In an era marked by rapid technological evolution, the finance function within businesses stands at the forefront of digital transformation in the Asia Pacific (APAC).

This shift is not merely about adopting new technologies; it’s about reimagining the role of finance in driving future business success.

As we delve into the critical role of digital transformation in finance, we draw on comprehensive research of HSBC’s study conducted by Toluna, which surveyed C-suite or business decision-makers across key global markets, including significant representation from the Asia-Pacific region.

The indispensable role of digital transformation in finance

Recent research conducted by HSBC and Toluna titled ‘Digital Horizons,’ surveying 2,900 C-suite executives across various global markets, including mainland China, Hong Kong, India and Singapore, reveals a consensus on the critical role of digital transformation in finance for future business success.

These respondents, all key players in companies with annual turnovers ranging from US$2.5 to US$50 million and deeply involved in finance-related decision-making, highlight the digital imperative in today’s business landscape.

AI, Automation, and Blockchain

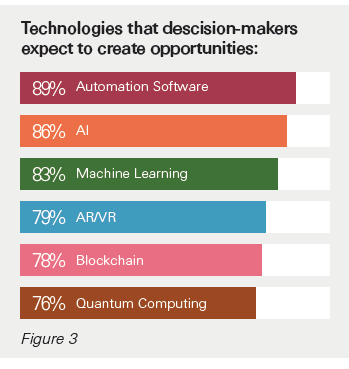

The advent of AI and automation is set to revolutionise productivity and efficiency. The HSBC report anticipates dramatic gains in these areas as machines undertake increasingly complex tasks.

For instance, the rapid adoption of OpenAI’s ChatGPT, reaching 100 million users in just two months, exemplifies how quickly digital tools can become integral to business operations.

This digital acceleration suggests a future where AI and automation streamline operations and unlock new avenues for innovation and growth.

Singapore’s significant AI fintech investment, soaring to US$333.13 million in the second half of 2023, is an example of how digital innovations enable more efficient and inclusive financial ecosystems on a global scale.

Blockchain technology further exemplifies this trend, offering secure, transparent transaction mechanisms that can simplify cross-border financial activities significantly.

The successful execution of the world’s first live repurchase transaction (repo) using a digitally issued bond on a public blockchain by UBS, SBI, and DBS under MAS’ Project Guardian underscores the transformative potential of blockchain in mainstream financial practices.

Cybersecurity concerns in the digital transformation journey

Integrating technologies like AI and blockchain into business processes and financial transactions heightens the need for robust cybersecurity measures.

Generative AI (GenAI), while offering significant opportunities for innovation and efficiency, also presents potential data privacy, security, and ethical use risks.

The Monetary Authority of Singapore’s (MAS) Cyber Security Advisory Panel (CSAP) has specifically raised awareness about the benefits and risks of adopting GenAI in the financial sector.

In addition, phishing campaigns and data breaches continued to impact Singaporean businesses, such as financial services leader OCBC, Starbucks, Shangri-La, and Carousell. The government recognises the rising number of cyberattacks and is collaborating with the broader industry to raise awareness.

This indicates a broader recognition of cybersecurity as a critical concern in the digital transformation journey.

Global communication and transactions in a digital era

The survey underscores the growing importance of digital platforms in facilitating global business operations.

Real-time payment platforms, such as India’s Unified Payments Interface (UPI), revolutionise financial transactions, enabling instant payments and fostering financial inclusion.

UPI’s success, with over 30 percent of transactions in India conducted through this platform, indicates a broader shift towards frictionless, borderless financial operations. By 2030, it is predicted that this percentage will more than double.

Similarly, Brazil’s instant payment platform, Pix, has surpassed traditional credit and debit card transactions, showcasing the transformative potential of digital payment solutions.

However, the transition towards digital-first business models also demands a nuanced understanding of the global regulatory and cultural landscape.

The HSBC study emphasises businesses’ need to navigate these complexities, leveraging technology to foster growth while ensuring compliance and cultural adaptability.

A human-centric approach amid technological advancements

Despite the march towards digitisation, the survey emphasises the irreplaceable value of human ingenuity.

As businesses adopt AI, automation, and blockchain, there remains an unequivocal need for a workforce capable of innovation, critical thinking, and empathy — qualities that technology alone cannot replicate.

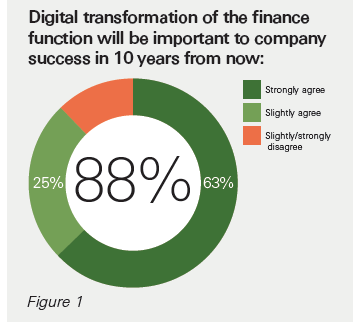

The survey’s findings further substantiate this human-centric approach: while 88 percent of decision-makers recognise the importance of digital transformation in finance, there is a pressing need for businesses to invest in upskilling initiatives.

Only 60 percent of respondents believe their companies are well-prepared for the emergence of new technologies, indicating a significant gap in readiness that must be addressed through comprehensive training and development programs.

The technological transformation also necessitates a robust focus on training and upskilling, with the rapid evolution of technology demanding that the workforce not only adapts but thrives.

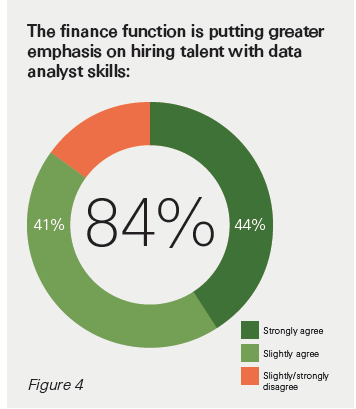

The survey reveals a proactive stance among businesses, with 84 percent emphasising the increasing importance of data analyst skills within finance roles, pointing towards a strategic shift in talent development to meet future demands.

The path toward digital transformation is not without its challenges. The survey identifies key areas of concern for businesses, including data security risks, the cost of investment in new systems and platforms, and integrating new technologies into existing workflows.

Additionally, the readiness gap poses a significant challenge, with a considerable proportion of businesses feeling unprepared for the digital future.

Striking a balance for future success

The HSBC and Toluna survey paints a clear picture of the future: digital transformation in finance is not just a trend but a fundamental shift in how businesses operate and compete.

Integrating AI, automation, and blockchain promises redefining operational efficiency, strategic decision-making, and competitive advantage.

However, this technological evolution does not diminish the importance of human talent. On the contrary, it amplifies the need for businesses to foster an environment where technology and human ingenuity coexist and complement each other.

By focusing on digital transformation while nurturing their workforce’s creativity, adaptability, and collaborative spirit, businesses can navigate the challenges of the digital age, ensuring success and sustainability in the years to come.