Singapore Dominates Nearly Half of All Fintech Funding in ASEAN

by Fintech News Singapore November 23, 2022Results from the UOB study were shared in the latest Fintech in ASEAN report, an annual report by UOB, PwC Singapore and the Singapore Fintech Association, which looks at the state of fintech in Southeast Asia and venture capital (VC) activity.

The report also delves into emerging trends observed across the region over the prior year.

According to the report, fintech investments remained strong in Southeast Asia during the first nine months of 2022, totaling US$4.3 billion through 163 deals.

So far, funding activity has been driven by late-stage financing, which made up 54% of all year-to-date (YTD) total. The figure represents an 11-point increase from last year and shows that investors are becoming more selective, favoring companies with a clear pathway towards profitability and sound financial management, the report says.

ASEAN-6 fintech funding trends, 2018 – YTD 2022, Source: Fintech in ASEAN 2022: Finance, reimagined, UOB, Nov 2022

In 2022, Singapore and Indonesia continued to dominate fintech funding, accounting for more than three-quarters (76%) of ASEAN’s total funding YTD. The Philippines and Vietnam, meanwhile, saw their share of the pie significantly reduce in part because of fewer mega-rounds occurring in 2022, compared to 2021.

Share of funding amount by country, 2021 vs YTD 2022, Source: Fintech in ASEAN 2022: Finance, reimagined, UOB, Nov 2022

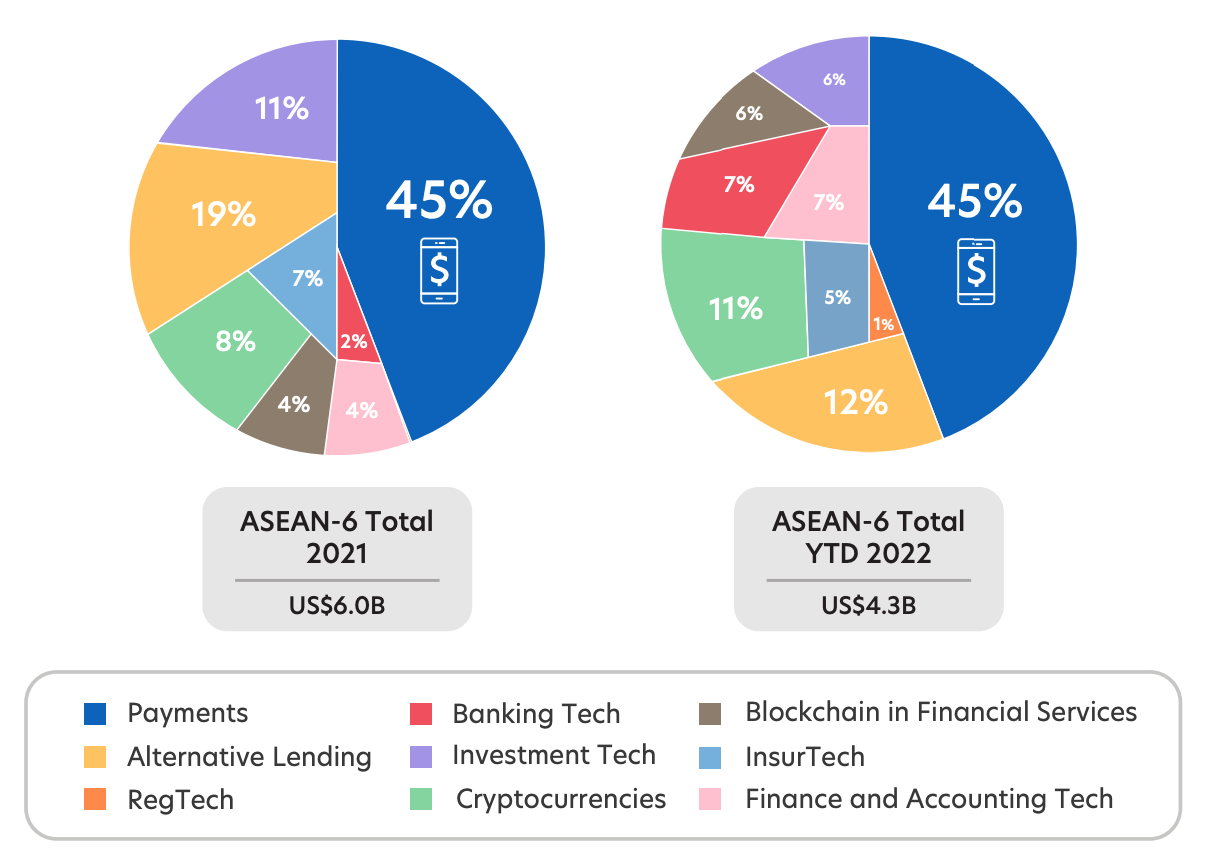

Payments remained the most funded fintech category in ASEAN, amassing a total of US$1.9 billion in the first nine months of 2022. The five largest deals during the period involved companies in the space: Coda Payment’s US$690 million Series C (Singapore); Xendit’s US$300 million Series D (Indonesia); Dana’s US$250 million Series D (Indonesia); Voyager Innovations’ US$210 million Series F (the Philippines); and TNG Digital’s US$168 million Series A (Malaysia).

Lending took the second place, raising a total of US$506 million, followed by cryptocurrency with US$461 million. This year, cryptocurrency overtook investment technology as the third biggest fintech segment by total funding.

Funding breakdown by fintech categories, 2021 vs YTD 2022, Source: Fintech in ASEAN 2022: Finance, reimagined, UOB, Nov 2022

In terms of deal flow, one in three investments in ASEAN went to crypto and blockchain companies, showcasing that investors continue to be interested in the digital assets and Web 3.0 spaces.

A separate report by global investment banking advisor BDA Partners shows that this year, merger and acquisition (M&A) deals are intensifying in Southeast Asia’s crypto and Web 3.0 industries, citing names including SmartPesa (Singapore), Ape Board (Singapore), WagmiSwap (Singapore), Velo Labs (Singapore) and Evrynet (Singapore).

This shows increased maturity of the sector, the emergence of industry leaders and rising interest from companies from other sectors in the space.

Embedded Finance Takes Off in Southeast Asia

Southeast Asian consumers are growing more familiar and comfortable with using financial services embedded into e-commerce, travel apps and other software platforms, a trend that’s especially apparent in Vietnam, Thailand and Indonesia, a new study by Singapore’s United Overseas Bank (UOB) shows.

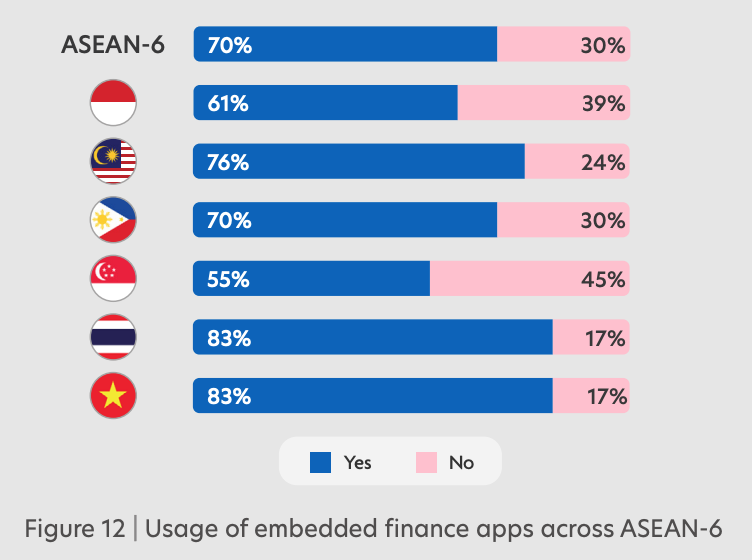

A survey of 4,000+ consumers across Indonesia, Malaysia, Singapore, Thailand, the Philippines and Vietnam, conducted in mid-2022, found high awareness of embedded finance across the six countries with more than four in five respondents (81%) indicating being aware of such services.

Usage is also high in the region, especially in Vietnam and Thailand where 83% of respondent in the respective two countries indicated using embedded finance apps, up 13 points from the regional average of 70%.

Usage of embedded finance apps across ASEAN-6, Source: Fintech in ASEAN 2022: Finance, reimagined, UOB, Nov 2022

On average, almost every three in four of respondents (74%) who use apps with embedded finance will use the them at least once a week, demonstrating the potential of such apps to increase user engagement, and how their convenience and seamlessness are appealing to consumers.

Frequency of usage of embedded finance apps across ASEAN-6, Source: Fintech in ASEAN 2022: Finance, reimagined, UOB, Nov 2022

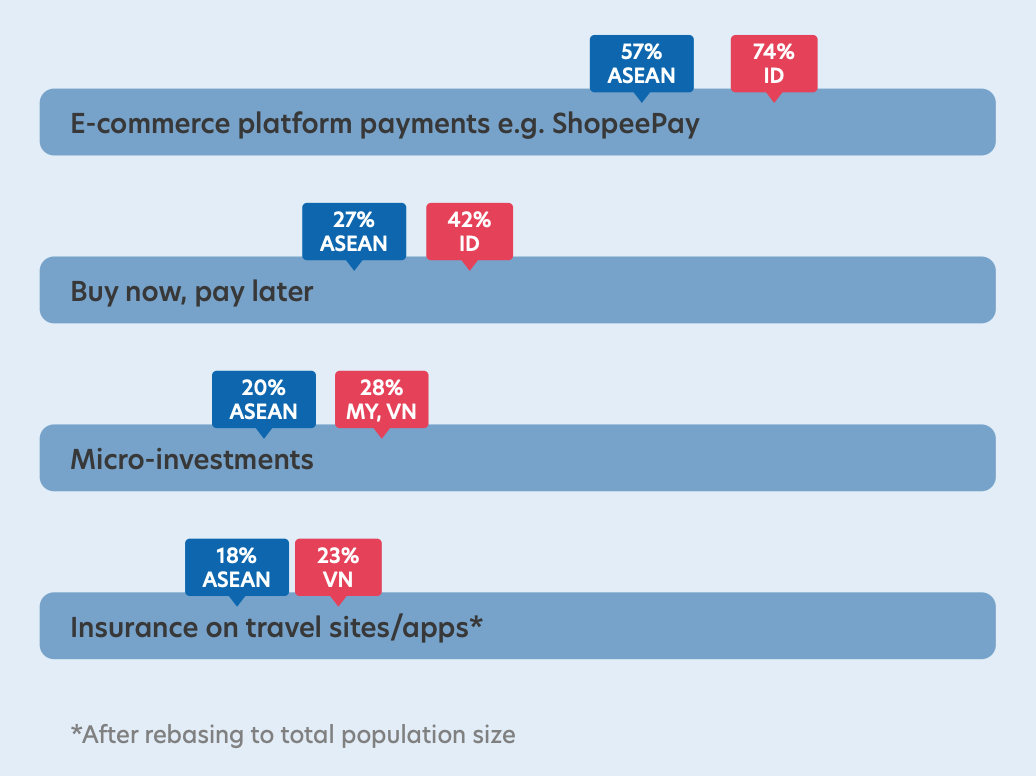

Delving into specific embedded finance products, the study found that Vietnam had the highest usage in micro-investments (28%) and integrated insurance on travel sites and apps (23%). Indonesia, meanwhile, had the highest usage for e-commerce payment platforms (74%) and buy now, pay later (BNPL) (42%).

Usage of embedded-related services in Southeast Asia, Source: Fintech in ASEAN 2022: Finance, reimagined, UOB, Nov 2022

In both countries, usage of e-commerce payment platforms surpassed cash, showcasing that embedded payment is not only on the rise but also, in some cases, dethroning cash, the region’s historically preferred payment method.

Payment methods most used across ASEAN-6, Source: Fintech in ASEAN 2022: Finance, reimagined, UOB, Nov 2022

These results show that consumers in Southeast Asia are growing fond of integrated platforms. This is especially the case in markets where access to banking services remain limited like Indonesia and Vietnam, and demonstrates that integrated apps with built-in financial services are offering an opportunity for users to adopt digital financial services.