Vietnam, Philippines, Indonesia Among Top 10 Most Unbanked Countries in the World

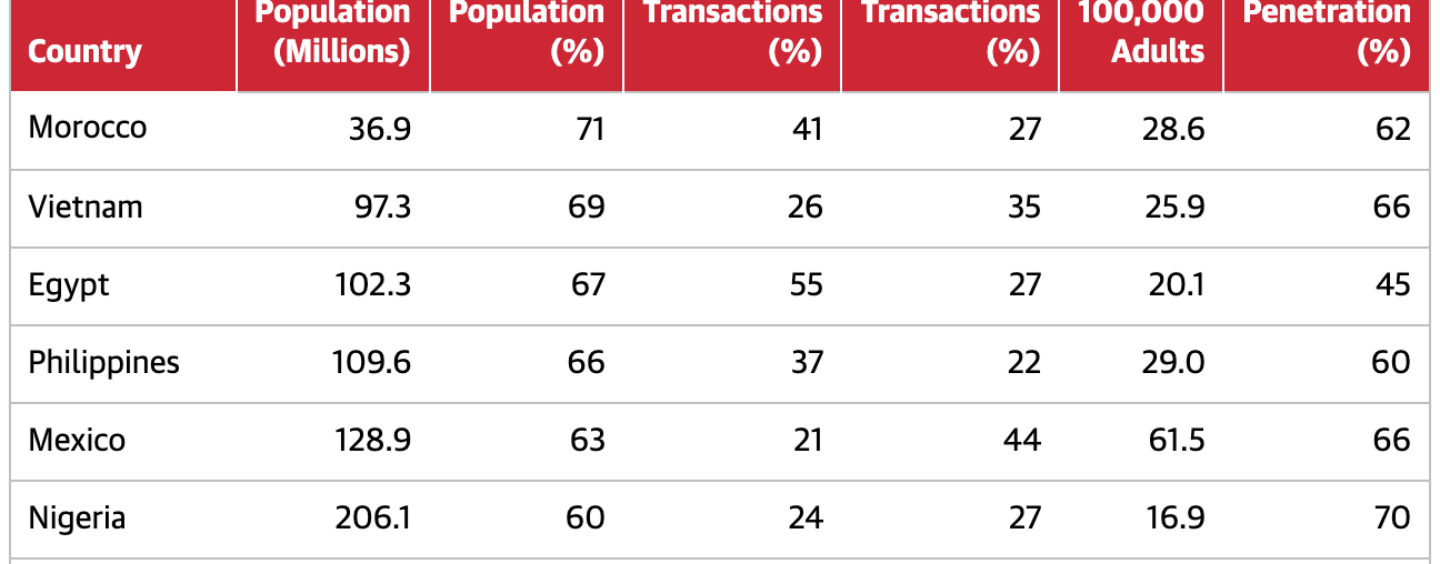

by Fintech News Singapore July 15, 2021Among the top ten most unbanked countries in the world, three are located in Asia Pacific (APAC), namely Vietnam, the Philippines and Indonesia, according to data provided by British research platform Merchant Machine.

Vietnam ranks second in the top ten list with 69% of its total population having no access to traditional banking services or similar financial organization, the Philippines ranks fourth with 66%, and Indonesia ranks ninth with 51%.

These metrics come amid relatively high cash usage, low card penetration and scarce traditional financial access points, like ATMs, in all three countries, the data show.

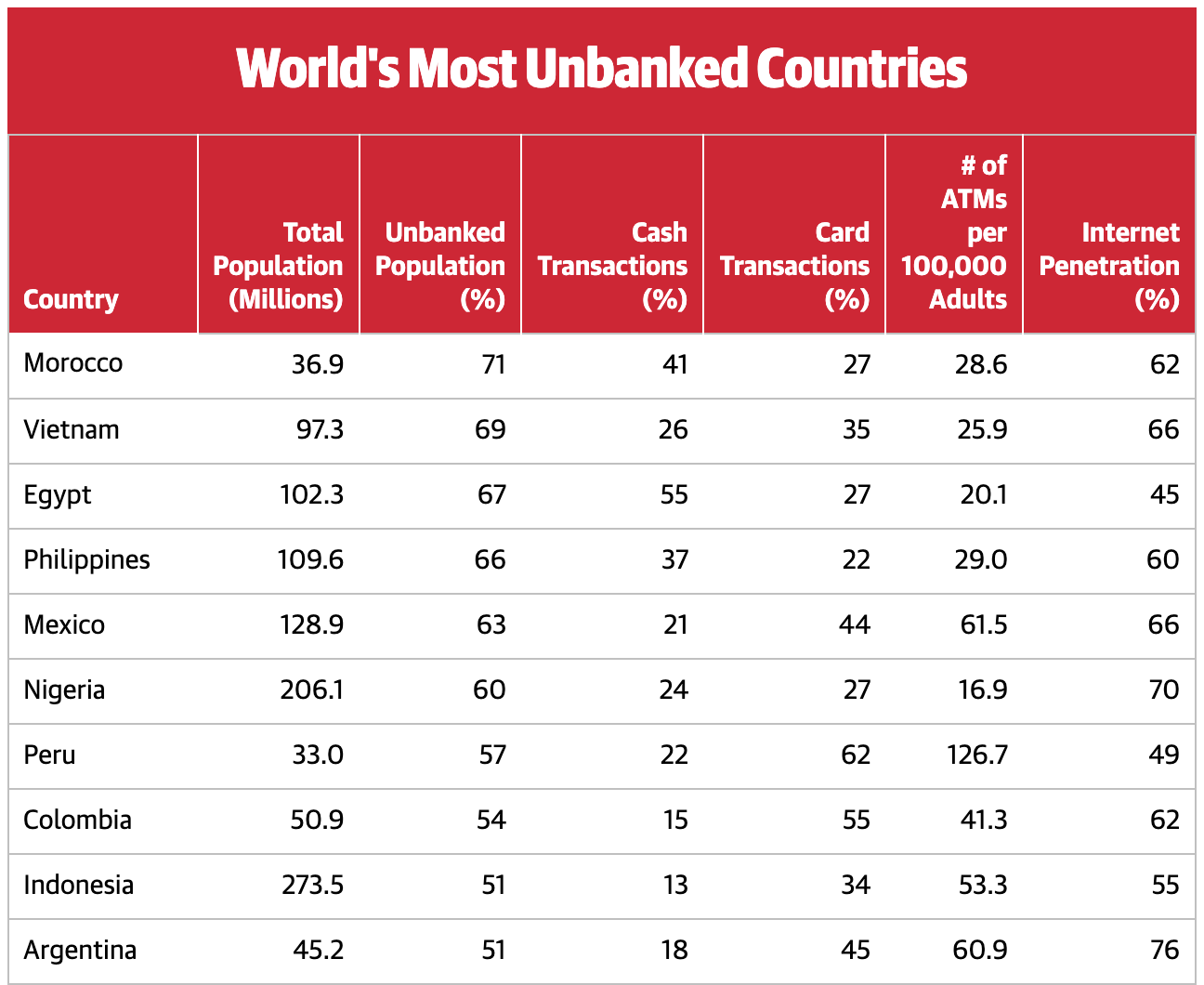

World’s Most Unbanked Countries, Source: Merchant Machine, 2021

Rise of digital financial services

In Southeast Asia, half of the population is unbanked with no access to financial products, and a further 18% are underbanked, meaning that they lack access to anything other than a bank account, according to a 2020 Fitch Ratings report.

The inaccessibility of the traditional banking system, coupled with the presence of a large population of young and digitally native consumers, have provided suppliers of digital financial services with the opportunity to step in and fill the gap.

Regional tech leaders like Singapore-based Grab and Indonesia’s GoTo (formed by the merger of Internet leaders GoJek and Tokopedia) started out their fintech journeys with e-wallet capabilities before broadening their offerings.

Grab, for example, offers payments and financial services across lending, insurance and retail wealth management in the region, in addition to a wide range of services including e-commerce, ride hailing, courier and food delivery.

Last year, Grab acquired Bento Invest, a Singapore-based robo-advisory startup. The acquisition has enabled it to launch an investment service that lets users invest small sums of money while spending on Grab’s various services. Grab’s consortium with Singtel was awarded in December 2020 a full digital bank license in Singapore, making its entrance into the virtual banking space imminent.

Grab is set to go public through a merger with Altimeter Growth Corp., a special purpose acquisition company (SPAC). The SPAC merger would value the company at nearly US$40 billion, making it the largest blank-check merger to date.

A booming fintech market

The convenience of these so-called super apps have led to their growing popularity across the region and helped propel Southeast Asia to becoming one of the fastest-growing fintech markets in the world.

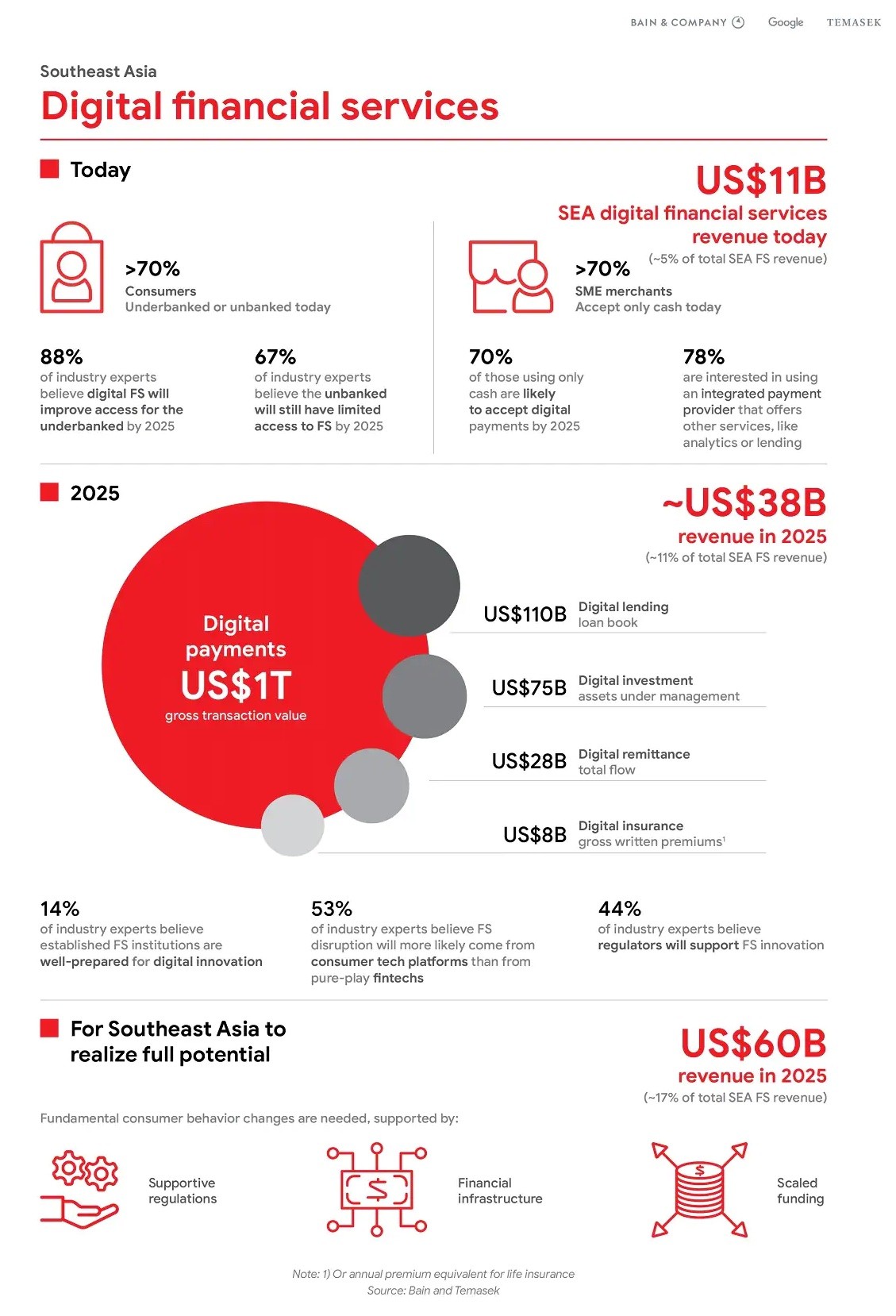

Southeast Asia’s digital financial services revenues are expected to grow at a compound annual growth rate of 22% between 2019 and 2025, surging from US$11 billion to a US$38 billion revenue opportunity by 2025, according to a report by Bain & Company, Google and Temasek.

Southeast Asia Digital Financial Services infographic, Source: Bain and Company, Google and Temasek

By 2025, the volume of funds flowing through digital wallets in Southeast Asia is projected to soar from its current US$39 billion to US$138 billion as digital financial services providers continue to help consumers make the transition from cash to digital transactions, according to an analysis by Australian financial institution Macquarie Group.

In February 2020, Vietnam prime minister Nguyen Xuan Phuc ratified an ambitious national financial inclusion plan that seeks to have at least 80% of the adult population with a bank account by 2025.

Though the Philippines has amongst the weakest financial inclusion coverages in the world, the country is ranked amongst global leaders in efforts to improve financial access. The country, which has embarked into a massive financial inclusion reform, aims to expand account penetration to 70% by 2023.

And in Indonesia, the Indonesia Financial Services Authority (OJK) launched in August 2020 the Digital Finance Innovation Roadmap and Action Plan 2020-24, which aims, among other things to enable inclusive financial services that are affordable, convenient and scalable, and support digital financial services that empower Indonesians and extend financing to MSMEs.