DBS’ CEO Piyush Apologises for ‘Embarrassing’ Disruption, Sets up Committee to Investigate

by Fintech News Singapore April 3, 2023DBS Bank has set up a special board committee with immediate effect to conduct a full and detailed investigation on the digital disruption that it had faced last Wednesday (29 March).

This was announced by DBS’ Chairman Peter Seah during its Annual General Meeting held on Friday (31 March) where he said that the bank will also engage external experts with broad and deep experience in overseeing large-scale IT systems and operations to work with the committee.

The committee will include board members; independent director Olivier Lim, Board Audit Committee Chairman Tham Sai Choy, veteran banker and tech expert Dr Bonghan Cho and Chng Kai Fong who also sits on the Board of GovTech.

This recent incident was the second time DBS has experienced such a prolonged disruption following that of a 39 hours one from 23 to 25 November 2021.

This resulted in the Monetary Authority of Singapore (MAS) imposing an additional capital requirement of S$930 million on DBS in February 2022.

Following this incident in 2021, DBS worked together along with some independent experts and re-architected its systems.

The bank had also improved its engineering team as well as its instrumentation and diagnostics, strengthened its recovery protocols and more. But the bank still unfortunately fell short last week.

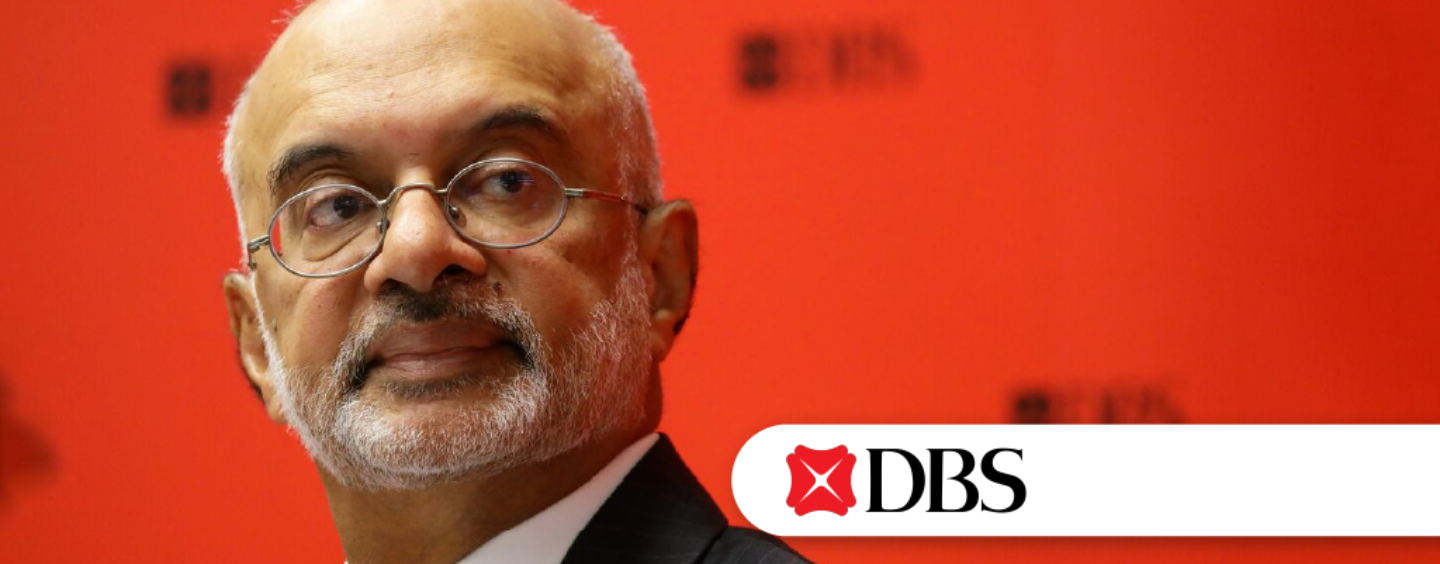

Piyush Gupta

Piyush Gupta, Group CEO of DBS made some clarifications about the incident on Wednesday saying,

“For the large part of the day, only about 40-50% of our customers could actually get in. People who got in could do everything because of the architecture chain, which allowed the other services to continue working. So, if you tried 2-3 times and could get in, then everything would work.”

He went on to apologise saying that the disruption in DBS’ digital banking services, the second time in 16 months, has been sobering and embarrassing. He added that the bank was committed to doing better.

Peter Seah

Seah echoed this sentiment saying,

“Ensuring uninterrupted digital banking services 24/7 has been our key priority. Unfortunately, we fell short of it and are truly sorry.”