Challengers Bank Raised Over US$6.8 Billion in 2020 to Disrupt Traditional Banking

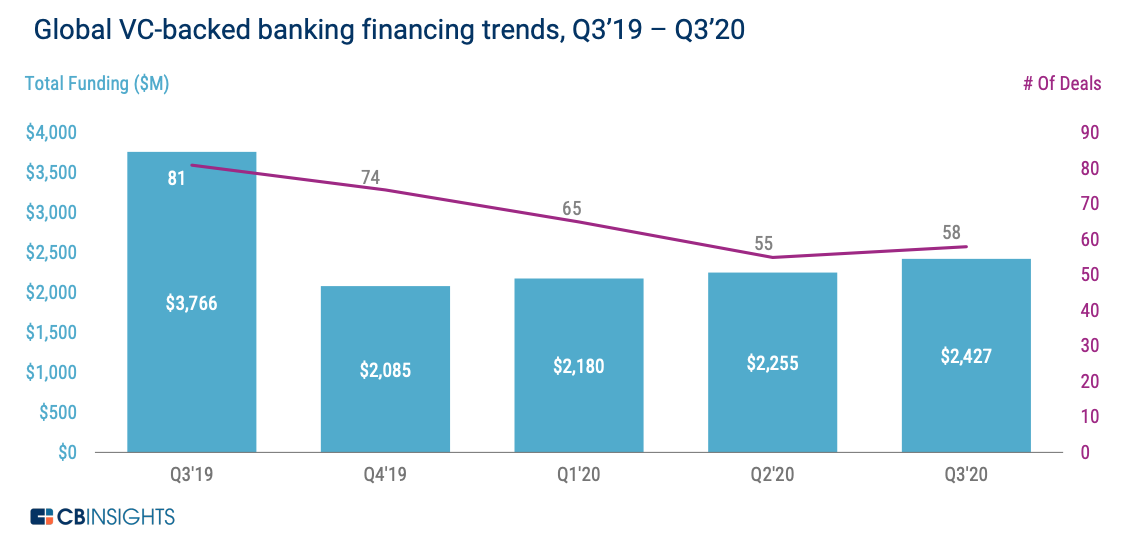

by Fintech News Singapore December 2, 2020Challengers banks continue to attract investors’ interest, raising US$2.4 billion through 58 deals in Q3’20. This brings the total amount of funding raised by digital banking players so far this year to more than US$6.8 billion, according to CB Insights’ State of Fintech Q3’20 Report.

Global VC-backed banking financing trends, Q3’19 – Q3’20, Source: The State of Fintech Q3’20, CB Insights

Deals in Q3’20 included Switzerland’s Neon (EUR 4.6 million), Point from the US (US$10.5 million), Spain’s Bnext (US$13 million), Finom from the Netherlands (US$12 million), and C6 Bank from Brazil (US$96 million).

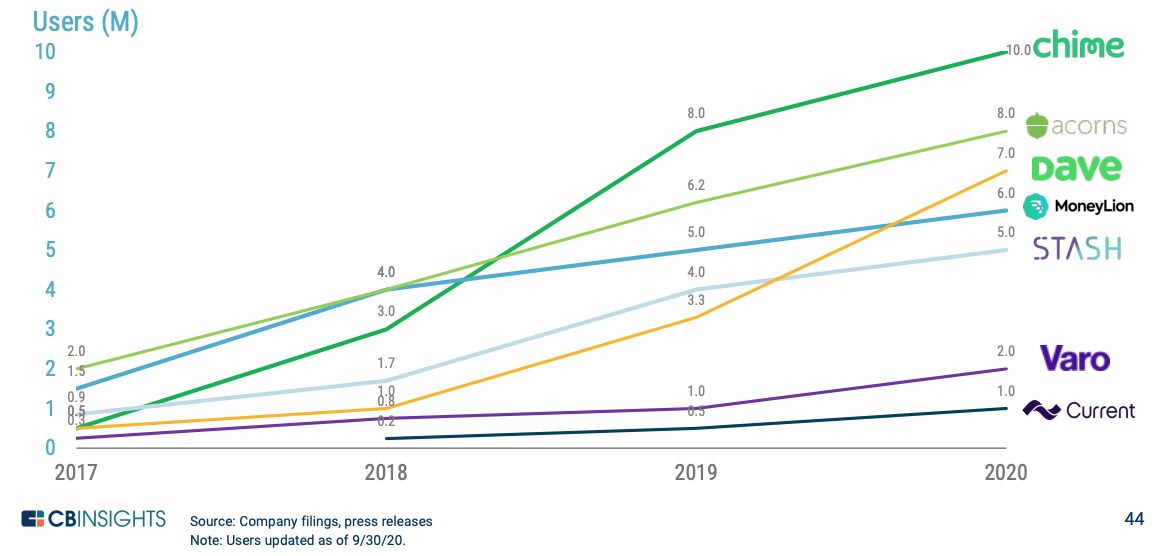

Despite COVID-19 and global uncertainties, challenger banks around the world showed sustained user growth. Chime, from the US, reached 10 million users, while Acorns and Dave, both from the US, now count some 8 million and 7 million users, respectively.

Challenger banks users, Source: The State of Fintech Q3’20, CB Insights

In Latin America, challenger banks continued to grow on the back of rising adoption by the unbanked population. Neon Pagamentos from Brazil, which raised US$300 million in Q3’20, reached over 9 million active users during that quarter, rising from just 2 million in Q4’19.

Mexican digital banking platform Oyster, which raised US$96 million, gained over 2.5 million users since launching publicly in 2019.

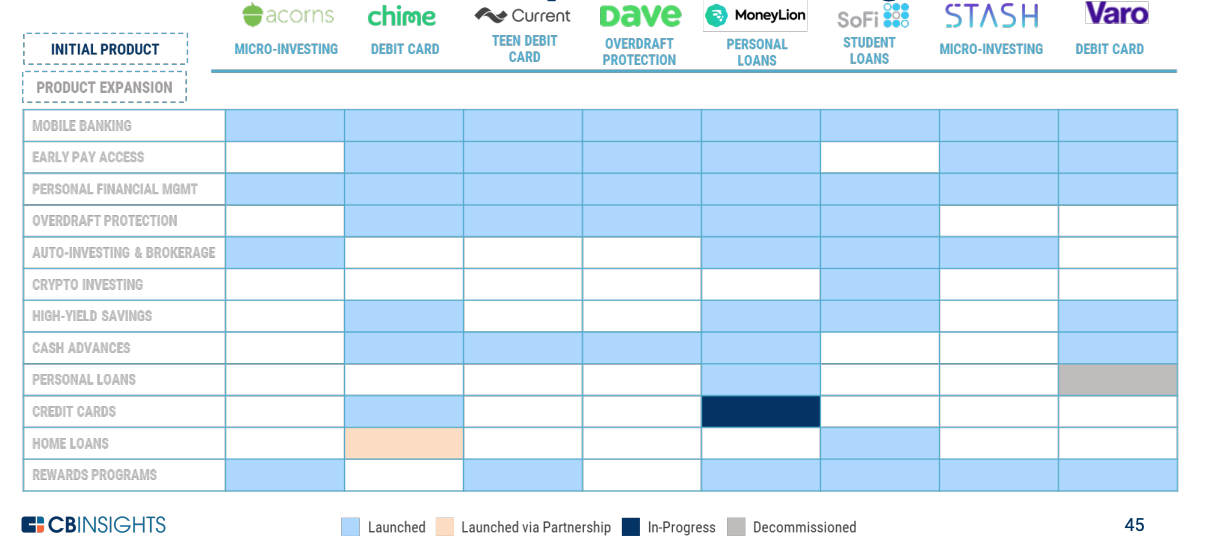

In Q3’20, banking fintechs continued expanding their product offerings, rapidly adding products and services outside of their original focus to find new monetization opportunities.

Notable moves in Q3’20 included UK challenger bank Revolut adding commission-free stock trading, and Australian neobank Xinja announcing plans for in-app trading for US customers.

Banking fintechs expanding product offerings, Source: The State of Fintech Q3’20, CB Insights

Q3’20 fintech trends in Asia

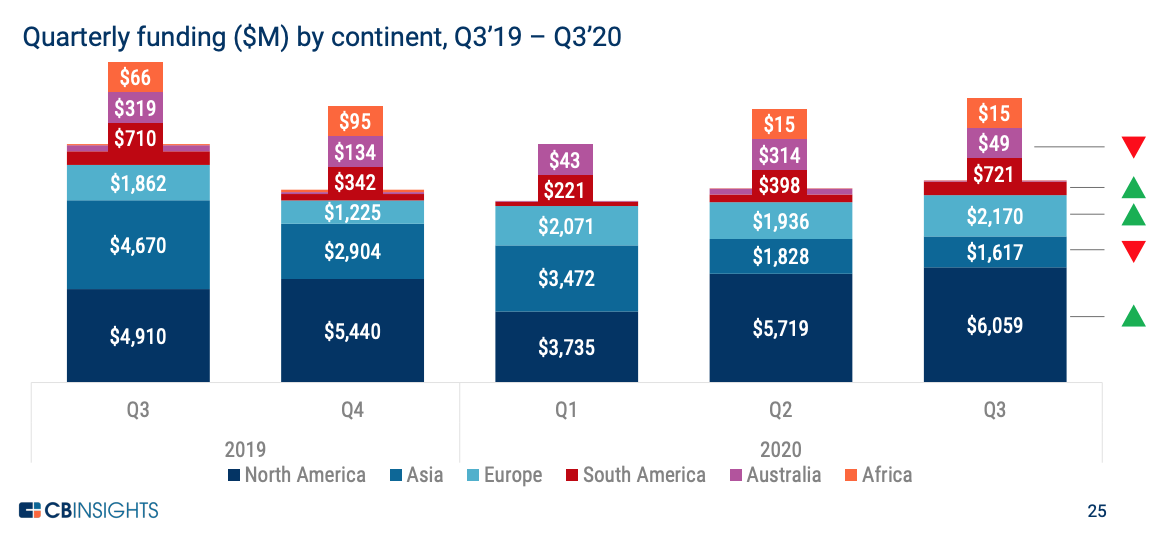

Funding to Asian fintechs fell 12% in Q3’20 to US$1.6 billion. The figure brings the total amount of venture capital (VC) funding raised so far this year to more than US$6.9 billion.

Quarterly funding ($M) by continent, Q3’19 – Q3’20, Source: The State of Fintech Q3’20, CB Insights

In South and Southeast Asia, insurtech funding saw a boost in Q3’20 with PolicyBazaar and Acko, both from India, raising US$130 million and US$60 million, respectively. In Indonesia, insurance comparison platform PasarPolis bagged US$54 million from investors that included Gojek and Xiaomi Ventures.

With COVID-19 continuing to boost e-commerce, established fintechs doubled down on lending and launched new products to capitalize on the frenzy. In Southeast Asia, on-demand transportation and mobile payments giant Grab introduced a buy now, pay later product in Q3’20, a service that allows users to shop for products online and make payments in interest-free installments. Users can also defer payments until the next month or a future date.

Global fintech trends

Globally, the embedded fintech momentum continued in Q3’20. Across multiple fintech segments, business-to-business (B2B) companies raised funds and launched new products to enable non-financial companies to offer financial products.

US payment services company Finix raised US$30 million in Q3’20. The startup helps other companies set up their own payment processing infrastructure systems in-house. Bond Financial Technologies, a banking-as-a-service startup, raised a US$32 million Series A. The company provides software that lets companies of all sorts offer products such as credit cards and debit cards. It has also worked to ensure the software integrates with a network of banks that can handle the regulatory obligations on behalf of its customers.

Q3’20 also saw tech giants continue making inroads into fintech. Notable developments include Apple acquiring mobile payment company Mobeewave for US$100 million, the partnership between Microsoft and fintech API provider Codat, and Google teaming up with eight banks to offer co-branded accounts.

Globally, fintech companies raised US$10.6 billion in Q3’20, up 4% from the previous quarter. This brings the total amount of VC funding so far this year to more than US$30.3 billion. Mega-rounds of more than US$100 million drove fintech funding that quarter with 25 rounds raising a combined US$6.4 billion.