Outlook Remains Optimistic for Singaporean Startups Despite Funding Slowdown

by Fintech News Singapore June 4, 2023Singapore’s emerging technology sector is expected to continue on its growth path, driven by supportive government initiatives and policies. This will be despite a challenging macroeconomic environment that’s marked by rising inflation, interest rate hikes and a looming global recession, a new report by SGInnovate says.

The latest Singapore Early-Stage Emerging Tech Startups 2022 Report, released in April by the government-owned innovation platform, looks at the current state of Singapore’s emerging tech sector, highlighting trends among local startups that are applying physical sciences, life sciences and engineering to address market needs in the industry verticals of advanced manufacturing, agrifood, sustainability, as well as health and biomedical sciences.

The report outlines the challenging fundraising landscape as well as the slowdown in new business formation, but argues that the favorable regulatory and policy environment will continue to fuel the growth of Singapore’s emerging tech industry.

University entrepreneurship programs, venture studios drive emerging tech innovation

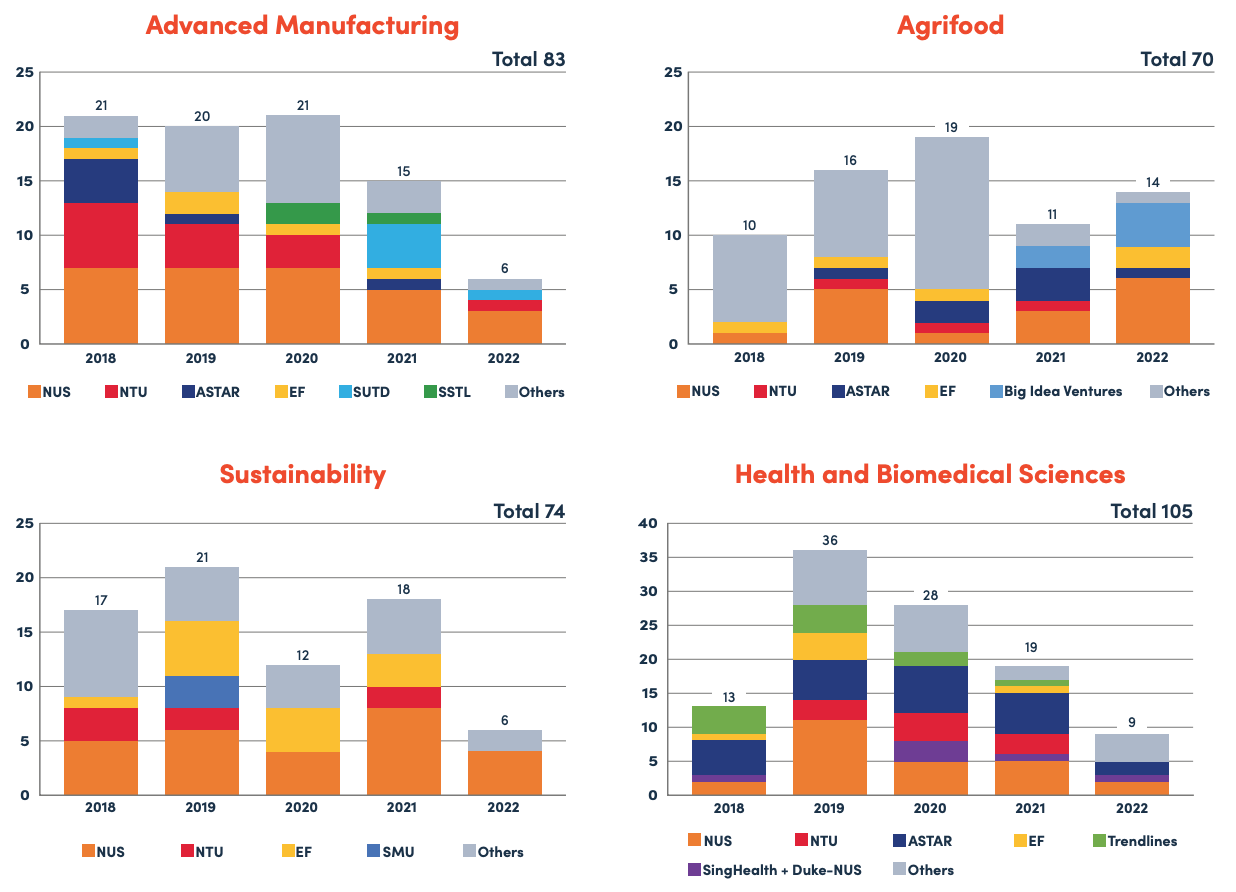

After a record year 2019, the number of emerging tech startups founded in Singapore steadily declined. In 2022, the report identified 35 Singapore-based emerging tech startups being incorporated in the country, but based on ecosystem trends, that number is expected to be higher at approximately 60 compared.

Singapore emerging tech startup incorporation per year, Source: Singapore Early-Stage Emerging Tech Startups 2022, SGInnovate, April 2023

The report shows that private sector organizations are now driving innovation in emerging tech, accounting for a great proportion of the startup incorporation pipeline last year.

It notes several key initiatives, including the collaboration between biotech-focused venture capital (VC) firm EVX Ventures and universities in Singapore and overseas to spin out biomedical startups, as well as the Space Accelerator Program by Singapore Space and Technology, which incubates and supports space tech startups, and the Big Idea Ventures accelerator program, which focuses on foodtech and agritech startups.

Moving forward, SGInnovate expects university entrepreneurship programs and industry acceleration programs to continue to play a critical role in building up Singapore’s emerging tech sector.

Funding activity declines

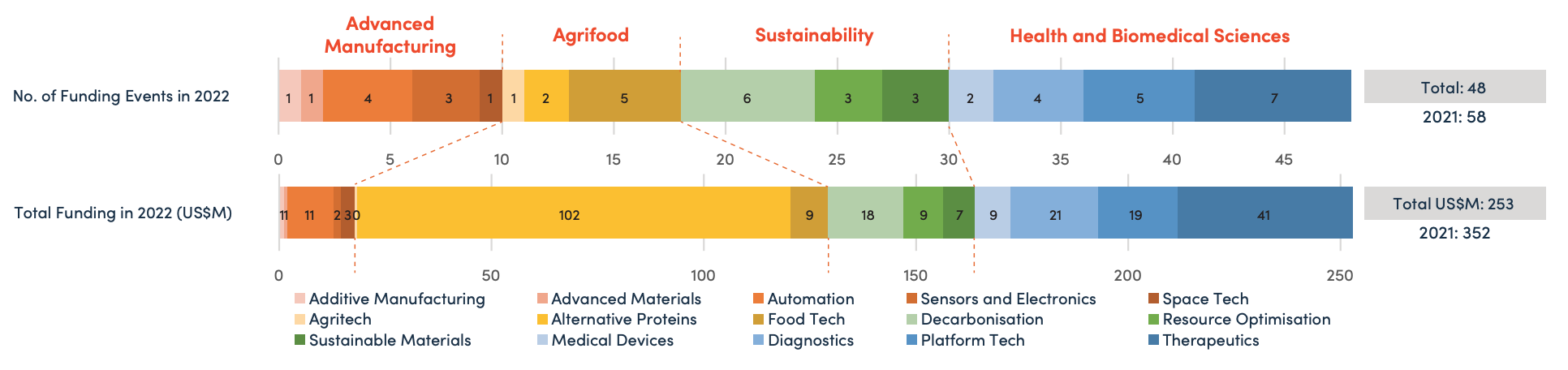

Reflective of the 2022 VC downturn, venture funding activity declined significantly in 2022. The number of deals dropped by 17% year-on-year (YoY) to 48, while fundraising amounts decreasing by 28% across all verticals and funding stages to US$253 million.

Singapore emerging tech funding activities in 2022 by sub-verticals, Source: Singapore Early-Stage Emerging Tech Startups 2022, SGInnovate, April 2023

2022 also recorded an increase in so-called extension rounds. 20 early-stage emerging tech startups raised Seed+/Pre-A or A+ funding rounds last year, more than double the number that did so in 2021 (9). This trend can be explained by the challenging fundraising market, the report says.

Extension rounds involve the infusion of additional funding from existing or new investors under the same terms as the previous financing round. Companies often resort to this type of financing to obtain additional capital and extend their runway until the environment improves while avoiding a down round financing.

A challenging fundraising environment

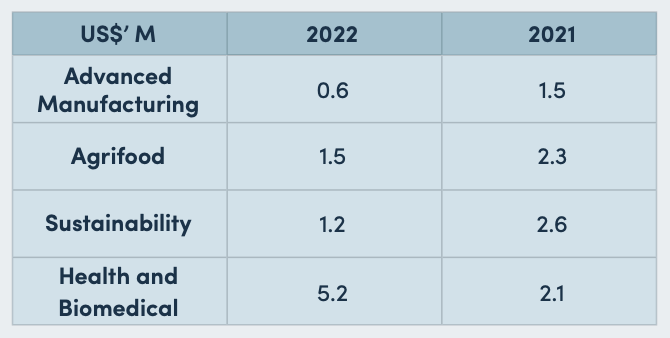

The research also found that most startups in their initial stages of development were impacted by uncertain economic conditions. In 2022, the average seed round size shrank for all verticals, except for health and biomedical sciences, declining by 60% in advanced manufacturing, 40% in agrifood and 54% in sustainability, while health and biomedical saw an increase of 148%.

Average seed round sizes in 2022 across four verticals compared to 2021, Source: Singapore Early-Stage Emerging Tech Startups 2022, SGInnovate, April 2023

Moving forward, the early-stage funding landscape will likely remain challenging as public market volatility continues to introduce uncertainty to private markets, the report says. However, it argues that the local VC scene will continue to be active in the early-stage emerging tech space due to the influx of capital into the city-state and level of government support available.

The sustainability vertical is expected to remain of relevance, supported by regulatory and public pressure. In particular, Singapore’s national strategy to shift half of its energy production to low-carbon hydrogen by 2050 will continue driving the growth of startups developing more efficient and low-cost technologies to produce, distribute and use this fuel. Additionally, stricter regulations and consumer pressure around the use of single-use packaging and petroleum-based plastics will continue fueling demand for more sustainable alternatives.

In health and biomedical science, the confluence of the city-state’s aging population, chronic disease, pandemic vigilance and rising affluence is setting the stage for further growth in the sector. In the medical device sub-vertical, equipment addressing home care, remote care and caregiving efficiency will be increasingly relevant as the population ages at a faster pace, the report says. In platform tech and therapeutics, Singapore’s historical strength in biomedical research will continue to generate a good pipeline of innovative startups.

Featured image credit: Edited from Freepik