European Fintech group ayondo has set sights on the Southeast Asian market where the firm expects significant growth in the years to come.

“The Asian market is experiencing a rapid growth of personal wealth and investors are very tech savvy. Plus, Asia has seen a rapid growth in money invested in Fintech in general,” Robert Lempka, co-founder and CEO of ayondo, told Fintechnews.

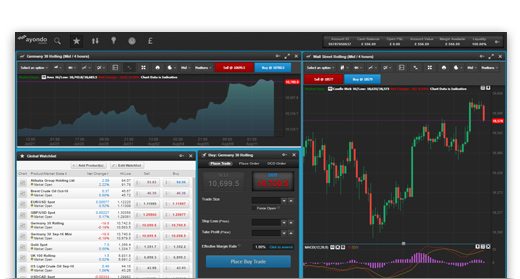

Aimed at democratizing trading, ayondo operates two main services: a social trading platform via its German subsidiary, and an online trading platform for experienced individuals investing in CFDs through its UK subsidiary.

Most recently, the firm entered a perpetual licensing deal with TradeHero, a leading Singaporean stock market simulation app. The deal gives ayondo full brand and name rights as well as operational control of TradeHero outside of China and the US.

The move came ahead of ayondo’s planned listing on the Singapore Exchange (SGX) as the firm looks to become the first Fintech company to be listed on the exchange.

In an exclusive interview with Fintechnews, Lempka provides insights on the state of social trading in Asia, shares his company’s aspirations, and tell us more about what’s coming next for ayondo.

– Can you let us know why you opened an office in Singapore? Is this because of the upcoming listing at SGX?

Since Luminor Capital became a significant stakeholder in the ayondo group in early 2014, we have always had a part of our heart in Singapore.

We opened a branch in July 2014 and have just recently moved offices to newly renovated premises at Armenian Street. Our Singapore branch is the home of our Mobile Lab, where the latest research and development takes place on our various products and services, giving it an edge in designing, building, experimenting and refining new technologies for our platforms.

– Is Social Trading very well known in Singapore and South East Asia?

The concept of Social Trading appeals to an increasing number of Asian investors, B2C as well as Institutionals, who approach us for potential partnership deals. The Asian market is experiencing a rapid growth of personal wealth and investors are very tech savvy. Plus, Asia has seen a rapid growth in money invested in Fintech in general.

“Asian Market is the Future for Social Trading”

– So we can say Asia is THE future growth market for Social Trading?

We strongly believe so, yes. While the European market will keep on appreciating Social Trading as being a modern way to invest and new countries will add to our portfolio of markets, Asian investors are rapidly discovering this new way of investing in the financial markets.

– What are your main learnings from establishing Social Trading in Europe?

Regulation and education is key. You have to stand on solid ground to grow your business. ayondo has just obtained a portfolio management license from BaFin, the German regulator, and we are the first Fintech company with such a license. Furthermore, we have a clear focus on educating our customers: we offer webinars and seminars and speak at trade shows to inform our current and soon-to-be clients about Social Trading. Risk management and high quality Top Traders are of immense importance to our business.

“It’s much more Fun”

– Your core team are all ex-bankers, how different is it to run a Fintech/Social Trading company?

It’s much more fun! We have an excellent Management Team at ayondo. To bring a Fintech company to a profitable and sustainable level, experience and integrity are extremely important.

– You always mention you want “to democratize the world of investing through easy-to-use disruptive technology and knowledge sharing”, can you explain please?

The more intuitive to handle a product is, the more people use it. We invest a lot into technology and user experience and are aiming to have potentially any investor understand that Social Trading is a great alternative form of investment. We aim to demonstrate that access to the financial markets can be intuitive and rewarding.

– So we can say Fintech has the power to disrupt trading even more?

Yes, in a good way.

– On your platform I can trade shares with zero commission. Is that true?

All the costs are included in the bid and offer spread. That means: what you see is what you get! All of the clients, as well as the Top Traders, are trading on the same spreads. Therefore, the performance charts displayed on the website are net of transaction costs and the customers are effectively not being charged any commission.

– You recently acquired TradeHero. What were the main reasons?

Volume is increasingly shifting to mobile usage. For ayondo, mobile technology is a big part of the Group’s strategy for expansion and growth. Besides offering mobile apps we wanted to expand our mobile product range to attract a new client base via educational mobile applications. So, TradeHero was the missing piece in our product range. Investments are going mobile, and to be competitive you have to be agile and adopt. Mobile is very important in Asia, the number of trades done on mobile devices is constantly increasing. Investors expect to be able to trade on the go and watch their Top Traders trading.

– But the TradeHero brand will stay, right?

The TradeHero brand is extremely well established in Asia. The mobile stock market simulation app offers risk-free investor education and is ranked #1 finance app in over 90 countries. For sure we will keep this valuable brand.

“We establish projects in Thailand, Malaysia and Vietnam”

– Have you identified other potential takeovers?

Never say never…. There might be other interesting opportunities. But first of all, let us get the listing on SGX done. This will happen in the first half of 2017 and we have to fully concentrate on this transaction.

– Besides Singapore, does ayondo plan to tap into other countries in Southeast Asia?

We definitely will tap into further markets and have established projects in Thailand, Malaysia and Vietnam. We are the only Social Trading Platform which has a white label facility. We have to make the most of it.

“in China you can feel the momentum”

– What about China? What are your thoughts on the Chinese market for your industry in particular? Is China a potential market for ayondo and Social Trading in general?

China offers a huge potential, not to mention the sheer number of people that are looking for investment opportunities. We have just participated in the Shanghai Money Fair. You can really feel the momentum that is building up in China.

– Is there any plan to expand your offering/portfolio to other financial products apart from trading?

Absolutely. Let’s catch up in the beginning of 2017, and I will tell you more. There will be always more to come. That’s a promise.

About Robert Lempka

Robert is co-founder and Chief Executive Officer of the ayondo Holding AG. While investing in business models and technologies that were aiming at more efficiency in financial markets, Robert concentrated on developing the ayondo Group into a leading provider of trading and investment services.

Robert was CEO of ABN AMRO marketindex, a next generation trading platform, and prior to that he held trading management positions at Dresdner Kleinwort in Frankfurt and at Goldman Sachs International in London. He graduated from Trier University, and was educated at Dublin City and UCLA.