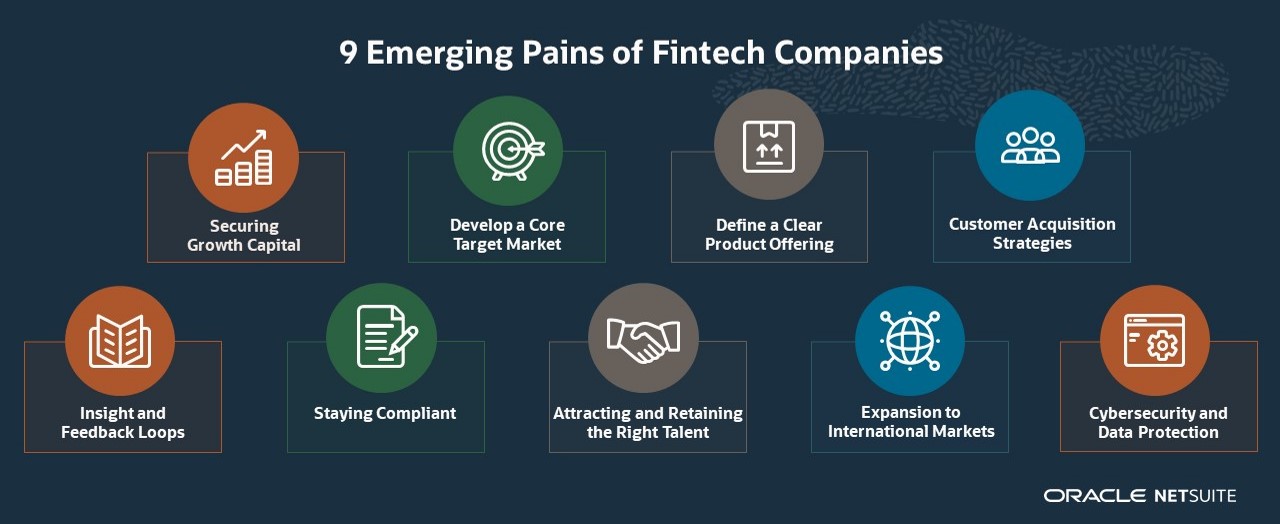

Here Are 9 Key Pains Points Up-And-Coming Fintechs Should Look Out For

by Fintech News Singapore March 1, 2022In a fintech startup’s race to scale up, they will face challenges across many fronts, including improving product profitability, recruiting and retaining talent, managing risks as well as complying with regulations.

In this article, Oracle NetSuite addresses the 9 key emerging pain points that fintech startups face.

1. Securing growth capital from investors

In a slowly maturing market, one of the biggest development challenges for fintech startups is attracting and persuading investors to back them.

Having a brilliant or unique product isn’t enough in itself. Investors will also look at the business infrastructure as well as its sustainability and potential to scale easily.

According to KPMG’s bi-annual Pulse of Fintech report, hot areas for fintech investment in 2021 include payments, insurtech, regtech, wealthtech, blockchain and cyber security.

New markets are also likely to emerge through Central and North Asia, and existing markets will see an explosion of mergers, acquisitions and IPO’s as young fintech companies mature and prepare to exit.

2. Developing a core target market

This is a key issue for any startup but it is particularly important for fintechs entering the highly competitive and cut-throat world of financial services.

It’s unrealistic to be all things to all people. Fintech startups need to pick their core market carefully and then target it with a laser-like focus.

3. Define a clear product offering

A clearly defined product or service goes hand in hand with developing a core target market.

Fintechs are already disrupting the status quo in areas such as payments, lending, investments and insurance.

A report by PWC revealed that while executives have differing ideas about which areas of fintech will be the most disruptive, they agree that artificial intelligence (AI) will create the biggest change in how financial services are delivered.

Consumers increasingly want personalised financial products that are easy to use and is accessible 24/7.

Accordingly, whichever product category fintechs target, they need to be thinking about how to solve existing problems in better ways by leveraging new technologies.

4. Customer acquisition strategies

Fintech startups have many advantages over traditional banks and financial services institutions namely greenfield technology, agility, lower operational costs and speed.

But fintech startups must still develop the most important asset of any business from scratch – its customer base.

The cost of acquiring new customers will be a key factor in success or failure. As a company scales, its customer acquisition costs should decrease while gross margins increase.

Source: Oracle NetSuite’s Business Guide

5. Insights and feedback loops

A slick, personalised and responsive customer experience is one of the key differentiators for fintechs in competition with traditional banks.

Maintaining that competitive edge means having a relentless focus on the customers, constantly collecting feedback and turning it into actionable insights that can be used to iterate, improve and perfect the product or service.

Capturing, categorising and prioritising this data is essential to being able to measure performance and generate the insights needed to continually improve the customers’ experience.

This data can come from many different sources, including transactions and sales, customer feedback surveys, customer support as well as social media.

6. Understanding how to stay compliant and work with regulators

As with any new technology-led trend, regulations can often take some time to catch up.

However, that doesn’t mean fintech startups operate in a regulatory vacuum and under the radar of the kind of rules that traditional financial services institutions have to play by, such as anti-money laundering, compliance, data protection and know-your-customer regulations.

The regulatory framework for fintech in the Asia Pacific region is diverse.

The sandbox approach has been adopted by regulators in Abu Dhabi, Australia, Hong Kong, Indonesia, Malaysia, Singapore and Thailand, where firms can test new products and services that are not covered by existing regulations.

Governments globally are mandating that legacy banks open much of their customer data to other businesses to stimulate competition.

These laws around financial services, data protection and open banking both define and limit the scope of fintech operations.

This mean that the country in which a fintech chooses to operate out of will be a significant factor in determining its success.

7. Attracting and sustaining the right type of talent

Attracting and retaining talent is a huge challenge for fintechs as the industry continues to thrive. Investment in the sector continues to be strong.

While salary and financial rewards are still big factors in attracting talent, fintechs need to develop a range of initiatives and benefits to ensure that not only is there a pipeline of new talent coming through but that they can also retain the best people in such a competitive environment.

8. How to expand to international markets

Once fintechs are established in a home market, expansion overseas is the obvious next step to scale up.

However, as with any startup, there are challenges to international expansion. The financial industries’ regulations, tax, legal and labour laws vary around the world, and it can be complex for a fintech startup to get to grips with compliance in a new territory.

Most fintechs struggle during this phase of expansion, as they do not have the infrastructure to transact in multiple currencies and navigate the complex world with different tax regulations.

It’s also easy to underestimate the importance of language and cultural differences when rolling out financial products or services in a new country.

There’s also the competition from established players in the local market to consider.

These are all factors that could be critical to the success or failure of launching a fintech service in a new country.

9. Cybersecurity and data protection

As a sector heavily reliant on handling sensitive information and using digital technologies, it’s no surprise that a major issue for fintech startups is cybersecurity and the threat of data protection breaches.

Fintechs are an attractive target for cybercriminals, and PwC’s Global Fintech Report 2019 highlighted that many organisations see compliance and data privacy risks as their greatest challenge in implementing their fintech strategies.

The Asia Pacific region ranges from heavy to limited in terms of data protection laws according to DLA Piper, and companies need to tailor their approach accordingly.

Where regulations are tougher, there is the risk of potentially substantial fines for security breaches and failures to adequately protect personal information.

Where they are less stringent, there are risks of enormous loss of customer trust where sensitive information is breached.

Want to learn more about the 9 emerging fintech pain points? Learn how to overcome them by downloading our business guide here.