The way we pay for goods and services is constantly evolving, and the payment trends in Asia are only accelerating in 2023 as digital innovations are increasingly harnessed to offer ease and convenience to consumers in a competitive retail environment.

In 2023, we can expect to see even more changes in trends in the payments landscape across Asia as new technologies and consumer preferences come into play. Here are some of the top payment trends to watch out for in Asia in 2023 and beyond.

Buy now, pay later (BNPL) will gain more popularity in Asia

For a while there, it truly seemed like ‘buy now, pay later’ (BNPL) options were being seen as a financially inclusive alternative to credit or interest-heavy repayments. While valuations for some of the most noteworthy global BNPLs have had to be reevaluated in recent times, BNPL remains a popular source of alternate financing for online purchases in Asia, particularly among the younger and lesser-banked segments of the regional population.

BNPL allows consumers to split the cost of a purchase into interest-free instalments, making it a convenient and affordable way to shop. With more and more retailers and online marketplaces offering BNPL options, it’s likely that this payment method will still be relevant across Asia in 2023.

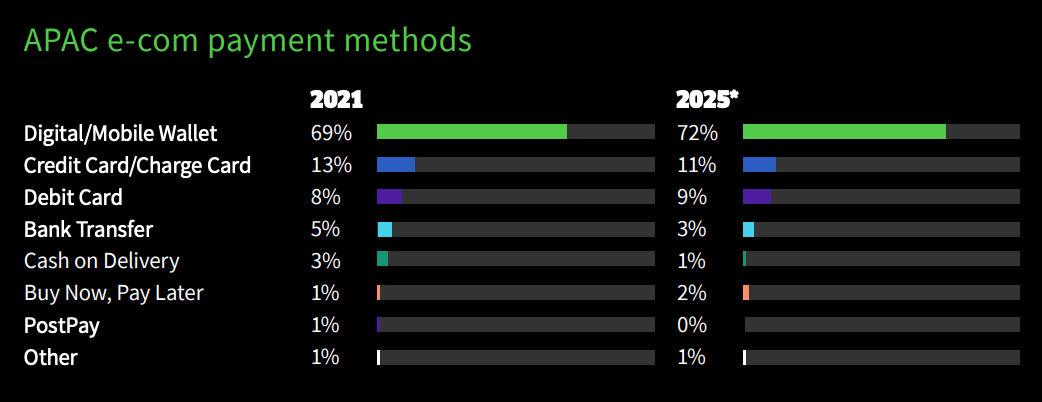

APAC e-commerce payment methods, Source: 2022 Global Payments Report by Worldpay from FIS

The BNPL payment industry in the Asia Pacific is incredibly robust, with pay-later trends expected to grow by 45.3% annually to reach US$201.9 billion by end-2022. The momentum is set to continue with BNPL operators expanding into new categories to drive growth amid rising competition. Australia-based early adopter Afterpay, for instance, was acquired by point-of-sale (POS) payments specialists Square and is now integrating BNPL options into Square retail solutions.

International players like Klarna and Afterpay as well as regional ones like Atome are making in-roads investing in the China BNPL space, where cross-border e-commerce has flourished alongside the domestic e-commerce market. At the same time, Chinese BNPL companies are expected to expand across APAC in the coming years.

Cross-border payment bridges will make it easier to pay overseas

Speaking of cross-border, one of the biggest challenges of international travel is dealing with different currencies. When trying to make a purchase in a foreign currency, travellers often have to rely on expensive and inconvenient methods like currency conversion. However, this is set to change with the rise of cross-border payment bridges.

Cross-border payment bridges are platforms that allow users to link their bank account with an overseas account, so that they can easily make and receive payments in different currencies. This will make it much easier (and cheaper) to shop abroad, and we can expect more businesses to start offering products and services in multiple countries. Central banks and financial hubs in fast-growing Asian territories such as in Southeast Asia are partnering up to push better payment interlinkages between their operational areas, not just to facilitate payments but to prepare for better cross-border trade, investment, and other economic activities.

The bridges will also make it easier for people to send money to family and friends overseas, pay for goods and services, as well as allow for more cost-effective B2B payments. Cryptocurrency trades and cross-border fintech bridge agreements between countries can often offer much lower transaction rates as well as less transactional hassles, but have yet to reach the point of seamless, real-time money transfers. Both incumbents and fintech startups are looking to disrupt this space, which might happen as early as 2023

Personalised loyalty offers to become more crucial

Personalised loyalty offers are a great way to increase customer engagement and retention. With the right strategy, you can target customers with specific products or services that they are likely to be interested in.

There are a few things for businesses to keep in mind when developing a personalised loyalty offer. The offer must be relevant to the customer, must be easy to understand, and must be easy to redeem. Among the payment trends highlighted here, this one is growing rapidly as the access to customer data explodes and becomes commonplace for businesses to leverage as they bid to stand out from their competition.

In a video interview with Fintech News Singapore experts agree that hyper-personalisation will be crucial for financial services to remain relevant.

Data from McKinsey and Salesforce supports that this will be key for businesses to remain competitive in an era of digitalisation, with 71% of consumers expecting personalised experiences from companies they patronise. This will only rise in future, as already three-quarters (74%) of Gen Z consumers demand personalised products or services.

Loyalty programs have always been a key part of the retail landscape, but in recent years, we’ve seen a shift toward more personalisation in these programs. Retailers are using data to segment their customers and target them with specific offers that are tailored to their individual needs and preferences — making them that much more compelling in contrast to generalised offers.

Contactless payment trends to take off in 2023

The COVID-19 pandemic has driven a huge increase in the use of contactless payments, as consumers seek to minimise the risk of infection by using cash. This trend is set to continue in the months and years ahead, as more and more businesses adopt contactless payment methods.

With the rise of mobile commerce and digital wallets, contactless payments are becoming more popular. In fact, a recent study found that nearly half of 3,000 consumers surveyed have used their smartphones to make in-store payments at Starbucks (49%), McDonald’s (43%), and Walmart (41%).

Besides app-based or digital wallet transactions, the majority of contactless payments will be driven by hardware possessing near-field communication (NFC) technology. This includes NFC-enabled smartphones and card terminals. But there are additional costs for merchants to purchase and set up NFC point-of-sale (POS) terminal infrastructure, which are absent in ‘soft POS’ systems which are smart devices with NFC and payment data housed within.

Contactless mobile transactions are catching on as one of the dominant payment trends worldwide, with 782 million users in 2022. But this is expected to grow by nearly 60% in the next two years to reach 1 billion global users by 2024,

There are many benefits of contactless payments, such as convenience, security, and speed. However, there are also some drawbacks, such as the potential for fraud and the lack of customer service.

Mobile will be king among payment trends in 2023

As highlighted above, transactions made from a smartphone or tablet are one of the trends driven by consumer demand for increasingly contactless payment means in 2023. In the past, most payments were made in cash or via cheque.

However, in recent years there has been a noticeable shift towards electronic and mobile payments. This trend is only set to continue, and it is important for businesses to be aware of the latest innovations in mobile-based payments technology.

These include the continued growth of mobile adoption, the increasing use of digital wallets, the aforementioned rise of contactless payments, and the growth of in-app payments.

Mobile payments are becoming ubiquitous, with more and more people using their smart devices to make purchases. Juniper Research projects that smartphone penetration in Asia Pacific will exceed 99% by 2024, and even now, nearly six out of 10 shoppers say the ability to make purchases via their mobile devices will be key to which retailers or platforms they will buy from.

Featured image credit: edited from Freepik