500 Startups-backed CoinPip seeks to disrupt the global remittances market by using bitcoin to facilitate domestic and international money transfers.

Similarly to Bitspark and Toast, CoinPip enables low-cost global money transfers by leveraging Bitcoin’s blockchain. Users don’t need to have any knowledge of or experience with using bitcoin; bitcoin is simply the medium through which the exchanges take place. They never interact with bitcoin as all transfers start and end in the currency of choice.

Released in June, CoinPip’s “Direct Payments” feature allows businesses and individuals to send money to the bank accounts of partners and remote workers in seven locations: mainland China, Hong Kong, Singapore, the Philippines, Indonesia, Taiwan and the US.

To send money, you first need to credit your CoinPip account by making a deposit via bank transfer. To initiative the transfer, you need to enter the receiver’s email, currency and amount. On the recipient side, CoinPip ensures that you get your funds in the chosen currency in 48 hours or less. CoinPip charges the sender a flat 2% rate. Users can manage their funds using desktop and mobile apps.

In addition to being much cheaper than traditional money transmitter services, CoinPip’s system reduces the transfer time for international payments and claims to process global transfers three times faster than traditional international bank transfers.

With “Direct Payments,” CoinPip seeks to provide a solution for users – most particularly freelancers – in developing markets that don’t have access to services such as Paypal, Anson Zeall, CEO and co-founder of CoinPip said in a release announcing the new service.

“Many of our clients are early stage startups in areas, such as Hong Kong, Silicon Valley, New York and Singapore, where it can be very expensive to hire full time internal staff members,” Zeall said.

“As a result, outsourcing is the ideal solution. That’s why it is essential to make sending money to other countries easy, fast and streamlined. With CoinPip, transactions can be settled and cleared within minutes, no matter where users happen to be based.”

CoinPip plans to expand the service to more countries, such as the UK, Kenya, Malaysia and Turkey, the company said in a blog post.

Based in Singapore, CoinPip seeks to “connect the world with blockchain technology.” More specifically, the company is looking to provide Southeast Asian markets with the full set of bitcoin-based financial services.

“We’re committed to bringing mass adoption of bitcoin to Asia,” the company claims.

“We’re based in Southeast Asia, and we’ve built our system to take advantage of practical, established technologies, like SMS, that will bring bitcoin’s promise into the real world. Mass adoption can only happen when technology and culture connect on a deeper level.”

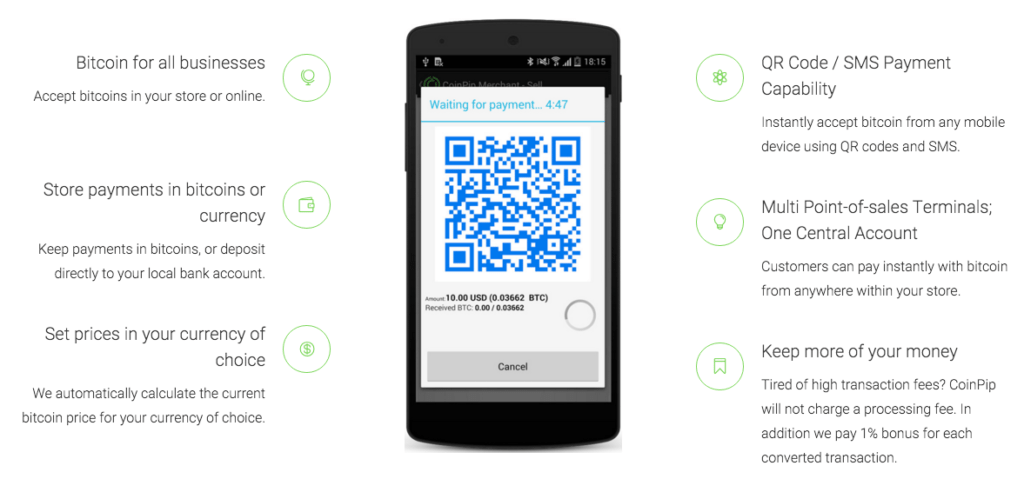

In addition to its global money transfer service, CoinPip also provides merchants with bitcoin payment solutions. The service, which currently covers some 122 countries and supports 70 regional currencies, enables brick-and-mortar and online businesses to easily start accepting bitcoin as a payment method using QR codes and SMS.

Business owners can choose whether they want to keep the payments in bitcoins or get them directly deposited to their local bank accounts. CoinPip automatically calculates the current bitcoin price for the currency of choice.

Image credit: CoinPip, Google +.