Posts From Fintech News Singapore

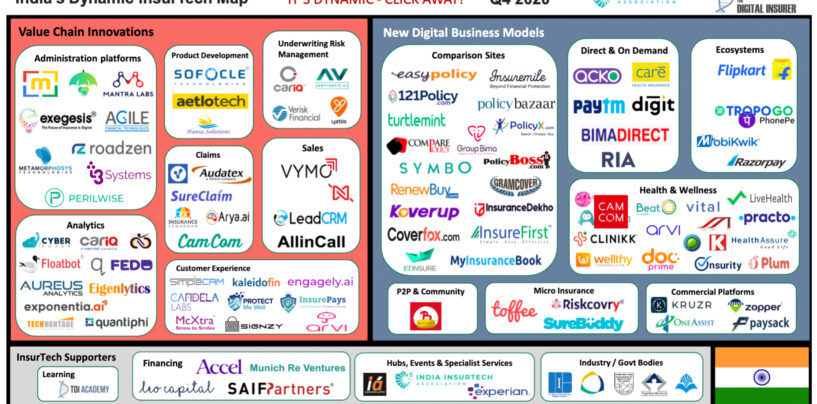

Insurtech Gets a Boost in India Amid Rising Digital Adoption

Fundamental shifts in consumer preferences, favorable regulation, and rising interest from investors are stimulating the growth of insurtech in India. Results of a survey conducted by the Boston Consulting Group (BCG) and the Federation of Indian Chambers of Commerce and

Read MoreHK Based Futu Launches Investment Platform Moomoo, Unveils New Singapore HQ

Futu Holdings announced the official launch of its one-stop investment platform, moomoo and unveiled the opening of its new regional headquarters in Singapore. The company said in a statement that the new headquarters was set up to better serve the

Read MoreBanking-as-a-Service a New Battleground for Banking Incumbents and Challenger Banks

With a new Banking-as-a-Service (BaaS) model, financial services providers can save up to 95 percent of a typical customer acquisition cost, according to a new report from Oliver Wyman. The report said that the typical customer acquisition cost can be

Read MoreThe State Open Banking in Thailand in 2021

Though no legal regulation on open banking currently exists in Thailand, the government’s digital push with the Thailand 4.0 strategy, and the introduction the Personal Data Protection Act (PDPA) last year suggest a move to open banking frameworks is inevitable.

Read More4 Key Considerations For Wealth Managers Looking to Unlock the Value of Data

When we talk about wealth management today in fintech, more often we’re talking about how to create wealth: goal setting, risk profile management, or simply investment management overall. But Dr. Sekar Jaganathan, Director of Digital Strategy in Kenanga Bank opines

Read MorePAYFAZZ Invests US$30 Million in Xfers to Form New Entity Fazz Financial Group

Indonesian fintech startup PAYFAZZ announced that it has invested US$30 million in Xfers, Singapore-headquartered counterpart to form a new financial entity called Fazz Financial Group (FFG). PAYFAZZ said that both companies will retain their respective names whilst operating under the

Read MoreInsurtech Symbo Secures US$9.4 Million Funding to Scale Its Platform in SE Asia and India

Symbo Platform Holdings, a Singapore-based insurtech platform, announced the completion of a US$9.4 million funding round led by the CreditEase Fintech Investment Fund. The round also saw participation from San Francisco-based investment firm Think Investments along with follow on investment

Read MoreClearstream Selects BearingPoint to Comply With Singapore’s Compliance Reporting

European supplier of post-trading services Clearstream has selected BearingPoint RegTech, a Netherlands-based compliance technology provider, for its Abacus360 Banking solution for MAS 610 reporting. BearingPoint RegTech said that Abacus360 Banking is a standard software for national and international prudential reporting,

Read MoreAPAC Banks Race to Revitalise Their Digital Transformation Programmes

The second edition of the Fintech and Digital Banking 2025 in Asia Pacific report by IDC commissioned by Backbase, reveals that APAC banks are going back to the drawing board on their digital transformation programs. Digital banking fitness has been

Read MoreKPMG Singapore Appoints Anton Ruddenklau as Head of Financial Services

KPMG Singapore has named Anton Ruddenklau as its Head of Financial Services with immediate effect. He most recently served as Global Co-Leader of Fintech for KPMG International, and Partner and Head of Digital and Innovation for Financial Services in KPMG

Read More