Posts From Fintech News Vietnam

Vietnam’s FPT Software Partners With Squirro to Unlock Insights From Data

Vietnam’s IT firm FPT Software announced that it has formed a partnership with Squirro, a Switzerland-based augmented intelligence solutions provider. Through this partnership, the two companies will offer their customers comprehensive enterprise solutions backed by Artificial Intelligence (AI) to leverage

Read MoreVietnamese Fintech Trusting Social Bags US$ 65 Million Investment From Masan Group

Trusting Social, a Vietnam-based AI-powered credit scoring platform, announced that it has secured US$ 65 million for the initial close of its Series C funding round from The Sherpa Company, a subsidiary of Masan Group. According to DealStreetAsia, Masan now

Read More5 Early-Stage Fintech Startups from Vietnam to Follow in 2022

2021 was a fruitful year for Vietnam’s fintech sector which saw rising consumer adoption of digital financial solutions amid COVID-19 restrictions and continued investor interest in the growth prospect of the sector. Vietnamese fintech companies raised a total of US$375

Read MoreVietnam’s HD Bank Picks Thought Machine to Reinvent Its Digital Offerings

Vietnam’s HD Bank announced that it has formed a strategic collaboration with Thought Machine, the UK-headquartered core banking technology company. HD Bank is embarking on a multi-year strategy to develop and deploy modern technology as part of a transformation programme,

Read MoreVietnam’s Retail Investment App Infina Bags US$6 Million in Seed Funding

Vietnam’s retail investment app Infina announced they have closed US$6 million in seed funding from Sequoia Capital India’s Surge, Y Combinator, Saison Capital, Starling Ventures, Alpha JWC, and AppWorks. Infina was part of Surge’s sixth cohort which is a rapid

Read MoreVietnam’s Digital Bank Timo Secures US$20 Million Funding Led by Square Peg

Vietnam-based digital bank Timo announced that they have successfully secured US$ 20 million in fresh funding. The investment round is led by Square Peg, a leading global VC firm whose investments include unicorns such as Canva, FinAccel and Airwallex. Other

Read MoreVietnam Based Fintech Anfin Raises US$ 1.2 Million in Seed Funding

Vietnam-based Anfin, a fintech firm with its proprietary stock trading platform, announced today that it has raised US$1.2 million in a seed round led by Goodwater Capital and Global Founders Capital (GFC) – the latter coming in as a returning

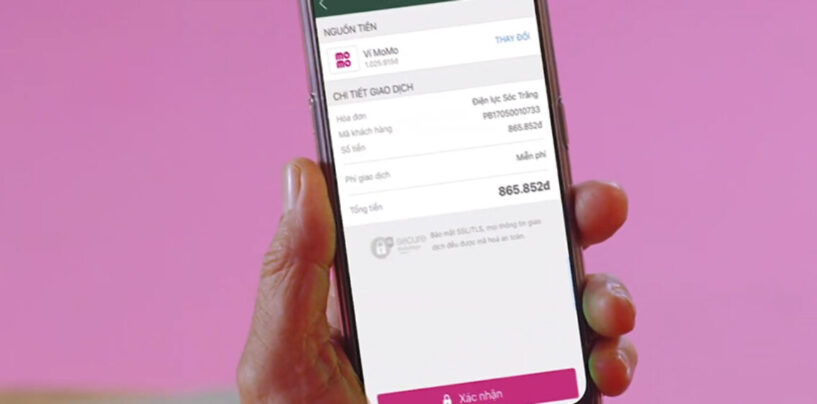

Read MoreVietnamese E-Wallet MoMo Joins Unicorn Club With US$200 Million Series E

Vietnamese e-wallet M-Service which operates under the MoMo brand announced it has raised US$200 million Series E in a funding round that was led by Mizuho Bank, a subsidiary of Mizuho Financial Group. With this latest fundraise, MoMo is now

Read MoreCIMB Bank Vietnam and F88 Form Partnership to Boost Financial Inclusion

Lending platform F88 Business has entered into a new strategic partnership with CIMB Bank Vietnam to promote financial inclusion to the unserved and underserved sector of the economy. According to the latest figures from the General Statistics Office (GSO), Vietnam

Read MoreKASIKORNBANK Sets up Its First Vietnamese Branch in Ho Chi Minh City

Thailand’s KASIKORNBANK (KBank) announced that it has opened a branch in Ho Chi Minh City with the aim of linking the trade and investment network within the ASEAN region. This will be KBank’s first branch in Vietnam, and its tenth

Read More