As the world undergoes rapid changes, businesses in the banking, financial services, and insurance (BFSI) sectors are also expected to adapt to new norms. Environmental, social, and governance (ESG) principles have become more than an option and are now essential for businesses to survive in this era. This shift in demand is driven by various stakeholders, including employees, shareholders, governments, and regulators.

According to a recent study by Finastra, 79 percent of APAC banks plan to increase their exposure to green lending in the next 12-18 months Similarly, investment-fund companies across the US, United Kingdom, Germany, and France have stated that ESG has become more critical to their investment strategy between 2021 and 2022.

Companies that fail to meet these principles may lose employees, customers, or operating licenses. Governments are now making ESG a condition for business approvals, making it necessary for companies to comply with ESG principles to continue growing.

In the absence of voluntary adoption, regulation will force compliance. Therefore, adopting ESG principles is necessary to ensure the sustainability of the business.

ESG Adoption in Asia

As the winds of change continue to blow across Asia, the adoption of ESG principles is on the rise, with an increasing number of companies embracing them.

According to Isabel Fernandez, EVP of the Lending Business Unit at Finastra, even utility companies now recognise that adopting ESG is crucial for their sustainability and growth.

“While coal-fired power plants were previously seen as necessary to provide electricity to areas without access to electricity, the tide has turned, and more of these companies have realized the importance of ESG,” she explained.

“In fact, across the board, ESG has gone from being a nice-to-have to a must-have,” she added.

These changes are driven not only by foreign direct investment and subsidiaries of non-local companies but also by companies with enlightened leadership teams. As more companies in the region embrace ESG principles, the Asia Pacific region is projected to experience the fastest growth rate of any major region in ESG assets under management (AUM).

According to these projections, the figure is expected to rise from US$1 trillion last year to US$3.3 trillion in 2026. Even under a worst-case scenario, the overall ESG AUM in the Asia Pacific region is forecast to reach US$2.1 trillion within five years. However, the best-case scenario projects that the figure could reach an impressive US$5 trillion. In 2022 alone, ESG bond proceeds in Southeast Asia grew by 38 percent to US$21.9 billion.

Isabel, said that the projected growth in ESG assets in the Asia Pacific region is an indication of a positive trend that will shape the region’s financial future for years to come.

“Companies in Asia need to continue prioritising ESG principles to ensure the region remains competitive and sustainable,” she added.

Combating Greenwashing

Greenwashing, or the deceptive practice of portraying an organization’s products or policies as environmentally friendly, is a significant concern. The industry must strive for genuine ESG improvement, as superficial changes can harm the environment and the company’s reputation.

A global report by the International Consumer Protection and Enforcement Network (ICPEN) revealed that approximately 40 percent of environmentally-related claims companies make are potentially misleading. This statistic highlights the urgent need for more accountability and transparency in the industry.

“ESG is not just a trend, but a necessary business practice to ensure long-term sustainability and competitiveness,” said Isabel. “However, we need to ensure that companies are truly committed to these principles. That’s where regulation and auditing play a crucial role.”

Isabel emphasised that auditors can review a company’s balance sheet and assess their ESG performance, ensuring they are not just paying lip service to these principles. “Regulatory pressure can also be a powerful incentive for companies to adopt ESG in earnest,” she added.

By implementing these measures, the industry can work towards building a more sustainable and trustworthy future.

Balancing Profitability and Sustainability

To address the climate crisis and other societal issues effectively, the financial industry must go beyond simply adopting ESG principles. While this is an essential first step, companies can do more by investing in green technology, developing sustainable products and services, and advocating for ESG principles.

Furthermore, banks can work to reduce their carbon footprint, support renewable energy, and engage with stakeholders to promote sustainability. By implementing these measures, the financial industry can contribute to building a more sustainable future for all.

Isabel said that transforming the ‘mighty middle’ is crucial for the financial industry to impact the world significantly. As Isabel explained, this segment makes up around 70 percent of most banks’ loan books, making it a crucial area to prioritise.

“Banks could bolster their ESG credentials by simply adding more green assets to their books, but this is not enough,” Isabel said. “Banks can really make an impact by helping their entire portfolio – including companies in the ‘mighty middle’, which are neither leaders nor laggards – to become greener.”

“Improving the sustainability of the entire portfolio can help companies mitigate risks and reduce costs, ultimately improving their profitability in the long run,” she said.

Another crucial step is the promotion of sustainability improvement loans, which emphasize the importance of companies improving themselves over time, irrespective of whether they are inherently green or pollutive.

The Role of Technology Advancements in Sustainability

According to Isabel, the most significant apprehension among sceptics revolves around the progress of technological advancements.

“In the past, certain technologies, such as solar energy, struggled to scale due to prohibitive costs, resulting in a relatively small contribution to the overall energy mix. However, an evolution in this landscape is currently unfolding,” said Isabel.

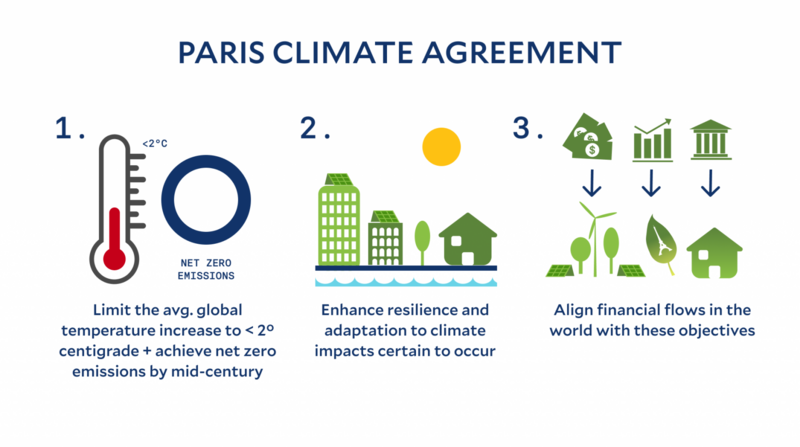

Upon examining projections and extending them linearly, there is ample cause for concern and negativity, especially considering the objectives outlined in the Paris Climate Agreement. Despite this, a silver lining emerges: recent technology developments provide solutions that yield quicker results and foster a more sustainable future.

Encouragingly, an uptick in investments directed toward technological advancements and accelerated innovations is being observed. This surge in support will address the concerns of sceptics and propel the world toward achieving global climate goals more rapidly and effectively.

Finastra’s Offerings for ESG

Finastra is committed to supporting the financial industry’s adoption of ESG principles to remain competitive amidst growing regulatory pressure. One of their key offerings is the Finastra ESG Service, a cloud-native SaaS solution simplifying sustainability-linked lending.

The solution is designed to facilitate the integration of sustainability performance target criteria into ESG pricing, enabling banks to provide their corporate clients with a better and more sustainable lending experience. It can seamlessly integrate with Finastra Loan IQ and other back-office systems, making it an open and scalable solution.

Loan IQ, Finastra’s leading commercial and syndicated lending servicing solution, is trusted by 9 out of the top 10 agent banks globally, with over thirty-five years of collaboration with industry participants bringing best practice methods to all aspects of lending. This proven solution is developed to meet the needs of the world’s most demanding loan markets, reducing IT systems maintenance costs by 20 to 30 percent and decreasing the time to create reports by 90 percent.

These metrics outline examples of the quantifiable benefits realised by Finastra clients; results are not guaranteed and will differ for each client depending on the current state and desired future state

Through their commitment to ESG principles and innovative software solutions, Finastra is leading the way in helping the financial industry prioritise sustainability and remain competitive in an evolving regulatory landscape.

Take advantage of the opportunity to elevate your ESG performance with Finastra’s cutting-edge ESG Service. Click here to learn more and get started today!