Posts From Fintech News Vietnam

Vietnamese Digibank Timo Promotes Jonas Eichhorst as New CEO

Vietnam-based digital bank Timo announced that its Chief Financial Officer, Jonas Eichhorst has been promoted as CEO and will retain his position on the board of directors. In his new leadership role, Jonas will continue to work closely with Henry

Read MoreVietnam’s Be Group Secures US$60 Million Loan Facility From Deutsche Bank

Vietnamese ride-hailing startup Be Group announced that it has secured a loan facility of approximately US$60 million from Deutsche Bank with the option to increase the financing up to US$100 million. Be Group said that it will use the funds to

Read MoreVietnamese Earned Wage Access Startup Nano Raises US$6.4 Million

Nano, Vietnam’s Earned Wage Access (EWA) provider, announced that it has raised US$6.4 million in an oversubscribed pre-Series A funding round led by Openspace, the early backer of Gojek, Kumu and Finhay. New investors that participated include Partech Partners, Tekton

Read MoreVietnam’s Banking Execs Call for Open Banking Framework

In Vietnam, although financial institutions have realised the potential of open banking to enable more inclusive and accessible financial services, a patchy legal framework is hampering their efforts to join the data revolution. Praising the opportunities brought about data sharing,

Read MoreVietnamese Fintech Anfin Bags US$4.8 Million Pre-series A Co-led by Y Combinator

Anfin, a Vietnam-based fintech firm with a proprietary stock trading platform, announced it has raised US$4.8 million in its pre-Series A funding round. The round was led by angel investor Clement Benoit, Founder of Stuart & Not so Dark as

Read MoreVietnam’s Finhay Raises US$25 Million Series B Co-led by Openspace Ventures and VIG

Vietnam’s digital investment platform Finhay has secured a US$25 million in a Series B funding round co-led by Openspace Ventures and VIG. Other participants in the funding round include Insignia, TVS, Headline, TNBAura and IVC. Finhay said that the new

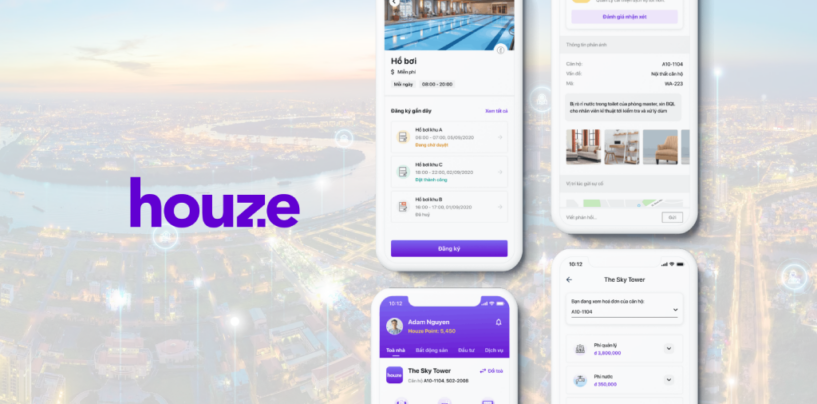

Read MoreVietnamese Proptech Houze Raises US$2 Million in Fundraise Led by DKRA Group

Houze, a proptech startup based in Vietnam that offers a fully integrated real estate ecosystem for agents and customers through its offline-to-online platform, has raised US$2 million in a funding led by DKRA Group. DKRA Group is a major real

Read MoreVietnam’s MSB Picks Temenos to Push Its Digital Transformation Plans

Vietnam Maritime Commercial Joint Stock Bank (MSB) has selected banking software company Temenos to modernise its core banking system. MSB is one of the largest commercial banks in Vietnam, with nearly 3.1 million retail and 64,300 corporate customers. The bank

Read Morebolttech Expands Its Vietnam Footprint With Viettel Telecom Partnership

Insurtech unicorn bolttech announced that it has partnered with Vietnam’s telecommunications network operator Viettel Telecom. The partnership launched insurance offerings, powered by bolttech’s insurance exchange platform, on Viettel’s customer app MyViettel. The offerings include health, travel, home, car, and motorbike

Read MoreHere Are Vietnam’s 8 Most Active Fintech Investors and The Startups They Are Betting On

2021 was a blockbuster year for Vietnamese fintech startups: established players gained traction on the back of rapid digital adoption due to COVID-19, and global investors poured millions into the sector to support the growth of promising ventures. Last year,

Read More