Four in Five Fintech Firms in ASEAN Set on Expanding Despite COVID-19

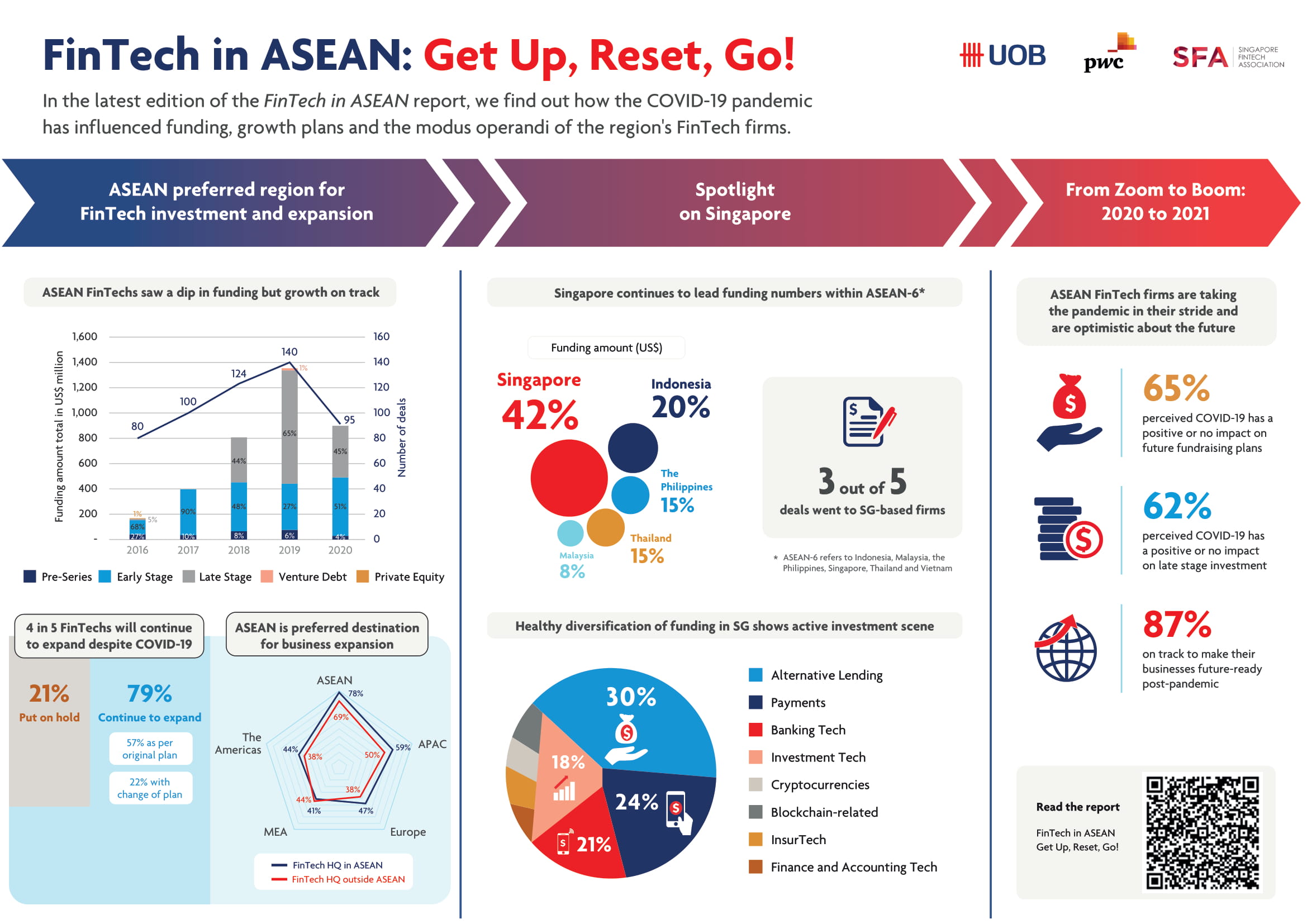

by Fintech News Singapore December 9, 2020Despite disruptions brought about by the COVID-19 pandemic, four in five fintech firms in ASEAN will push ahead with their expansion plans in the next two years, this is according to a report by UOB, PwC and the Singapore Fintech Association.

The optimism comes on the back of the accelerated trend in digital adoption across ASEAN amid the pandemic, with more than 40 million new internet users this year. Seventy percent of the ASEAN population today use the internet and this is expected to continue to increase in the next decade as digital services such as online marketplaces become commonplace.

This macro trend provides fintech firms in the region an opportunity to provide the growing digitally-connected population with digital financial solutions in areas such as payments and alternative lending. One way in which fintech firms can extend their services in ASEAN is through working with banks to combine the respective strengths of each, including the customer touchpoints that banks offer and the technology capabilities of fintech firms.

Of the total 95 completed deals that took place in the first three quarters of 2020, almost two-thirds of these deals went to fintech firms in Singapore.

Investor interest in Singapore-based fintech firms also remained strong, with these firms continuing to attract the highest funding amount (42 per cent) in the region. This could be as investors place faith in Singapore’s favourable regulatory and business environment and its good track record of mitigating the impact of crises such as the COVID-19 pandemic.

With Singapore being the most mature fintech market in ASEAN, funding in Singapore-based fintech firms remains diversified across every category, with alternative lending, payments and banking technology taking the lead. In the other ASEAN markets, funding in the payments space continues to dominate in expectation of the unabated adoption and usage of digital payments.

Fintech firms in ASEAN remain optimistic about the future despite the pandemic According to the report, fintech firms in ASEAN continue to have a positive outlook on the future as they take the pandemic in stride. Around two in three fintch firms stated that the pandemic has either no impact or a positive one on their future fundraising plans (65 per cent) and late stage investment (62 per cent). The majority of fintech firms in ASEAN (87 per cent) also said they are on track to ensuring their businesses can last post-pandemic, with a focus on product innovation and driving revenue growth in the next year.

Findings of the report will be presented to attendees of the Singapore FinTech Festival 2020 via a Green Shoots Session at the Impact Summit on Wednesday, 9 December, 19:40 – 20:00 SGT.