McKinsey: APAC Continues to Lead Global Payments Revenue Despite 2020 Decline

by Fintech News Singapore October 29, 2021Despite a slight decline, Asia-Pacific (APAC) continued to dominate the global payments landscape in 2020. With approximately US$900 billion in revenue, the region accounted for 47% of global payments revenues, according to the 2021 McKinsey Global Payments Report. This year, payments revenue in APAC is expected to grow in the 9-11% range, recouping 2020’s declines to return to pre-COVID-19 levels.

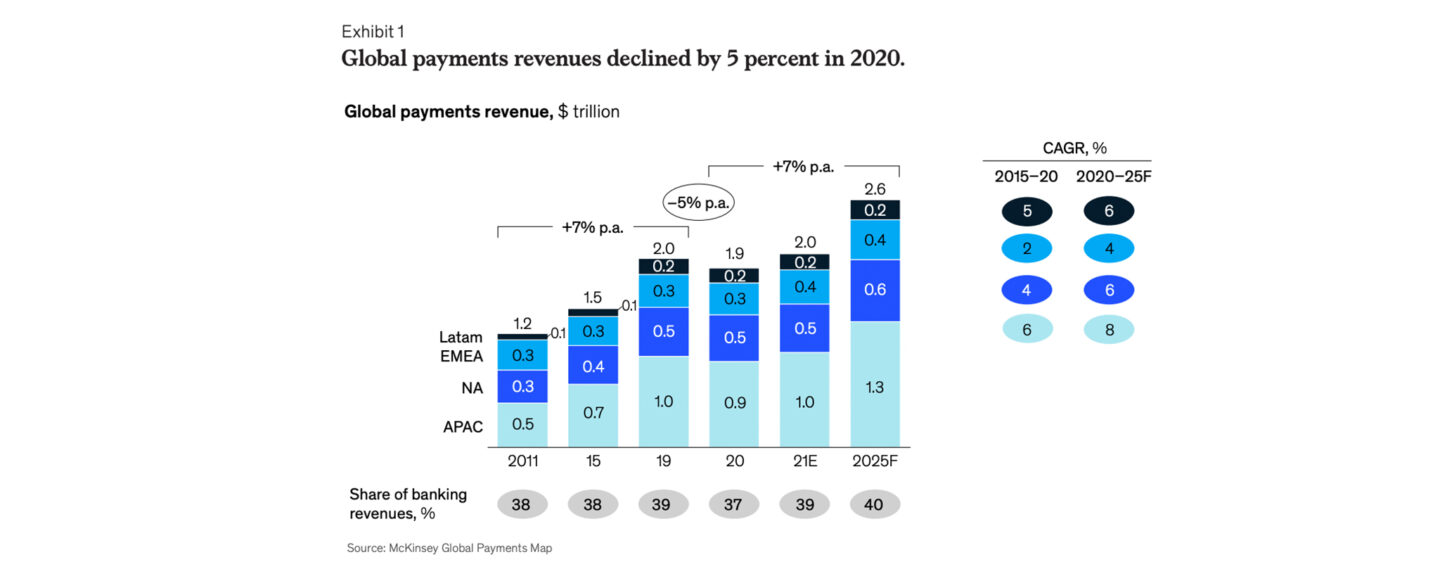

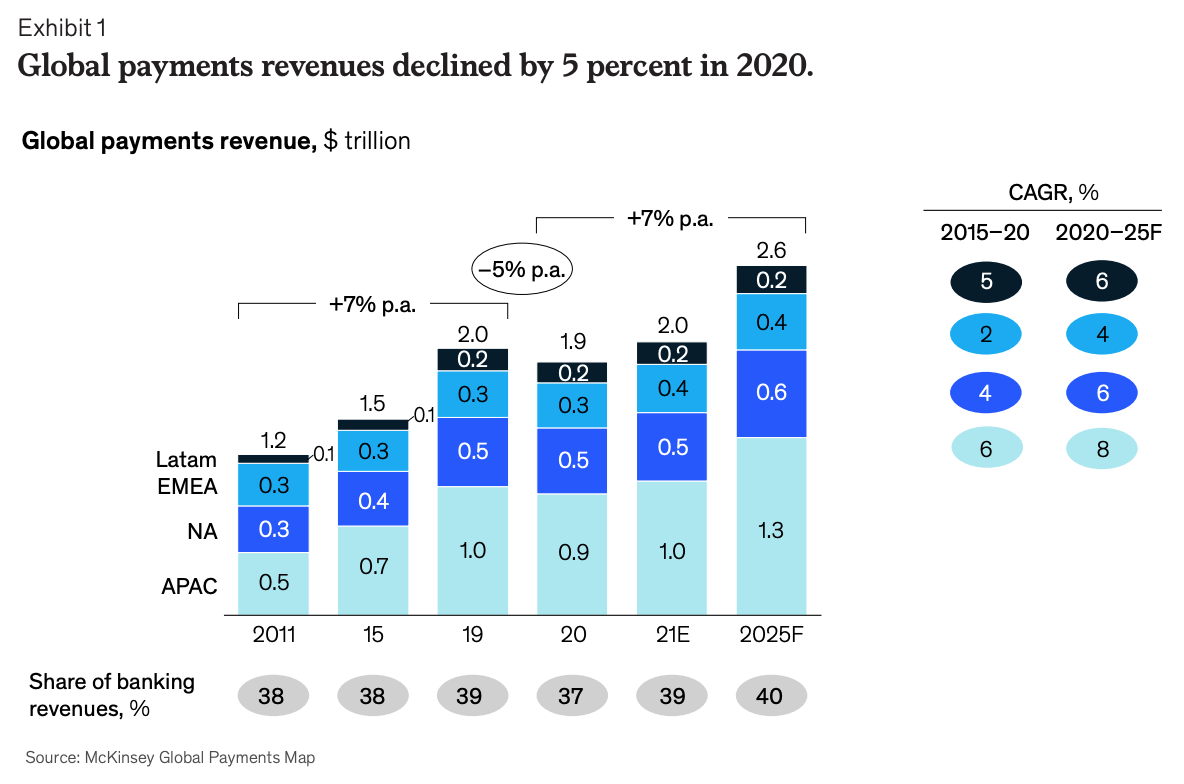

Global payments revenue, $ trillion, Source: 2021 McKinsey Global Payments Report, Oct 2021

Global payments revenue took a hit in 2020, sliding 5% from US$2 trillion in 2019 to US$1.9 trillion in 2020. APAC continued, nevertheless, to make up the lion’s share with China single-handedly generating US$690 billion in payments revenue.

Noteworthily, India recorded strong growth in 2020, surpassing Japan to become the region’s second-largest revenue generator. Indonesia is another impressive growth story, posting a 2014–2019 compound annual growth rate (CAGR) of nearly 9%.

McKinsey projects that together, India and Indonesia will generate US$34 billion of incremental annual revenue by 2025, representing annual growth of nearly 8%. Compared to the projected annual growth rate of the APAC region (excluding China) of 7%, this means that payments revenue in India and Indonesia will grow at a faster rate.

A leader in real-time payments

COVID-19 has brought about new opportunities in the globally payments landscape as decline in cash usage accelerated and adoption of digital payments surged.

Real-time payments continued to gain in prominence in 2020, recording a 41% rise globally in the number of transactions, the report says.

Currently, 56 countries have active real-time payments rails, a fourfold increase from just six years earlier, but APAC is emerging as the world leader in both development and adoption.

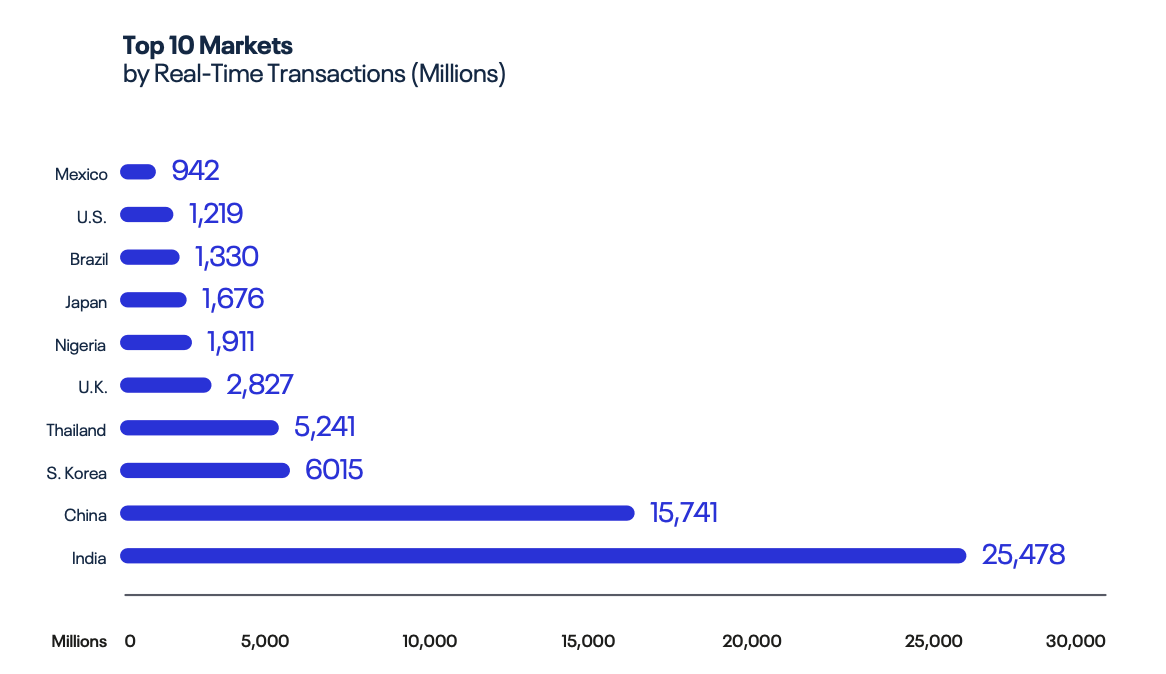

Top 10 real-time payments markets by number of transactions in 2020, Source: Prime-Time for Real Time, ACI Worldwide and GlobalData, 2021

In 2020, growth in instant payments in the region was the strongest in India, surging more than 70% in 2020. India is followed by China, South Korea and Thailand.

In recent years, many applications have been introduced across the region to capitalize on these infrastructures, further adding impetus to growth. In India, integration of the United Payments Interface (UPI) into platform apps such as Google Pay, PhonePe and Bhim App has driven more instant payments.

In Singapore, peer-to-peer (P2P) funds transfer service PayNow, which runs on the country’s real-time payments scheme Fast And Secure Transfers (FAST), launched non-bank integration in early 2021, allowing e-wallet providers including GrabPay, Liquid Pay and Singtel Dash to provide real-time payments to their customers.

Though real-time payments only represented 4.9% of all transactions in 2020 in Singapore, compared to 15.6% for India, according to data from ACI Worldwide and GlobalData, integration within mobile wallets and consumer platforms is set to propel growth.

Progress in real-time, cross-border payments

Increased access to real-time payment rails will further fuel rapid growth in cross-border payment activity as governments work to link up their national payments systems, McKinsey predicts.

This year, Singapore began connecting PayNow with Thailand’s PromptPay system. It’s now working on linking PayNow to Malaysia’s DuitNow and India’s UPI. Similar initiatives were also launched to connect Thailand with Malaysia, Indonesia and Vietnam, enabling businesses and consumers to receive instant payments.

SWIFT, the network that facilitates most international payments today, is also making progress in real-time cross-border payments. SWIFT’s gpi Instant service, which connects its fast cross-border payments rails to countries’ domestic real-time payments networks, onboarded in June 2021 the Industrial Credit and Investment Corporation of India (ICICI Bank) as its first banking partner in APAC. The partnership intends to facilitate inward remittances into India.

Separately, the Monetary Authority of Singapore (MAS) has been working together with the Bank for International Settlements (BIS) Innovation Hub in Singapore on Project Nexus, an initiative aimed at connecting existing national instant payment infrastructures.

“Project Nexus is our blueprint and vision … for interconnecting instant, real-time payment infrastructures, that now exist in 60 countries and counting,” Andrew McCormack, the Centre Head of the BIS Innovation Hub in Singapore, said during a Fintech Fireside Asia panel discussion in September.

“We wanted to come up with a base protocol vision for how instant payment infrastructures could potentially be connected. We’ve finished the first phase and they’re now looking to go into a prototype phase with some new partners. That’s coming up in the next months or so.”