SWIFT Embraces APIs, Partnership Strategy to Digitize Global Trade

by Fintech News Singapore September 1, 2021The Society for Worldwide Interbank Financial Telecommunication (SWIFT), a global member-owned cooperative and the world’s leading provider of secure financial messaging services, is upgrading its trade proposition, leveraging new communication channels, APIs, and embracing a partnership strategy to digitize the complex trade ecosystem and boost efficiency, the organization says in a new paper.

In a paper titled Digitising trade: the time is now, SWIFT discusses trade digitalization and gives an overview of the initiatives it has been working on.

According to the paper, despite global trade dropping significantly because of COVID-19, usage of SWIFT’s Digital Trade Channel (MT 798), which enables corporates and banks to digitize and standardize their documentary trade interactions, soared 72.4%, illustrating the appetite among corporations for digitization.

Although the industry has long discussed trade digitalization, the pandemic has rendered it critical, potentially creating the tipping point for scalable progress in digitalization, the paper says.

Global Digital Trade Channel, Source: Digitising trade: the time is now, Swift, August 2021

SWIFT’s Digital Trade Channel is part of the organization’s ongoing efforts to digitize trade and expand the capabilities of its platform beyond messaging and documentary trade.

SWIFT’s broader digital trade innovation project revolves around building an ecosystem that would leverage APIs, cloud technology and industry partnerships to provide the banking community with both proprietary and third-party trade services, in addition to its identity, security and standards protocols.

Over the next two years and beyond, SWIFT says it will deliver a strategic roadmap for the development of its “next-generation digital platform” comprising comprehensive transaction management services. The vision here is to allow interoperability between different standards, channels, protocols and across currencies, whilst embedding adjacent value-added services, the paper says.

The need for standardization and interoperability

Trade is a complex ecosystem that involves a large number of actors, rules and regulators sprawled across physical and financial supply chains in multiple countries and industries. Given the breadth and complexity of the ecosystem, efforts to digitize the industry have been fragmented.

Financial institutions have been investigating technologies including distributed ledger technology (DLT), smart contracts, the Internet of Things (IoT), artificial intelligence (AI) and machine learning (ML), and backed initiatives such as Contour, formerly Voltron, and Marco Polo Network.

In April 2021, DBS Bank moved from Contour’s beta network to its production network, effectively providing digital trade services to customers in four Asia Pacific (APAC) markets, namely Australia, China, Hong Kong and Singapore.

Contour, also based in Singapore, provides a blockchain-based network focusing on digitizing paper-based trade finance processes, including the creation, exchange, approval and issuance of letters of credit.

DBS Bank was the first Singapore-based bank to join Contour’s beta network and completed the first fully digital letter of credit transaction on the platform last year.

In Singapore still, Singapore Customs and the Government Technology Agency (GovTech) officially launched in 2018 the Networked Trade Platform (NTP), a trade information management platform for the trade and logistics industry, as well as adjacent sectors such as the trade finance industry.

NTP allows businesses to share and reuse secure data and documents among their business partners and the government, helping them streamline processes, reduce inefficiencies of manual trade document exchange, and leverage data analytics to draw insights from their trade data. Third-party developers are also able to provide NTP account holders with value added services through the platform.

Over the years, digital trade platforms such as Contour and NTP have mushroomed and created “digital islands” with different processes, workflows, actors, functionalities and ultimately data, the SWIFT paper says. For digitalization to scale and thrive, common standards are needed to connect these platforms, processes and participants.

In this area, the benefits of APIs are promising, SWIFT says, adding that it’s working with the community to establish a catalogue of trade-based APIs for banks and corporates.

SWIFT is also involved in TradeTrust, an interoperability framework for the exchange of digital trade documentation.

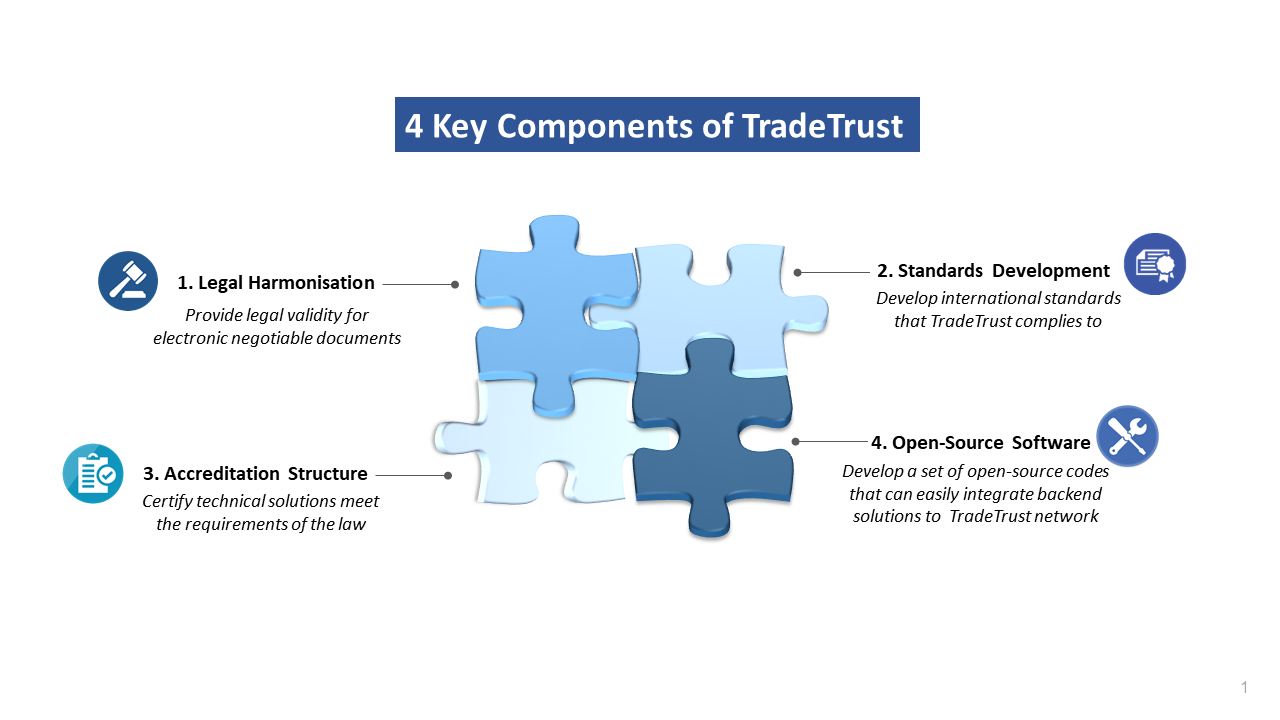

Developed by Singapore’s Infocomm Media Development Authority (IMDA), TradeTrust comprises a set of globally-accepted standards and frameworks that connects governments and businesses to a public blockchain to enable interoperability and exchange of electronic trade documents across digital platforms.

For TradeTrust, IMDA is also collaborating with other governments and public authorities, including the Port of Rotterdam Authority, the Commerce Bureau Shenzhen Municipality in China, and the Australia Border Force.

4 Key Components of TradeTrust, Source: Singapore’s Infocomm Media Development Authority (IMDA)