S&P Global Debuts Stablecoin Ratings with GUSD, USDP, USDC Taking Top Spots

by Fintech News Singapore December 13, 2023Credit rating agency S&P Global Ratings has unveiled its new stablecoin stability assessment service, designed to evaluate their capability in maintaining a stable value in comparison to traditional fiat currencies.

This initiative is a step forward in expanding the firm’s analytical and risk assessment capabilities to cater to clients in both traditional finance and the evolving decentralised finance (DeFi) sectors.

The assessment methodology employed by S&P Global Ratings is thorough and multifaceted. Initially, the focus is on assessing asset quality risks, which encompasses an examination of credit risks, market value fluctuations, and custody risks associated with the stablecoins.

Following the assessment of asset quality, the firm delves into the evaluation of any overcollateralisation requirements and the effectiveness of liquidation mechanisms. This step is key to determining how these factors can mitigate the identified risks, providing a deeper insight into the financial safeguards in place for each stablecoin.

The assessment also extensively reviews five additional areas namely governance, legal and regulatory framework, redeemability and liquidity, technology and third-party dependencies, and track record.

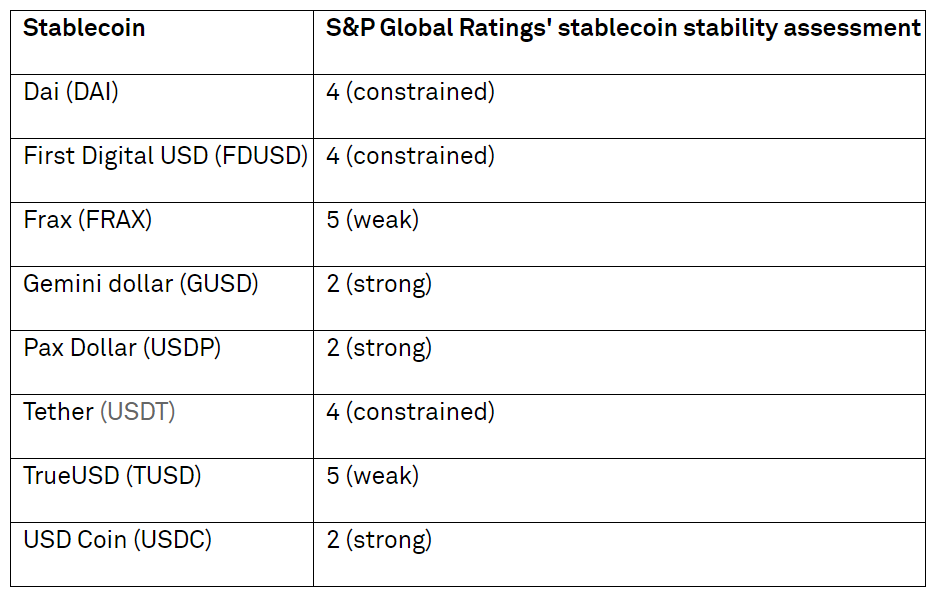

In its first series of assessments, the firm evaluated eight prominent stablecoins. Gemini dollar (GUSD), Pax Dollar (USDP), and USD Coin (USDC) emerged as the top performers, each receiving a ‘strong’ rating of 2.

This was followed by Dai (DAI), First Digital USD (FDUSD), and Tether (USDT), all rated as ‘constrained’ with a score of 4. Frax (FRAX) and TrueUSD (TUSD) were at the lower end of the spectrum, both rated as ‘weak’ with a score of 5.

The stablecoin stability assessment was developed following in-depth interviews with key figures in both traditional and decentralised finance, underlining a market need for more clarity and insight into the inherent risks of different stablecoins.

To delve deeper into the stablecoin stability assessment, S&P Global Ratings is organising a live webinar on 10 January.

The report issued by S&P Global Ratings serves informational purposes and does not constitute a formal rating action.

Lapo Guadagnuolo, senior analyst at S&P Global Ratings said,

“As we look to the future, we see stablecoins becoming further embedded into the fabric of financial markets, acting as an important bridge between digital and real-world assets.

Nonetheless, it’s important to acknowledge that stablecoins are not immune to factors such as asset quality, governance, and liquidity. Our evaluations consider a variety of elements that can cause them to depeg below or above their targeted value.”

Chuck Mounts

Chuck Mounts, Chief DeFi Officer, S&P Global Ratings said,

“The launch of this new service underscores our commitment to staying at the forefront of digital asset market trends and providing our clients with the insights they need to make informed decisions.

In our extensive discussions with key market participants and stakeholders, they are as excited as we are that a firm with the rich history and standing of S&P Global is applying its expertise in this market.”