Singapore’s Cryptocurrency Industry: How Are Key Players Positioning for Growth?

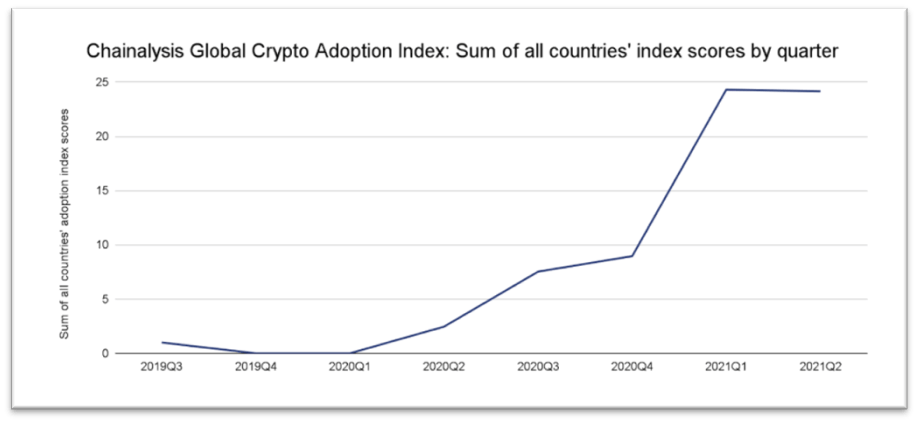

by Fintech News Singapore September 6, 2021The 2021 Global Crypto Adoption Index by Chainalysis, a blockchain data analytics tool provider, revealed that globally, more individuals are now participating in cryptocurrency while existing cryptocurrency adoption is also on the rise.

From Q3 2019 to the end of Q2 2021, there was a staggering 2300% growth in total global adoption, with research suggesting that the reasons behind this tremendous increase differ in various parts of the world.

Chainalysis Global Crypto Adoption Index: Sum of all countries’ index scores by quarter, Source: Chainalysis

For the emerging markets, this increase can be attributed to the fact that many are purchasing cryptocurrencies to preserve their savings amid currency devaluation. Apart from this, they are also performing international transactions, either for individual remittances or for commercial use cases with cryptocurrencies.

Many of these emerging market cryptocurrencies place a limit on the amount of national currency that their citizens can remit out of the country, making cryptocurrencies an ideal solution for citizens who need to perform transactions that may exceed the set limit.

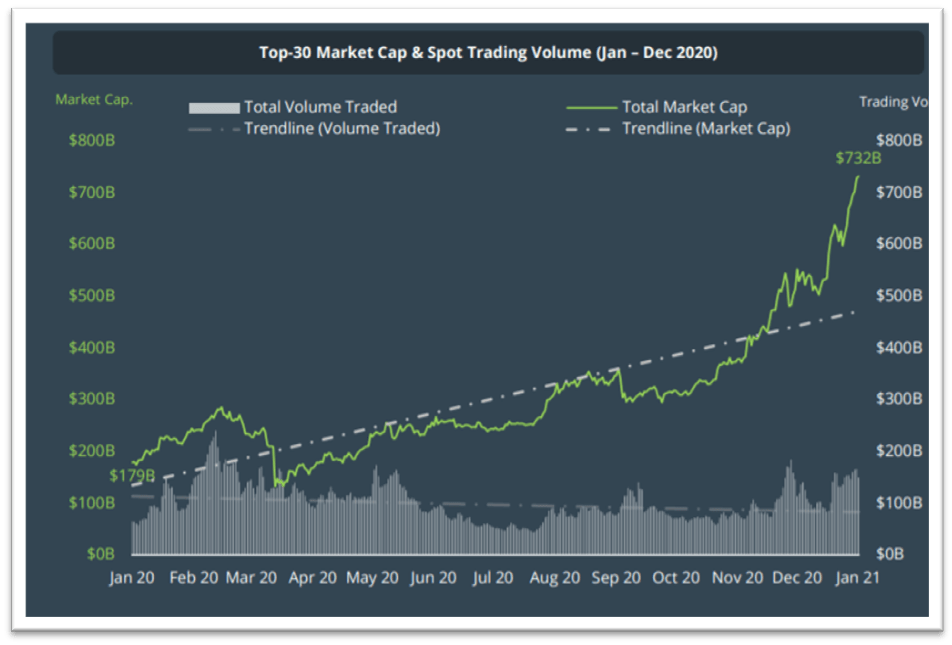

Similarly, the 2020 Yearly Report by CoinGecko also reflected this growth as the report showed that the total market capitalisation of the top 30 coins increased by 308% or approximately $552 billion, which is a stark difference from the 62% growth or $68 billion that was recorded in 2019.

Top-30 Market Coins Capitalisation and Spot Trading Volume from January to December 2020, Source: CoinGecko

MAS Grants In-Principle Approvals for Digital Payment Token Service Providers

The Monetary Authority of Singapore (MAS) in July 2021 stated that they were in the final stages of reviewing applications for digital payment token (DPT) service providers to operate in the country.

After the Payment Services Act came into effect on 28 January 2020, entities that have been engaging in regulated activities prior to the commencement of the act are exempted from holding a license, subject to the condition that these entities must submit license applications before July 2020. This exemption remains in force until a time when the applications are either withdrawn by the applicants or approved or rejected by MAS.

Since then, MAS has received around 170 applications to provide DPT services, out of which 30 applications, or 18%, have since been withdrawn and another two have been rejected.

Applications are assessed based on various factors such as the ability of the entity to meet the money laundering and financing of terrorism (ML/FT) standards and the technology risks posed by the business model.

Independent Reserve has since received an in-principle approval to operate as a regulated provider for DPT services. In a press release, the company stated that it is one of the first virtual asset service providers (VASPs) to obtain such an approval for a major payment institution license in Singapore. The Australian cryptocurrency exchange, which was founded in 2013, began expanding internationally in late 2019 and established its first overseas operations in Singapore.

In August 2021, DBS Vickers (DBSV), the brokerage arm of DBS, also received the second in-principle approval from MAS to provide DPT services as a major payment institution. The brokerage is currently working through the necessary follow-ups towards meeting MAS’ license requirements. Upon successfully securing the license, DBSV, being a member of the DBS Digital Exchange (DDEx) will be able to directly support asset managers and companies to trade in digital payment tokens via the DDEx.

On September 1, 2021, FOMO Pay, a Singapore fintech company, also announced that it has received a license from MAS to facilitate DPT transactions, including but not limited to cryptocurrency and the Central Bank Digital Currency (CBDC).

The granting of these approvals and licenses following a thorough screening process can certainly strengthen Singapore’s position as a crypto-friendly nation, even as countries like China are clamping down on cryptocurrencies while other nations are still finding ways to best regulate this industry.

DBS Launches Cryptocurrency Trust for Private Banking Clients and Increases Operating Hours for DDEx.

Besides Singapore’s financial regulator, one of its incumbent banks, DBS, has also been taking steps in this space. In May 2021, DBS launched a cryptocurrency trust for its private banking clients. Through this trust solution, clients can work with DBS Private Bank to include cryptocurrencies that are hosted on the DDEX such as Bitcoin, Ethereum, Bitcoin Cash, and XRP into their wealth succession plans. Described as Asia’s first bank-backed trust solution for cryptocurrencies, it is built on the DDEx.

Since its launch in December 2020, the DDEx has seen approximately 400 investors onboarded onto its platform as of the end of June 2021. It also achieved close to SGD 180 million in total trading volume in the second quarter of 2021, representing more than five times the volume of the previous quarter. In line with this growth, DDEx began operating 24/7 effective August 16, 2021.

Launch Of Crypto-FX Pairs by Saxo Markets

Other than DBS, Saxo Market, an online trading platform, has also developed a unique proposition for its clients and launched a new cryptocurrency offering in May 2021 where its Singaporean clients can trade Bitcoin, Ethereum, and Litecoin against the Euro, US Dollar, and Japanese Yen from a single margin account.

Clients can trade and hedge both long and short exposure in the three cryptocurrencies, which are in the form of derivatives instead of physical coins. Accredited investors will be able to trade on a 40% or 50% margin, with retail clients on a 60% margin. Through these ‘Crypto-FX pairs’, Saxo hopes to offer its clients access to the growing cryptocurrency space in a trusted and secure way. A licensed subsidiary of Saxo Bank A/S, Saxo Markets has been operating in Singapore since 2006.

Investment by Vertex Ventures and GIC Private Limited in Various Cryptocurrency Exchanges

In 2018 Vertex Ventures, the venture capital arm of Singapore’s state fund, Temasek, made an investment in Binance.

Similarly, GIC Private Limited, Singapore’s sovereign wealth fund, was reported by Bloomberg to have invested in Coinbase’s $300 million funding round in 2018. In 2021, GIC also led an $80 million Series C funding round in Anchorage, a digital asset platform in addition to a $70 million investment in BC Technology Group, the parent firm of digital asset platform, OSL.

Binance Singapore has appointed Richard Teng in August 2021 to helm its Singapore operations as the Chief Executive Officer (CEO). Teng brings with him 13 years of experience with MAS before he moved on to become the Chief Regulatory Officer of the Singapore Exchange (SGX) for more than 7 years. Teng then left to become the CEO of the Abu Dhabi Global Market (ADGM) from March 2015 to March 2021.

According to Teng, the rapid mainstream adoption of both blockchain and crypto technology calls for greater understanding and appreciation from individuals, institutions, and governments and aims to work closely with industry leaders and policymakers to achieve this and support sustainable growth of the industry.

Featured image credit: Image by cryptostock from Pixabay