Singapore and China to Begin e-CNY Pilot, Explore Cross-Border Payment Linkage

by Fintech News Singapore December 7, 2023Singapore and China have agreed to collaborate on a pilot programme that uses the e-CNY, China’s central bank digital currency (CBDC), for cross-border transactions. This programme is designed to ease payments for travelers from both countries during their overseas visits.

This pilot programme is part of a series of initiatives announced following the 19th Joint Council for Bilateral Cooperation (JCBC) in Tianjin. These initiatives aim to expand digital finance and capital markets cooperation between the two nations.

Early-stage discussions are also underway between Singapore’s local banks and China’s UnionPay International to potentially link Singapore’s PayNow and UnionPay. This could lead to more secure, convenient, and cost-effective cross-border payments and remittances.

Another key development is the launch of the Exchange Traded Funds (ETF) Product Link between the Singapore Exchange (SGX) and the Shanghai Stock Exchange (SSE). This follows the success of a similar link established between SGX and the Shenzhen Stock Exchange (SZSE) in 2022. The ETF Product Link is expected to enhance collaboration between fund managers and improve investor access to diverse ETF products in both markets.

Additionally, the SGX has signed a Memorandum of Understanding (MOU) with the Guangzhou Futures Exchange (GFEX) to collaborate on information exchange and joint research, particularly in areas related to green development. This agreement aligns with the broader goals of sustainable and green finance.

Further building on the green finance collaboration, the China-Singapore Green Finance Task Force (GFTF) held its inaugural meeting in April 2023. Under the GFTF, initiatives are being developed to create a green corridor for financing and to enhance capacity building in green and transition finance.

Leong Sing Chiong

Leong Sing Chiong, Deputy Managing Director (Markets and Development), Monetary Authority of Singapore (MAS) said,

“It has been a fruitful year of financial cooperation between Singapore and China.

MAS welcomes the new initiatives in digital finance and capital markets connectivity, as these will catalyse new financial flows between our financial centres, and deepen trade and economic relations between our economies.”

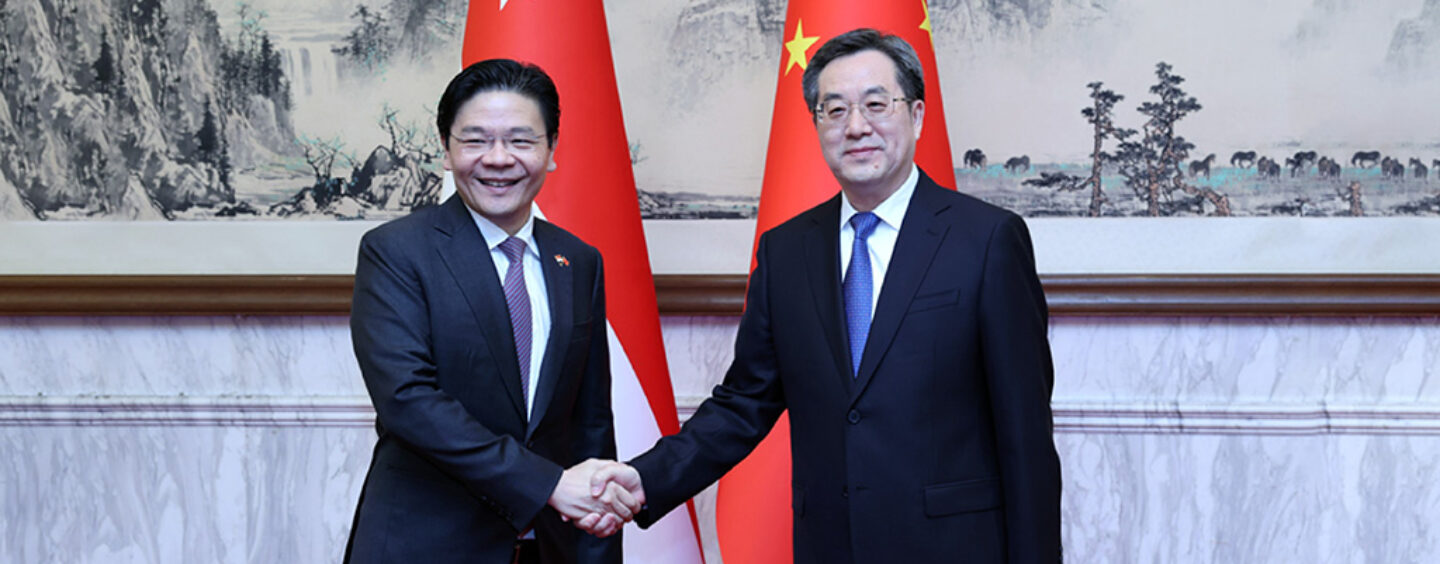

Featured image: The initiatives were discussed at the 19th Joint Council for Bilateral Cooperation (JCBC) in Tianjin, which was co-chaired by Singapore Deputy Prime Minister and Minister for Finance, Lawrence Wong, and the People’s Republic of China Executive Vice Premier of the State Council, Ding Xuexiang.