Singapore is the Number 1 Fintech-Hub Leader / Switzerland 2nd

by Fintech News Singapore March 2, 2017The Swiss «IFZ FinTech Study 2017» of the Lucerne University of Applied Sciences and Arts provides interested parties with a comprehensive overview of the Swiss FinTech sector.

The first part of the study describes the ecosystem of FinTech: On the one hand, it deals with the political and legal, economic, social, as well as technological environment.

On the other hand, it provides the reader with an evaluation of the business models of 190 Swiss FinTech companies. The second part of the study introduces the reader in more detail to 104 Swiss companies that offer digital financial services. These overviews of the companies include information about target markets, distribution channels and revenue models, as well as various business performance indicators.

Switzerland offers excellent conditions for the FinTech sector / Singapore No. 1 Hub

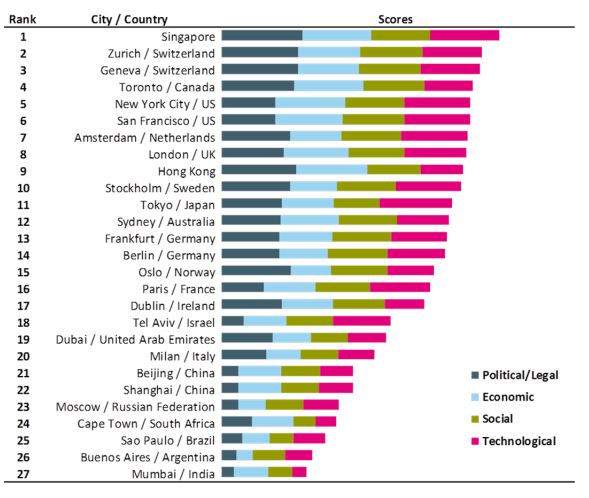

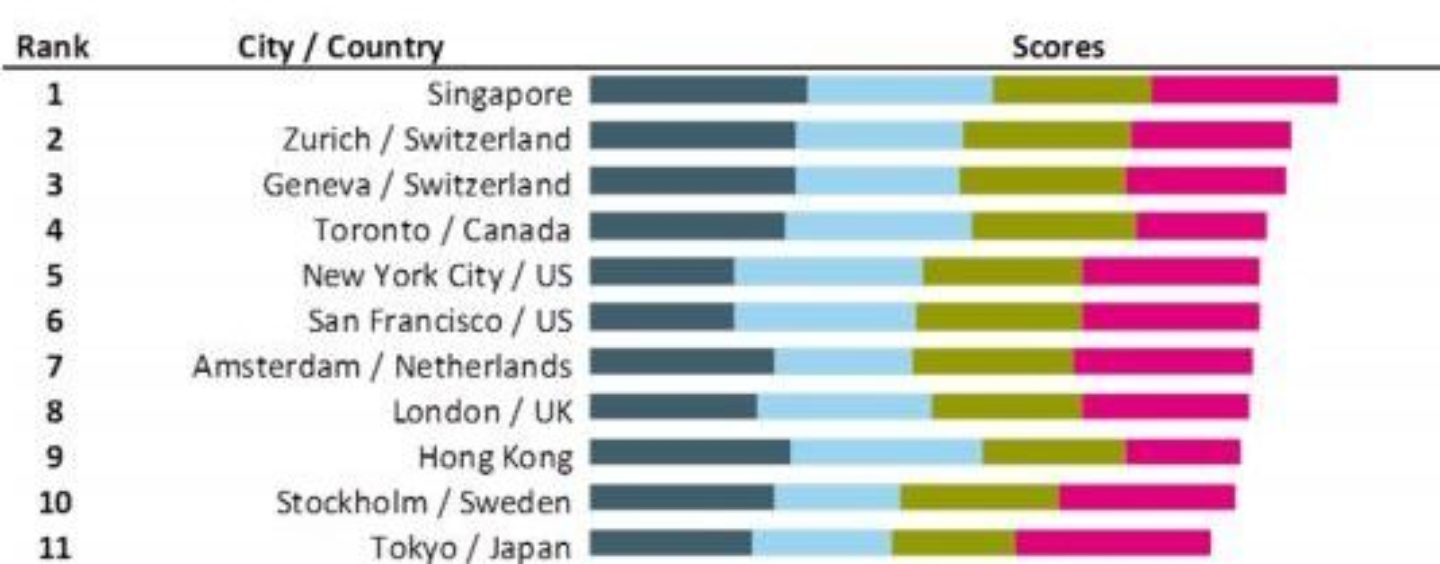

In order to assess the capabilities of the Swiss FinTech ecosystem in an international context,the project team has issued a global ranking for FinTech centres. This ranking confirms that the FinTech sector is able to benefit from very good conditions in Switzerland: The analysis of 27 business centres led to a ranking, in which Zurich and Geneva occupy the second and third place, trailing only behind Singapore.

In particular, both Swiss cities display a need to catch up in the economic and technological dimension as compared with Singapore. The ranking is based on 68 indicators, which rate the basic conditions with regard to the political and legal, economic, social, as well as technological environment.

Among the indicators that were taken into account are the political stability, efficiency of administrative bodies, access to credit and venture capital, number of university graduates in the fields of science and technology, as well as access and implementation of information and communications technology.

The great conditions payoff: «The Swiss FinTech scene continued to grow in 2016», says Thomas Ankenbrand, project manager of the «IFZ FinTech Study 2017».

In the past year, 190 FinTech companies conducted their business in Switzerland, which is shown by the database that was developed by the Lucerne University of Applied Sciences and Arts and lists the FinTech companies based in Switzerland. This amounts to an increase of 17% compared to 2015.

In 2010, the number was significantly lower with 24 FinTech companies. With regard to the number of domestic companies, Zurich, now hosting 84 (a plus of 12) FinTech companies, was able to extend its lead over other cities. It is followed by Zug, hosting 29 (a plus of 8), and Geneva, hosting 19 (a plus of 6) FinTech companies.

«This growth could not yet be fully converted to new jobs or higher company valuations, despite the increasing number of FinTech companies. The Swiss FinTech sector still has a lot of potential for growth», says Thomas Ankenbrand.

FinTech is global

The Swiss market by itself is too small for most FinTech business models. As a consequence, the global orientation and specialization of Swiss FinTech companies continued to intensify in the past year. Approximately 60% of the companies pursue an international business-to-business strategy. This means that they are often specialized global suppliers for established financial services enterprises.

Incubators/accelerators and venture capital investors act on an international level as well. In order to guarantee the continuing growth of the Swiss FinTech industry, it will therefore be crucial to distribute its products and services worldwide, as well as to ensure a global access to talented employees and venture capital.

Furthermore, it will be necessary to continue to dynamically adjust the regulatory environment to upcoming developments, as is shown in detail in the study. «Otherwise, many companies will stop serving the global market from Switzerland», says Thomas Ankenbrand.

FinTech companies are generally not in competition with banks

Finally, the project team has examined the general assumption that FinTech companies are indirect competition with banks. The researchers have come to the conclusion that, for the most part, FinTech companies cooperate with banks or act as their suppliers.

Additionally, the revenue models of FinTech companies have shifted towards license fees and SaaS (Software-as-a-Service) in the past year, as is quite common for technology-based business models. The typical revenue models of established financial enterprises either have little relevance for FinTech companies (interest and trading operations), or are losing relevance (commissionbusiness).

«FinTech companies tend to support banks in their digitalization efforts and thus act as an innovative spearhead rather than directly competing with them», says Thomas Ankenbrand.