Southeast Asia’s O2O Platforms Reach Mainstream Acceptance

by Fintech News Singapore November 4, 2021In Southeast Asia, digital ecosystems have reached mainstream acceptance. A new research by Bain & Company found that more than 77% of surveyed consumers in the region’s six biggest economies (SEA-6), namely Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam, have used at least one online-to-offline (O2O) platform in the past 12 months, while one in five micro, small and medium-sized enterprises (MSMEs) indicated being on O2O platforms.

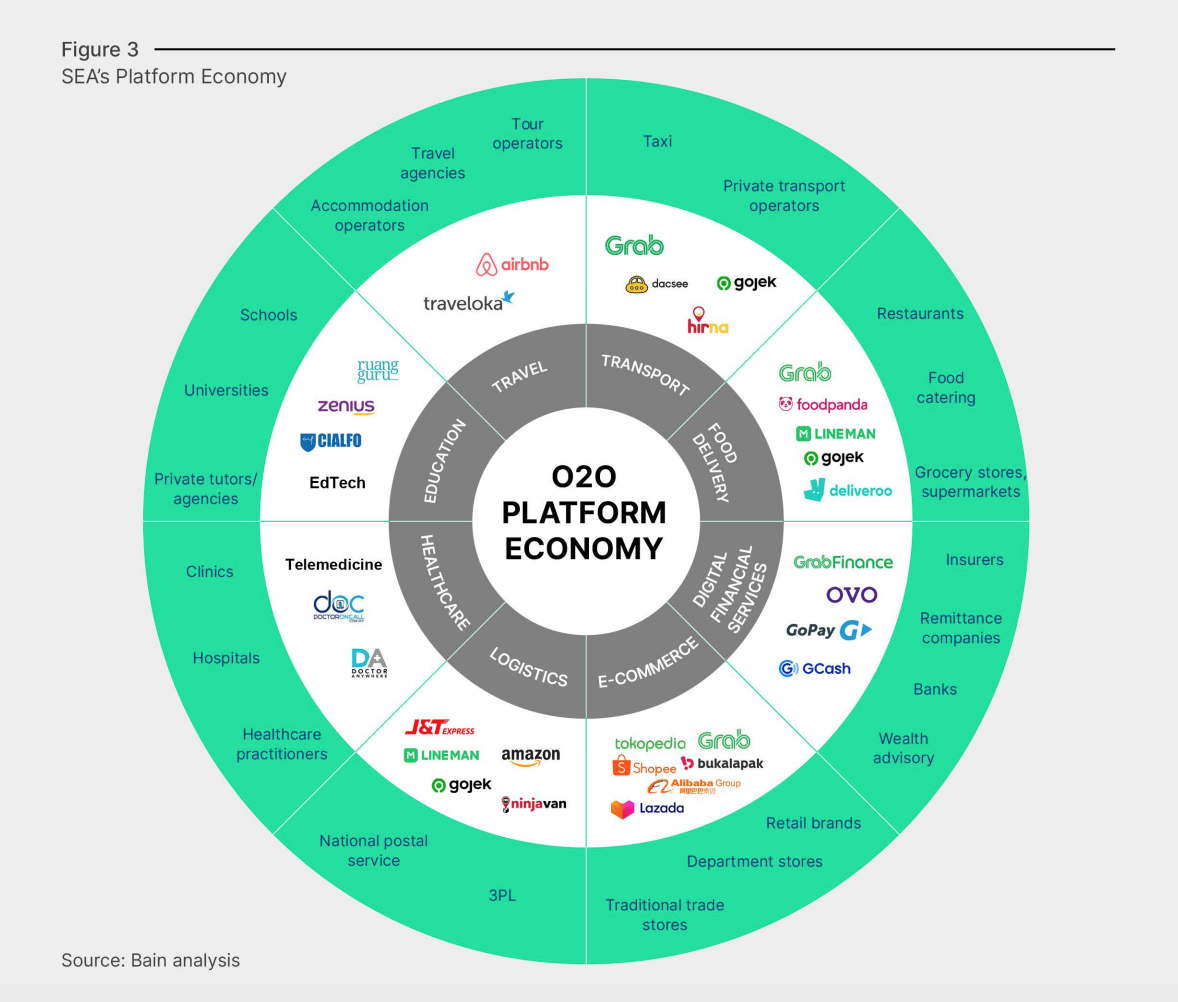

O2O platforms facilitate transactions with both an online and offline component. Unlike information platforms, these platforms require both physical and digital infrastructure to function.

O2O platforms cut across several sectors, including e-commerce, ride-hailing, logistics and digital financial services. Popular brands include super-app Grab, its Indonesian rival GoJek, as well as digital financial services ecosystems OVO from Indonesia, and GCash from the Philippines.

SEA’s Platform Economy, Source: Bain analysis, via The Platform Economy: Southeast Asia’s Digital Growth Catalyst, Oct 2021

Improving financial inclusion

In Southeast Asia, these platforms have brought new opportunities and innovations in the development of the wider digital economy.

By embedding digital financial services into their ecosystems, O2O platforms have played a key role in improving financial inclusion and driving digital payments adoption.

71% of consumers and 74% of MSMEs with digital loans surveyed by Bain & Company were previously unable to get financial from banks/lenders, indicating that O2O platforms are effectively increasing access to credit.

The report cites the case of Kredivo, a platform that uses data from telcos, e-commerce providers and geo-based services to offer small personal loans and buy now, pay later (BNPL) options to more than 3 million customers in Indonesia. Kredivo is a service of Singapore-based fintech company FinAccel, a unicorn startup with plans to go public through a US$2.5 billion merger with a blank-check company.

Post-COVID-19, financial inclusion is expected to further improve, as emerging payment habits become entrenched and as O2O platforms continue to attract more users, the report says.

Booming digital payments adoption

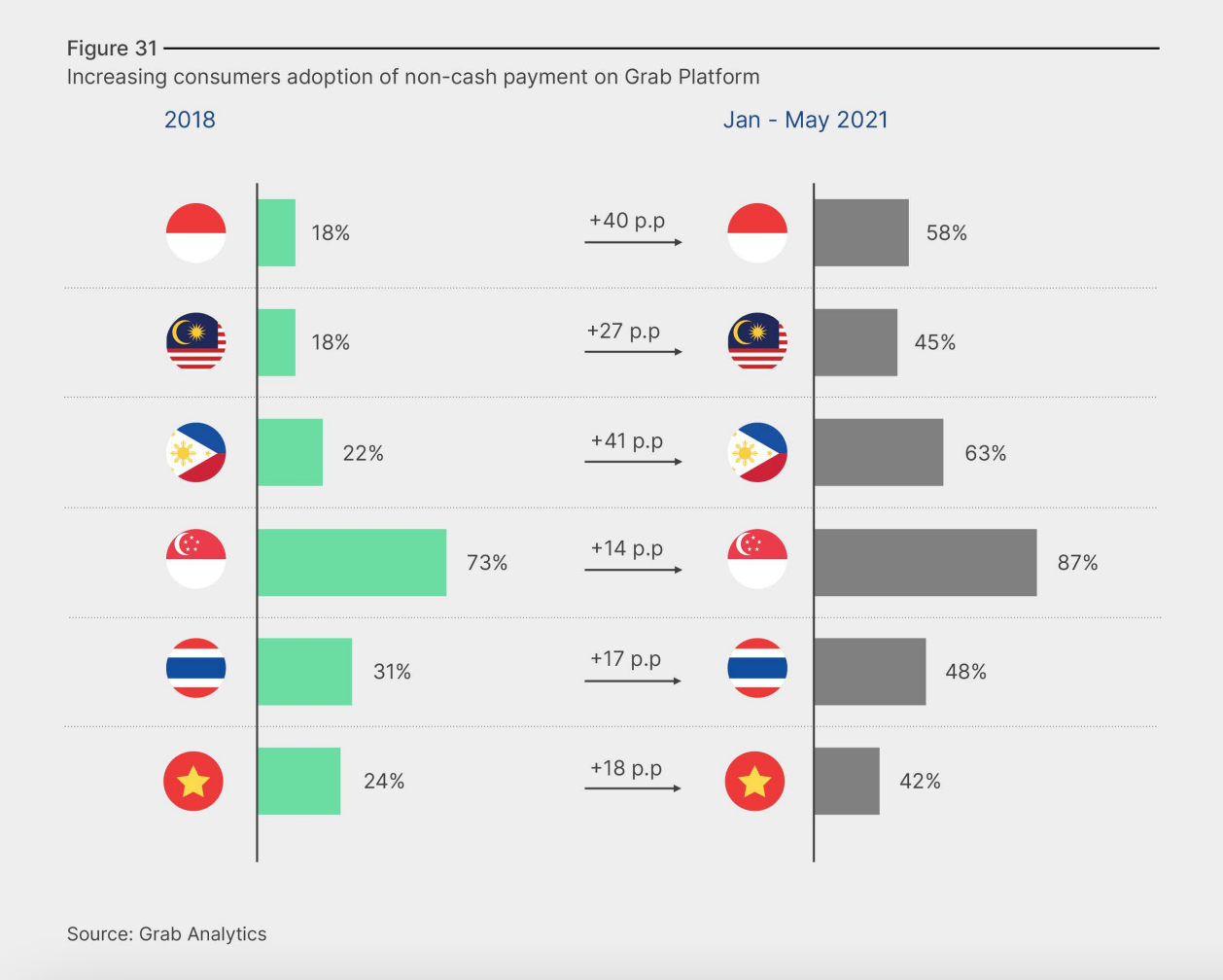

Since the beginning of the pandemic, adoption of digital financial services has considerably increased, driven by an accelerated shift to digital channels. More precisely, adoption of digital payments jumped by between 14% and 41% percentage points in each of the SEA-6 nations during COVID-19, the research found.

The Philippines saw the strongest growth, recording a 41 percentage points increase between 2018 and January-May 2021. It’s followed by Indonesia (+40 percentage points), Malaysia (+27 percentage points), Vietnam (+18 percentage points), Thailand (+17 percentage points) and Singapore (+14 percentage points).

Increasing consumers adoption of non-cash payment on Grab platform, Source: Grab Analytics, via The Platform Economy: Southeast Asia’s Digital Growth Catalyst, Oct 2021

The majority of surveyed consumers in SEA-6 (>70%) agreed that digital payments are more convenient, as well as safer and more secure to use than cash. Similarly, over 70% of surveyed MSMEs indicated a number of benefits to using digital payments, including increased sales, cost savings, as well as increased security.

In Indonesia, for example, almost 70% of the MSMEs partnering with OVO, a digital financial services platform, saw their monthly income increase by over 25% on average.

Challenges to overcome

The platform economy is developing rapidly in Southeast Asia and bringing significant benefits. Yet, several challenges and hurdles still need to be addressed.

For one, improvement in connectivity and logistics infrastructure, especially in non-urban areas, and increasing foundational digital literacy, must be priorities for governments, the report says.

Secondly, as the platform economy continues to grow, policymakers must continually consider how to foster fair competition, and ensure consumer rights and protection, particularly in the areas of data privacy and fraud.

Well-designed, clear and transparent policies and regulations will help support the growth of sector and could be a positive signal for investors, the report says.

The rise of Southeast Asia’s platform economy has forced incumbents to embrace the digital ecosystem approach. An earlier report by EY indicated that traditional financial services businesses are now actively collaborating with other industry participants to venture in adjacent segments and create one-stop, integrated consumer experiences.

In Thailand, for example, United Overseas Bank (UOB) provides a digital banking offering called TMRW. TMRW relies on an aggressive ecosystem partnerships strategy, which has enabled it to provide tailored services and solutions across all areas of their customers’ lives.

In Vietnam, VPBank and the Be Group, a ride-hailing services provider, partnered up to launch in January 2021 a digital banking offering called Cake. Accessible through the Be app, Cake provides a variety of products and services similar to a traditional bank, including account opening, money transfers, bill payments, savings accounts, and a debit card.