BankGo Launches Open Beta in Vietnam And Just Closed a Seed Round With $3m Premoney Valuation

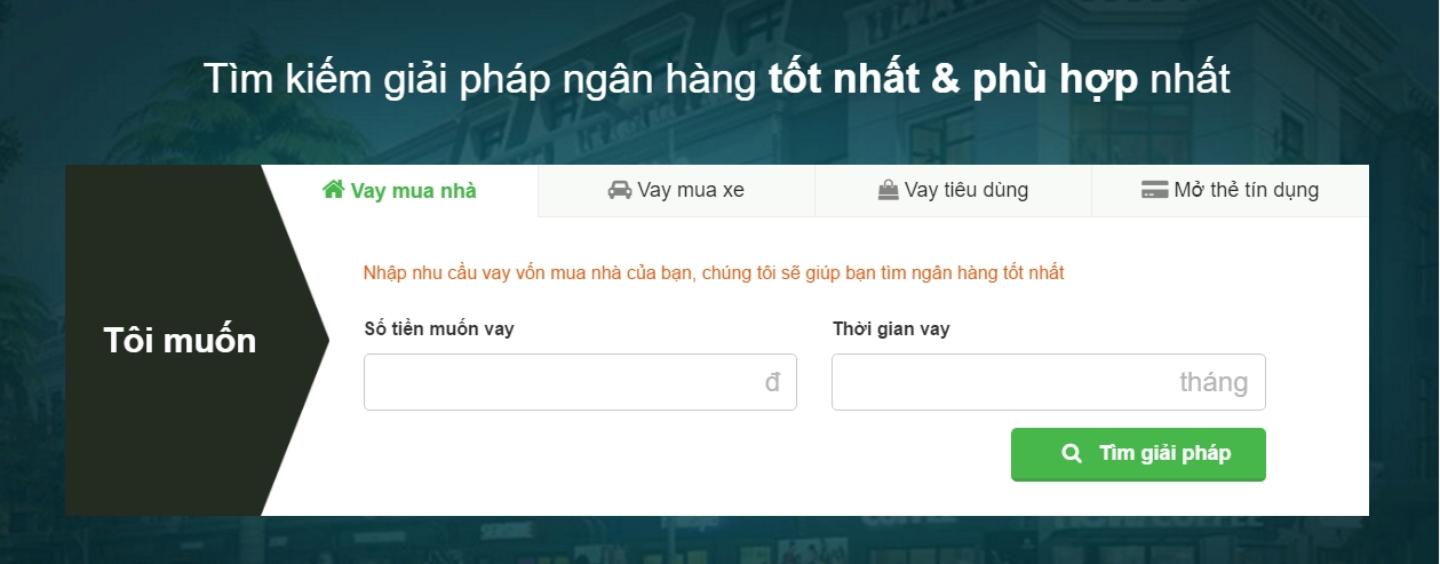

by Fintech News Singapore October 18, 2016BankGo is a financial comparison platform for personal loans (housing, car, consumer loans) and credit cards in Vietnam. They launched a close beta version on March 2016 and got 250,000 USD loan book via the platform.

Through BankGo, Borrowers can be able to borrow money from Banks more easily to buy house/ car/ consumer products with best interest rate as well as other loan conditions.

Through BankGo, Borrowers can be able to borrow money from Banks more easily to buy house/ car/ consumer products with best interest rate as well as other loan conditions.

This is a market of $15.12 billions sales volume in Vietnam in 2015 (consumer loans only, data from Vietnam Consumer Finance Market Report 2015 by StoxPlus). BankGo is a kind of online selling arm for Banks and gets commission fee on the successfull loan applications/ new credit cards from Banks, it is free for Borrowers.

BankGo helps Borrowers to search, compare, recommend Banks with best interest rate as well as other loan conditions and then connect them to apply loan with Banks. While Banks cooperate with BankGo to get qualified loan applications and more new Borrowers.

“We want to contribute to make the financial information in Vietnam more transparent, with better banking services and making financial products in Vietnam to become as common products, be easy to buy” shared by Vu Viet Hung – Founder & CEO, BankGo & Founder of U&Bank, the largest online forum for Bankers in Vietnam. Hung was a Manager of TPBank/ HD Bank/ VIB Bank for over 10 years before starting BankGo.

Vu Viet Hung, Founder & CEO, BankGo

They just launched an open beta version and closed a Seed round with $3m premoney valuation. The investor is known as an Investment Director of a fund in Vietnam. This new capital will be used for product development and borrowers acquisition.

The similar business models with BankGo are BankBazaar (India), CompareAsia (Hong Kong).

Fintechnews already wrote about Bankgo in March. Read the Story here.