By 2030, blockchain-enabled asset tokenization is expected to grow fiftyfold into a US$16.1 trillion business opportunity, a rise which will be driven by demand for greater access to private markets and illiquid assets such as real estate and commodities, a new report by global consulting firm the Boston Consulting Group (BCG) and ADDX, a digital exchange for private markets, says.

Globally, growth in tokenized assets is expected to be strong within the next couple of years. Real estate, equities, bonds and investment funds, as well as less traditional assets such as car fleets and patents, are set to make up most of tokenized assets, which, by 2030, are forecast to represent 10% of global gross domestic product (GDP).

Image: Tokenization of global illiquid assets, Source: Boston Consulting Group (BCG); ADDX, 2022

Asset tokenization, which refers to the creation of tokens on a blockchain to represent an asset, holds great potential in making illiquid assets, such as land, natural resources and fine art, more tradable and liquid, the report says.

It enables divisibility and allows investors to buy tokens representing a tiny percentage of the underlying assets. This ultimately lowers the barriers to investment and gives retail investors access to asset classes typically limited to wealthy investors and institutions due to constraints on ticket size, such as pre-IPO stocks, hedge funds and infrastructure projects.

Drivers fueling the growth of asset tokenization

According to the report, asset tokenization could be on the cusp of wide global adoption, and several trends are pointing in that direction.

First, the report notes that tokenized asset trading has risen consistently over the years and will continue to grow moving forward. In 2021, the global asset tokenization market surpassed US$2.3 billion. By 2026, it’s projected to reach US$5.6 billion, implying a 19% compound annual growth rate, according to Blockchain Council. In Asia alone, the potential of asset tokenization is close to US$3 trillion, BCG and ADDX estimate.

Another strong indicator pertaining to the rising prominence of asset tokenization is the increasingly positive sentiment stakeholders have on the trend.

A 2021 survey conducted by Deloitte, which polled financial services firms across Europe, the Middle East and Africa (EMEA), found that a strong majority (76%) saw tokenization of securities or financial instruments as a significant potential long-term opportunity. Nearly 70% of respondents expected organizations to start offering services related to tokenization within the next two years.

Source: 2021 Deloitte EMEA financial services firms survey

In parallel, numerous pilots and projects have been successful conducted recently, further adding optimism towards tokenization.

In Indonesia, digital investment app Nanovest launched the NanoByte Token (NBT) earlier this year for users to trade US stocks and cryptocurrencies in Indonesia. The trading app quickly gained popularity, onboarding more than two million user during its beta launch. Nanovest is now planning to add asset classes including mutual funds, fractionalized bonds, and stocks.

In India, social app Chingari launched in October 2021 its own native token, GARI, to reward content creators. The app has since surpassed a total of 150 million users and growth in the usage of GARI has been strong, with 600,000 people having adopted the token within just three months of its launch.

Another key growth driver outlined in the report is the rising recognition of tokenization by monetary authorities and regulators, citing the example of the Monetary Authority of Singapore (MAS), which launched in May 2022 Project Guardian, a collaborative initiative with the financial services sector to explore the economic potential and value-adding use cases of asset tokenization.

The report also notes that an increasing number of asset classes are now being tokenized, with examples like Agrotoken, a tokenization infrastructure from in Argentina for agricultural commodities, and Budja.io, a startup that tokenizes art for ownership on the blockchain. This showcases that entrepreneurs are still actively innovating and exploring new use cases.

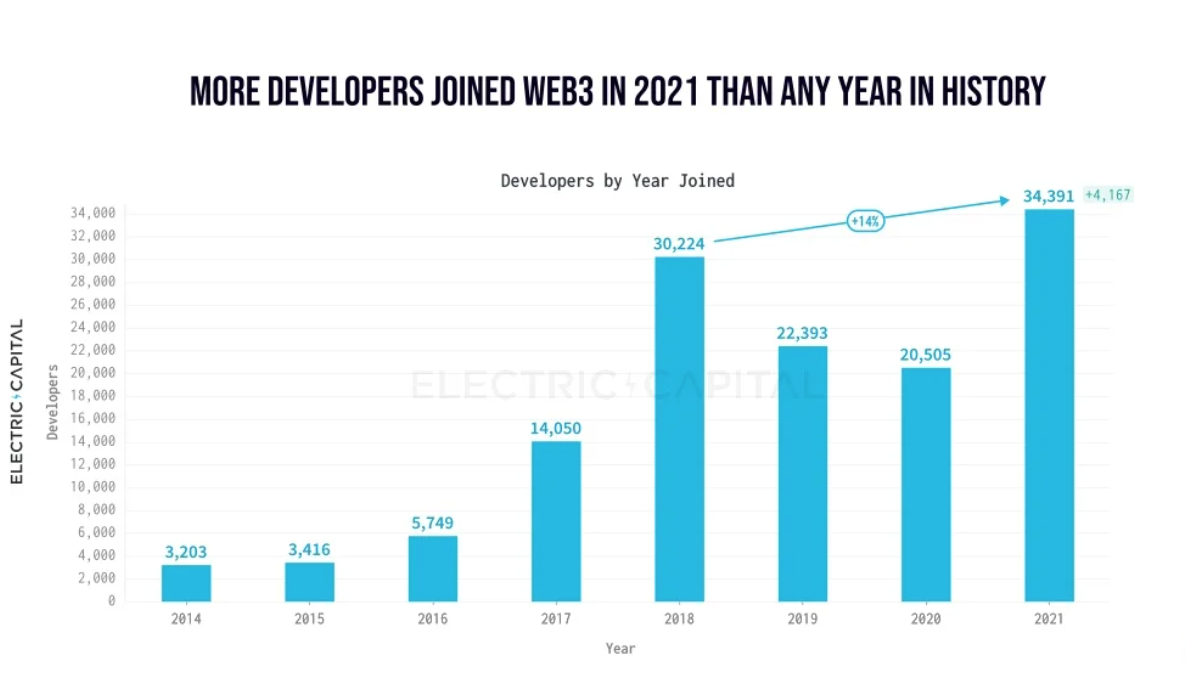

Finally, it mentions the presence of a growing pool of active developers dedicated to blockchain technology, which demonstrates that the ecosystem continues to attract builders. According to the 2021 Developer Report, produced by venture firm Electric Capital, more than 34,000 new developers worked on an open source Web3 project in 2021, the highest number of new developers in history.

Ethereum continued to be the largest ecosystem, recording over 1,100 monthly active developers in December 2021, a 42% increase since January 2021.

Image: New Web 3.0 developers committing code yearly, Source: Electric Capital, 2022