China has leapfrogged ahead of London, New York and Silicon Valley to become “the undoubted center of global fintech innovation and adoption,” according to a new report by EY and DBS Bank.

The document, titled “The Rise of Fintech in China: Redefining Financial Services,” looks at China’s dynamic and rapidly evolving fintech ecosystem and examines the drivers behind its “explosive growth.”

The document, titled “The Rise of Fintech in China: Redefining Financial Services,” looks at China’s dynamic and rapidly evolving fintech ecosystem and examines the drivers behind its “explosive growth.”

“The speed at which China’s fintech landscape has developed is truly remarkable,” said Neal Cross, chief innovation officer of DBS.

“It’s gotten this far because China’s landscape has operated in a sandbox-like environment conducive for fintech to thrive – a strong domestic market, coupled with a constant push for innovation and experimentation driven by leading giants, unhindered by international influence. Much of this can be attributed to the favorable government policies and regulations.”

Chinese fintech champions are blowing away competition all over the world, Cross said, and have recently started taking center stage at the global level.

Ant Financial’s Yu’e Bao is one of the largest online funds managing US$96 billion for more than 295 million clients, as of mid-2016. Ant Financial, the financial services arm of Alibaba, also operates Alipay, the world’s biggest online payments platform with over 400 million active users.

China is the largest peer-to-peer lending market globally, advancing 3% of system retail loans versus 0.7% for peer-to-peer lenders in the US. The country’s biggest peer-to-peer lending platform Lufax had more than 23.3 million users as of July 2016, a number that has more than doubled in a year.

The surge in fintech investment in Asia-Pacific in 2016 can largely be attributed to China with US$1 billion being invested in two of China’s largest Internet finance companies, Lufax and JD Finance.

In the second quarter of 2016, Ant Financial raised US$4.5 billion, the largest single private platform in any fintech company globally, valuing it at US$70 billion.

Chinese fintech companies raised a total of US$8.8 billion between July 2015 and June 2016, the largest share of global investment in the sector. This represents an increase of 252% since 2010.

According to the report, China’s fintech industry is leading by huge margins in Asia-Pacific, notably in segments that include payments, insurance and peer-to-peer lending.

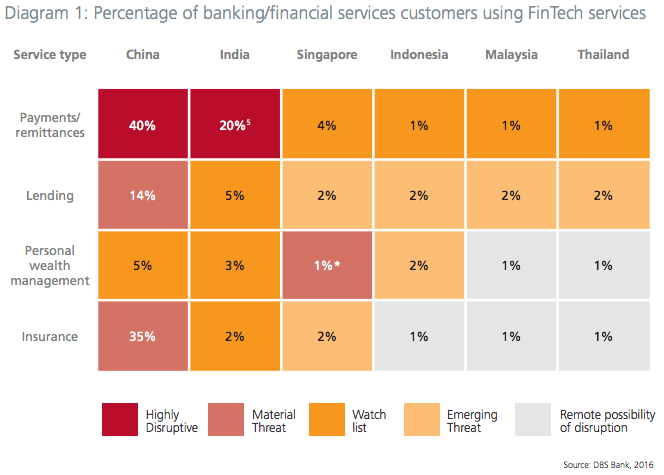

Data provided by DBS Bank suggest that 40% of Chinese banking/financial services customers are using payments and remittances services provided by fintech, against 20% in India and only 4% in Singapore.

A staggering 35% of Chinese customers are using insurtech services, against only 2% in India and 2% in Singapore.

Key drivers of China’s fintech leadership

The rise of fintech in China has been fuelled by a number of elements, including the fact that Chinese financial institutions have been falling to meet consumers’ needs, underserving both the SME and retail customer segments.

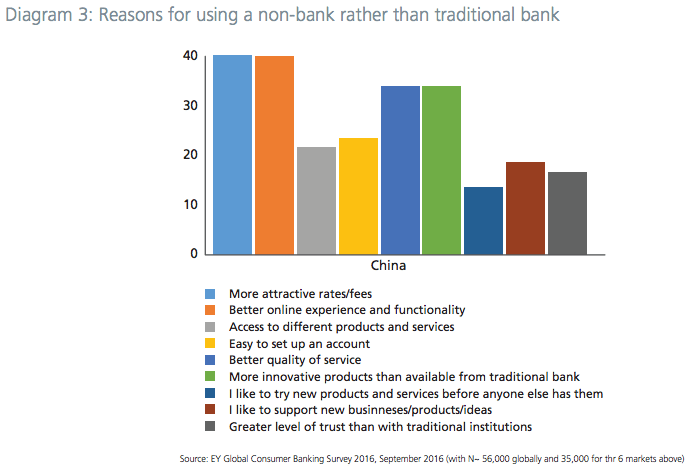

A consumer banking survey conducted by EY found that customers prefer to use non-bank services because they have more attractive rates and fees, better online experience and functionality, better quality of service and more innovative products.

Compared to the US and Europe, China’s digital infrastructure is far more mature with a popular ready and able to use their smartphones for mobile banking, the report says.

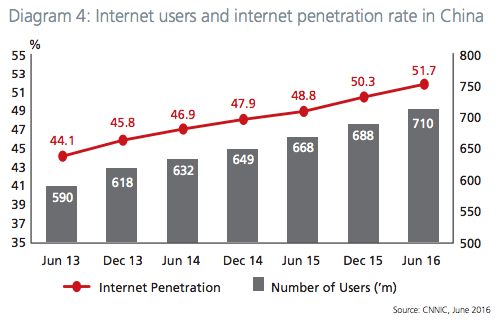

China has some 710 million Internet users, more than the US and Europe combined. This brings the country’s online penetration rate to 51.7% of the population.

Additionally, smartphones have become the universal Internet access device. As of July 2016, 656 million or 92.5% of users were going online via connected devices.

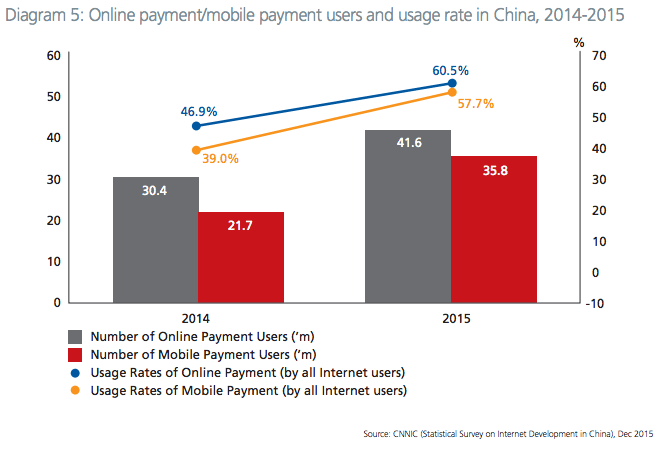

Mobile online payments users accounted for 358 million individuals, by the end of 2015. 57.7% of Chinese Internet users are said to be using mobile payments.

“Chinese fintech development is primarily characterized by the sheer scale of unmet needs and the opportunities they present. In addition, new providers are typically not constrained by the legacy infrastructure or regulations present in more developed markets,” said James Lloyd, fintech leader of EY Asia-Pacific.

“China’s unique mix of rapid urbanization, massive (and underserved) market, e-commerce growth, explosion in online and mobile phone penetration, and customer adoption willingness have created a fertile ground for innovation in commerce, banking and financial services more broadly.”

China’s Internet giants, including Alibaba and Tencent, have largely contributed to the rise of fintech. These giants are now going global.

Alibaba Group currently has more than 86% of revenues from China but aims to eventually generate half of all sales from overseas. Meanwhile, Baidu has been extending its overseas service, Baidu Wallet, in Thailand, with additional service to follow for South Korea, Japan, Hong Kong, Macau and Taiwan. Social media giant Tencent has been investing internationally in companies focused on mobile money, artificial intelligence and gaming.

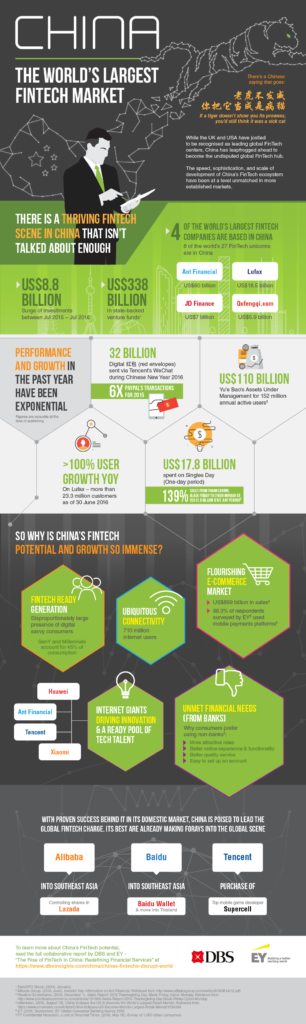

EY and DBS Bank infographic:

Featured image via EY and DBS Bank, “The Rise of Fintech in China.”