In the Age of Data, Financial Institutions Must Adopt a Multi-Cloud Strategy

by Fintech News Singapore May 27, 2021Emerging technologies, evolving customer demands and a changing regulatory landscape are redefining the financial services industry, forcing incumbents to transform their business models and adopt a data-first strategy in order to survive, a new paper by Equinix and Dell Technologies says.

The paper, titled Designing a Data-First Strategy for Financial Services: Foundations of Digital Transformation in Financial Services, looks at the changing financial services landscape, delves into the digital challenges incumbents face, and explores the different types of technology they must adopt to remain competitive.

Non-banking service providers including bigtechs like Google, Apple and Amazon have entered the financial landscape and are rapidly gaining ground.

The 2019 World Retail Banking Report by Capgemini and Efma found that 75% of tech-savvy customers were using at least one financial product from a bigtech. Customers cited lower costs (70%), ease of use (68%) and faster service (54%) as the top three reasons for turning to financial products from non-traditional players.

Neobanks and challenger banks also are rapidly expanding and are now serving an estimated 39 million customer base. By 2027, the neobanking sector is projected to reach a valuation of US$578 billion, growing at a compound annual growth rate of about 46.5%, according to a report by Facts and Factors Market Research.

Setting the foundation for data-driven banking

Success in today’s financial services industry is increasingly reliant on the flow of data across financial ecosystems, and incumbents must address how they can securely move data across their ecosystems, enable low latency access to partners, while complying with local data regulations. The answer to that is a multi-cloud strategy, the Equinix/Dell Technologies paper says.

Adopting a cloud-first and multi-cloud strategy gives banks more choices as well as elasticity to scale quickly. It also mitigates the risk of vendor lock-in, cyber threats, geopolitical stand-off and other possible disruptions that may affect business continuity, the paper says.

A successful multi-cloud strategy comprises three main elements: zero-gravity data access; consistent Kubernetes’ (K8) operations; and the integration of platform-as-a-service (IPaaS) as well as API management.

Data-gravity refers to the way data “attracts” other data and services. As the amount of data continues to grow, at some point, it will become difficult and even impossible to access or migrate the data, making it thus harder to extract value from it.

Equinix addresses this issue by allowing public cloud providers such as Amazon Web Services (AWS) and Microsoft Azure to directly access and use data in the Equinix data center without it having to be moved, effectively enabling firms to adopt a multi-cloud strategy.

Dell Technologies and Equinix’s joint Zero-Gravity Data Framework provides customers with the flexibility to engage with whichever public clouds are most relevant to their objectives at any given time, and equips them to implement a data-first strategy, the paper says.

Dell Technologies and Equinix’s Zero-Gravity Data Framework, Designing a Data-First Strategy for Financial Services: Foundations of Digital Transformation in Financial Services, Dell Technologies and Equinix

With growing multi-cloud uptake, businesses are increasingly turning to containers for the portability and scalability that they offer, and one popular option is the K8 platform.

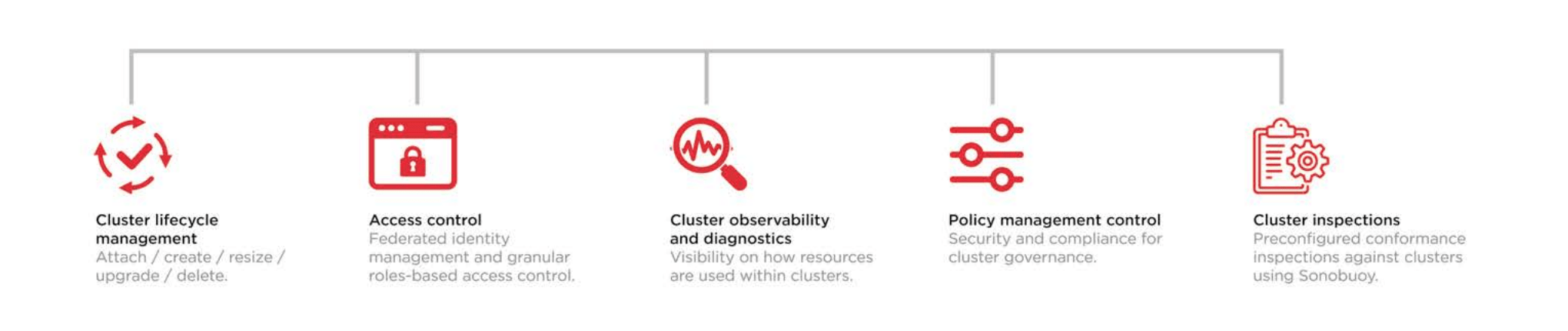

Equinix and Dell Technologies anticipate that rather than having one large K8 cluster, most businesses will rather have multiple clusters, a fragmentation which will bring a number of challenges, including siloed management and the lack of visibility from a centralized console.

To address this, financial institutions must adopt a unified K8 operations platform. This platform should bring together the management of different K8 clusters spread across different clouds, allowing operations teams to define consistent security policies and access control throughout these different environments.

The Benefits of a Unified Kubernetes Operations Platform, Designing a Data-First Strategy for Financial Services: Foundations of Digital Transformation in Financial Services, Dell Technologies and Equinix

Finally, the third key component of a successful multi-cloud strategy is an IPaaS and API management platform.

An IPaaS is a platform for building and deploying integrations within the cloud as well as between the cloud and enterprise. With iPaaS, integration projects can be implemented across all cloud-based and on-premise endpoints, APIs, mobile devices and Internet-of-Thing (IoT) input.

For financial institutions, this means easier integration with third-parties, support for open banking, as well as artificial intelligence (AI) and machine learning (ML) capabilities, the report says.

The release of the paper comes on the back of the unveiling of Dell Technologies Apex, a portfolio of as-a-service offering for businesses looking to adopt a hybrid or multi-cloud strategy. Dell Technologies has partnered with Equinix to broaden the availability of Apex via the Equinix International Business Exchange data centers.

Featured image credit: Technology photo created by rawpixel.com – www.freepik.com