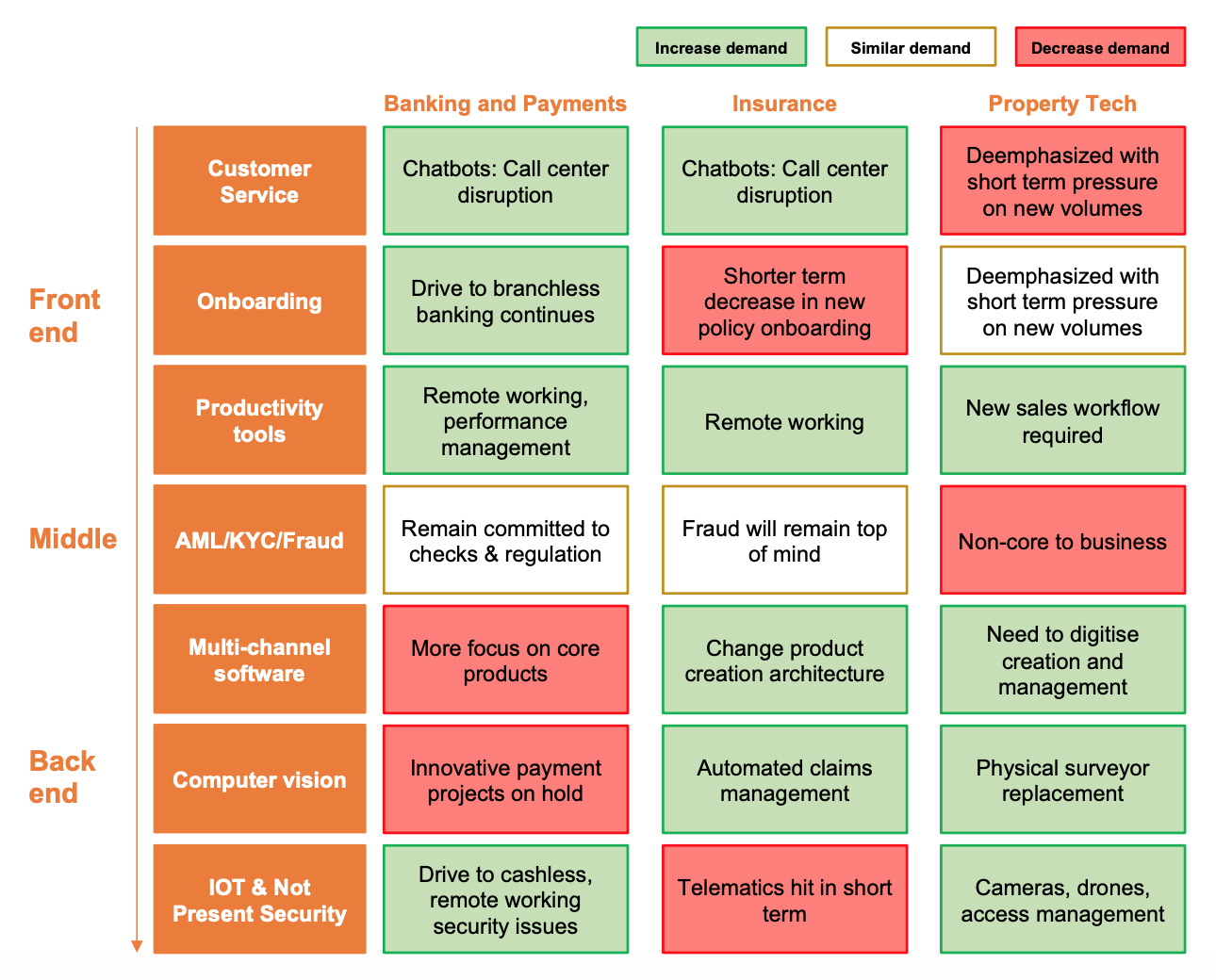

According to Finch Capital, an early-stage venture capital firm focusing on Europe and Southeast Asia, fintech enablers will gain notable traction as demand from traditional financial institutions for artificial intelligence (AI), the Internet-of-Things (IoT) and software-as-a-service (SaaS) surges amid the pandemic, the firm said in a report released earlier this year.

Fintech enablers expect a boost in demand, Source: The Future of Disruptive and Enabling Financial Technology post CV-19, Finch Capital, April 2020

B2B fintech in Southeast Asia

In Southeast Asia, B2B fintech has remained rather underdeveloped – with the exception of Singapore – but early movers like credit scoring startups Trusting Social have reaped the benefits of being early market entrants.

Founded in 2013, Trusting Social is a startup headquartered in Singapore but originally from Vietnam that uses big data technologies, advanced credit modeling and mobile data to provide alternative credit scoring for emerging markets. Trusting Social claims it currently covers more than 500 million consumers across India, Indonesia and Vietnam, and has raised US$44 million in funding so far, according to Crunchbase, from investors that include Sequoia Capital, 500 Startups, Kima Ventures and BeeNext.

Unlike most Southeast Asian markets like Vietnam, the Philippines and Indonesia where B2C fintechs make up most of the sector, Singapore’s fintech companies have been predominantly focused on providing services to corporates.

PwC and Singapore Fintech Association, which surveyed last year 832 individuals working across 394 fintech firms, found that over half worked in a fintech company operating under either a B2B, or both a B2B and B2C model. Only 8.6% operated exclusively under a B2C business model.

Notable B2B fintech companies from the city-state include SmartKarma, an investment research network, Active.ai, a startup that uses AI to deliver conversational banking services, BetterTradeOff, which offers personalized life-planning, and Silent Eight, a regtech firm that has developed a solution for customer screening and transaction monitoring.

While B2B fintechs in South East Asia are nowhere near as big as its European counterparts, all signs to point towards similar trends happening in this part of the world.

Featured image credit:Water photo created by mrsiraphol – www.freepik.com