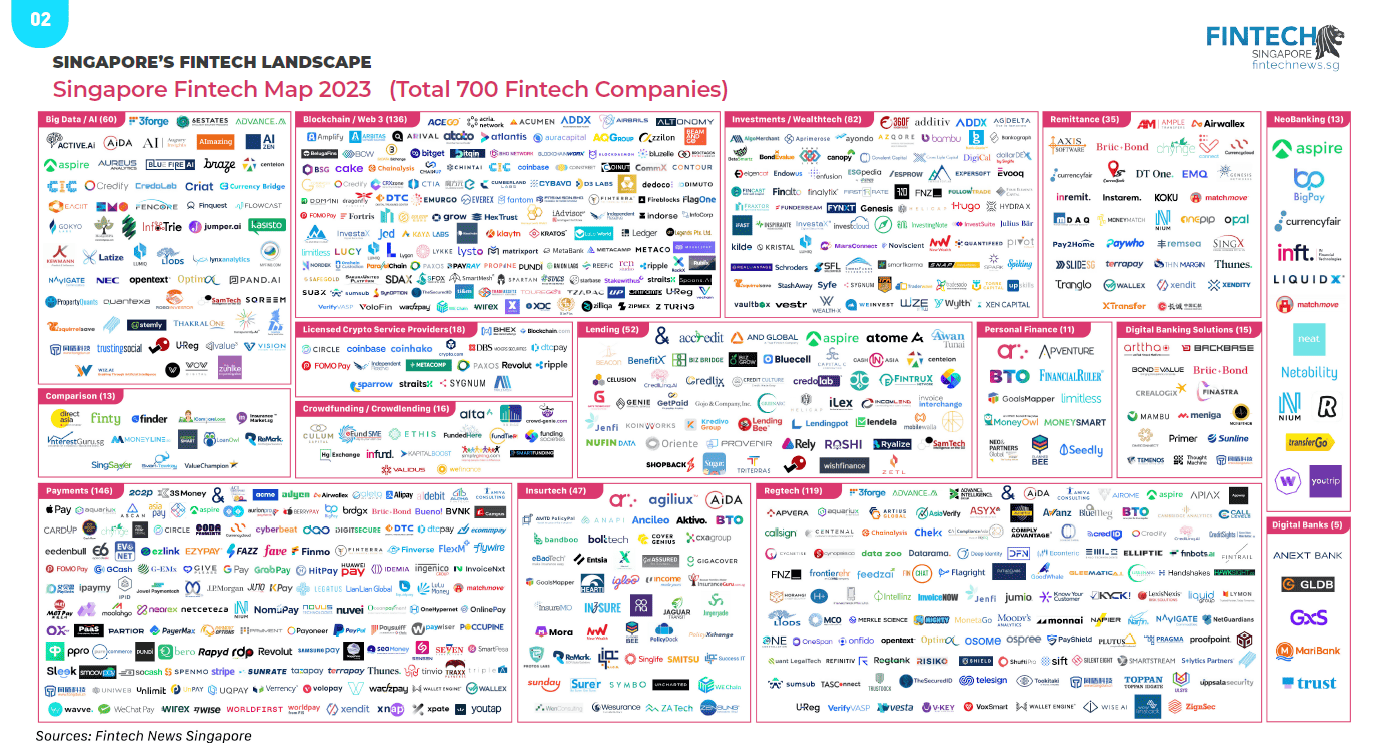

Fintech Startups in Singapore

There are 700 Fintech Startups in Singapore.

Fintech Startups in Singapore

6Estates is an AI company that focuses on back office intelligence automation with unstructured data in finance domain.

This Singapore-based startup combines the best domain knowledge in big data, artificial intelligence and credit scoring to bring the next-gen data-centric platforms to transform traditional and emerging industries across the Asia Pacific.

AImazing is a tech start-up that specializes in digitizing offline receipt data which empowers businesses to make strategic decisions.

Aureus Analytics is a predictive analytics and big data-based customer intelligence and experience platform for insurance companies and banks, that helps them retain customers and upsell/cross-sell to them.

Blue Fire AI is an AI company which works mainly with companies dealing with the Capital Markets.

AI credit scoring – CredoLab provides subscription-based tools and value-added services that enable consumer lenders to reduce the cost of risk, increase operational efficiency, and enhance profitability using big data and traditional datasets.

CriAT is a Singapore-registered FinTech company specializing in Deep Credit Analytical Technologies.

Fencore DataHub makes data management easy for financial institutions. It is a cloud-native, no-code platform that empowers business users to meet their data management needs with intuitive drag-and-drop interfaces, and a focus on interoperability.

Fencore is headquartered in Singapore, and services markets globally.

Finquest is a platform delivering personalised connections to its clients in the Asian mid-market M&A and direct investment space.

Flowcast provides an enterprise-grade AI solution to banks in automating and improving credit decisions and monitoring.

InfoTrie aims to leverage Big Data technologies to change the way unstructured data is consumed in Finance today. It offers cutting-edge technology to analyze the humongous flow of financial industry information.

Lynx Analytics is a predictive analytics outlet run by quantitative marketing scientists and industry experienced data scientists. A brainchild of a group of INSEAD students and professors, Lynx Analytics uses a lot of technologies such as graph analytics, AI and machine learning.

Moneythor is a software company founded in 2013, which offers banks and fintech firms a toolkit to enhance their digital banking services, with a prime focus on the generation of data-driven personalized and contextual recommendations for their customers.

Optimai specializes in providing financial IT solutions for stockbroking and asset management companies.

We specialize in providing foreign exchange/gold and cross-asset solutions for financial institutions and companies while focusing on the demand for China’s financial market localization.

PropertyQuants helps its clients to harness data at scale, to find the best real estate investments globally.

SQREEM uses data analytics and AI to identify and understand previously unrecognized consumer behavioral patterns, to enable governments and financial institutions to actively and passively detect financial crimes, fraud, and malfeasance through anomaly detection.

Trusting Social builds the next generation of credit score based on social data, to make lending faster, cheaper and friendlier. The company provides consumer credit score based on social, web and mobile data.

Value3 is a B2B FinTech offering Capital Markets AI-platform for independent, predictive and automated credit ratings, research and analytics.

Altonomy is a trading, advisory and asset management firm specializing in cryptocurrency and digital assets. It is the first-ever dedicated sell-side trading desk to provide institutional-grade liquidity solutions, OTC trading, advisory and asset management services under one roof.

Anquan Capital is a private investment company and venture builder which has launched a group of deep technology and product companies since inception in 2015 ; Zilliqa, Treasure Cloud and Aqilliz

Binance is the world’s leading blockchain and cryptocurrency infrastructure provider with a financial product suite that includes the largest digital asset exchange by volume.

Bitget established in 2018 and headquarter located in Singapore, it is a global leading cryptocurrency derivatives exchange.

Bluzelle is a smart, in-memory data store technology. It can used as a cache or database. Bluzelle is highly available, durable and globally distributed. No operational overhead or configuration necessary. Bluzelle is suited for gaming and media.

Broctagon Fintech Group is a multi-asset liquidity and technology provider headquartered in Singapore with over 10 years of established global presence in China, India, Russia, Cyprus, Hong Kong, Thailand and Vietnam.

Bsquared – We are a globally connected technology enabled liquidity provider, working with brokerages, exchanges, banks, payment providers, trader and funds around the world to deliver seamless execution in major digital assets and fiat currencies.

Bybit is a cryptocurrency derivatives exchange offering trading on perpetual contracts with up to 100x leverage. Established in 2018, Bybit is a cryptocurrency derivatives platform that supports both inverse and linear perpetual contracts.

Coinhako is known for being the easiest platform to buy Bitcoin and Digital Assets in Singapore, and Asia. Low Cost, Local Currency Trading, Easy Setup. Founded in 2014, Coinhako is a leading wallet service, in Singapore, for cryptocurrencies such as Bitcoin, Bitcoin Cash and Ethereum.

CoinMoola utilises and implements the best security practices in the current industry so that you will not have to worry about your cryptocurrencies!

Founded in 2017, COINSTREET PARTNERS is an award-winning, AI-powered, global decentralized investment banking group, and a financial service and asset management firm for tokenized assets & digitized securities.

COINUT (COIN Ultimate Trading), a cryptocurrency exchange platform, was designed to make it easier, faster, cheaper & most secure for anyone to trade cryptocurrencies & fiat currencies globally.

On CommX’s asset tokenisation & exchange platform ‘Tokify’, we work with asset owners such as galleries or real estate, to help them sell art or real estate in affordable fractions, & boost asset sales using a blockchain-enabled platform that can fractionalise and tokenise any physical asset for sale to investors, making assets more affordable.

Contour is building the world’s open trade finance network. By focusing on collaboration and leveraging new technologies we are dissolving the barriers to seamless trade.

Copernicus Gold is a stored value facility, based in Singapore, that issues digital gold linked to a physical store of gold. The company has created a ‘gold standard’ as a currency instrument, that enables anyone, anywhere, to acquire, save or pay with digital gold.

The Next Generation FinTech Solution COSS stands for Crypto One-Stop Solution and represents a cryptocurrency exchange platform, which encompasses all features of a digital economic system based on crypto.

Based in Republic of Singapore and founded in February of 2014, Intellect Mkt. Pte. Ltd. is a crypto currencies wallet platform where merchants and consumers can transact with the new digital currencies like bitcoin, litecoin, etc.

Crypto.com was founded in 2016 on a simple belief: it’s a basic human right for everyone to control their money, data and identity.

CYBAVO is a leading cybersecurity company based in Singapore focused in offering insured and compliance-ready institutional-level private key custody and management solutions for enterprises and financial institutions.

Powered by Nasdaq’s world class trading engines, CTX offers an open and regulated trading platform for the token economy.

DeFiChain is a blockchain that is enabling DeFi (Decentralized Finance) on Bitcoin. The DeFi Foundation is responsible for issuance of tokens to users and groups to speed up adoption.

Empowering everyone to easily create a digital-native fund. Professionally managed by qualified keyless portfolio manage.

At Digix, we are building an ecosystem that aims to be the 21st century gold standard on the Ethereum blockchain, through the launch of our first product, the gold backed token DGX.

Ecxx.com is a premium Digital Assets Platform in Singapore. We are built in Sunny Singapore!

Blockchain-based cooperative banking for international SMEs and high-risk online merchants. Everex develops a hybrid GPR bank card on V/MC rails offering global issuances and same day settlements in USD Stablecoins for cross-border money transfers and online payments.

Finterra is the cloud based financial service platform designed for you to harness all of your financial power into a seamless, integrated platform, whilst you take advantage of Finterra’s growth.

The world’s first hybrid liquidity aggregator. Regulated and secure, FXF’s platform is designed to offer best rates and prices from the world’s leading CeFi and DeFi protocols through one connection, one account and one KYC process.

At GCOX, we aim to be the first fully-licensed celebrity tokens exchange that will tokenise the popularity of celebrities. This allows fans to gain unparalleled access to their celebrities via our various exclusive platforms.

Genesis facilitates billions in digital currency trades, loans and transactions on a monthly basis.

Hashstacs is a blockchain development company and technological solutions provider for the financial world. The company enables financial institutions to realise new revenue generating and operational efficiency use cases.

Hodlnaut is the leading Crypto Borrowing and Lending Platform based in Singapore whose mission is to provide financial services to cryptocurrency users.

Established in 2013, Independent Reserve is an Australian institutional grade cryptocurrency exchange with an orderbook enabling Australian and NZ clients to securely trade, invest and hold digital currencies.

Indorse is an enterprise SaaS platform. Enterprise companies use the Indorse platform to build great tech teams, upskill their workforce, and enable innovation. Our all-in-one platform is focused on tech & coding skills and is based on a community of leading industry experts.

Infinito is a leading Japanese blockchain technology house with over 300 experts and 3+ years of professional experience in the field of cryptography and blockchain technologies.

InfoCorp Technologies is a fintech company that provides the infrastructure to accelerate financial inclusion to unbanked and underserved communities through the use of blockchain technology.

JED is a leading technology company that builds trade and supply chain solutions powered by blockchain technology.

Distributed Data Provenance for Finance, Industry, and Enterprise. At Keychain we believe that every development team should be able to leverage the power of blockchain technology.

The mission of the Kommerce project is to make working capital more easily available to traders in Emerging Markets.

Kryptos-X is a digital asset market platform that allows consumers and institutions to buy and sell digital assets and currencies.

KyberNetwork is a system that allows the exchange and conversion of digital assets. They offer payment APIs and a contract wallet that also allow users to seamlessly receive payments from any tokens. KyberNetwork also enables derivative trading.

Founded in 2014, Ledger is a leader in security and infrastructure solutions for cryptocurrencies and blockchain applications.

Liquid is a cryptocurrency platform providing liquidity to the crypto economy. Quoine is a Financial Technology (Fintech) company headquartered in Japan with offices in Singapore and Vietnam.

Luno is a leading global cryptocurrency company with over 5 million customers in 40 countries and a team of over 350. Headquartered in London, Luno operates across Africa, South East Asia and Europe.

Founded in February 2019, Matrixport is your gateway to a digital economy where you can trade, entrust, invest, and borrow crypto assets all in one place.

MugglePay is a peer-to-peer payment solution to accept money global. Make crypto payment easy. MugglePay provide SDK for merchants to accept crypto.

The first of its kind, NZIA’s decentralized wireless payment system provides an alternate payment infrastructure for CBDC that augments existing payment networks.

Based in Singapore, Onchain Custodian is offering an insured, secure, convenient and compliant platform for the safekeeping of investing of institutional digital asset holdings with incomparable user experience.

We put the power in your hands to buy, sell and use digital currency. We believe that the digital currency world should be user-friendly, simple to operate and instant for anyone, anywhere in the world.

The OpenChain Project defines the key requirements of a quality open source compliance program.

Paxos is building a future where all assets—from money to commodities to securities—will be digitized and can move instantaneously, 24/7.

PayRay operates in the field of working capital financing, established in Lithuania from July 2018. We provide fast and flexible working capital financing solutions.

Propine is building a safe, regulated, and certified future for digital securities with the support and partnerships of reputed private, quasi-governmental and governmental organisations to create an ecosystem of trust, quality and compliance.

As the first-of-its-kind technology, Provenance combines the distributed, trustless, and immutable characteristics of blockchain with the functions of ledger, registry and bilateral exchange for assets and markets.

Pundi X helps transform retail businesses with its blockchain-based point of sale solution. See how you can buy, sell and accept all payment methods including cryptocurrency with the powerful XPOS

QCP Capital is a digital asset trading firm based in Singapore. The firm manages proprietary investment and trading strategies with a focus on quantitative methods, arbitrage and derivatives.

Qume – one of the only crypto derivatives exchange operating under a regulated framework. The exchange has the lowest latency in the industry and has been built for high frequency trading akin to trading systems in traditional markets.

R3 is an enterprise software firm that is pioneering digital industry transformation. We deliver purpose-built distributed ledger technology for all types of businesses in all industries.

Republic Protocol is an open-source decentralized dark pool exchange. It facilitates cross-chain atomic trades on a hidden order book over the Ethereum and Bitcoin networks.

Ripple provides one frictionless experience to send money globally using the power of blockchain technology.

RootAnt is a technology enabler of Banking as a Service, specializing in Embedded Financing for enterprises, connecting enterprises and financial institutions with new digital financial products for easier, cheaper and faster financing services in various contexts.

Rublix is building a networking platform where participants can access trusted trading information from verified experts.

Founded in 2014, SFOX, San Francisco Open Exchange, is the first and leading U.S. cryptocurrency prime broker that provides reliable and secure global trading and custody solutions to traders, investors and institutions such as exchanges, money managers, funds, banks and payment companies.

Sparrow is the leading options trading platform, providing the simplest way to control risk and monetize your digital assets.

Spoons.ai develop a new technology and innovation for the finance industry, blockchain lending platform that builds on the peer-to-peer model of blockchain and incorporates traditional lending to create a time-efficient, seamless system.

Secured yield solutions for crypto asset investors. Institutional and retail clients around the world service with us for various yield needs on cryptocurrency assets.

Starbase is token funding platform. We provide crowdfunding platform + ICO consulting for innovative projects to launch their ideas.

Switcheo is the world’s leading DEX platform. Buy or trade crypto like Ethereum, Neo and more. Switcheo builds platforms that break new ground.

TenX is a company specializing in cryptocurrency payments. It provides cards and wallets to enable the spending of Bitcoin, Ethereum and Litecoin in real situations even if the teller only accepts fiat currency via Visa.

Tokenize is a Singapore based digital currency trading platform. It is a team that aspires to build the next generation digital currency exchange that supports established and emerging digital currencies.

TripleA is the future of payment: the freedom to choose however you want. Crypto payment is fundamentally about choice. It’s about the customers’ choice to pay however they want.

Upbit Singapore is powered by Upbit, the global top exchange with world-class blockchain technology, regulatory expertise and operational know-how.

VeChainThor is the public blockchain that derives its value from activities created by members within the ecosystem solving real world economic problems.

Wirex is a digital payment platform with a mission – to make crypto and traditional currencies equal and accessible to everyone.

Wish Finance is a provider of a blockchain as a service platform for small business lending.

XanPool is an internationally compliant fiat-gateway software solution for exchanges, wallets, and other cryptocurrency businesses.

XinFin (XDC) is an open-source hybrid blockchain platform. Combining the best attributes of both private and public blockchain XinFin offers a scalable, secure enterprise-grade blockchain.

Zilliqa is a high-performance, high-security blockchain platform for enterprises and next-generation applications.

We are a pioneer direct insurer born in 2010 with the aim to provide people an alternative to buying insurance direct versus through brokers and middlemen which is prevalent in Asia vs in USA or Europe.

EnjoyCompare is a comparison site focused on credit cards, loans, home loans, car insurance, travel insurance and broadband comparison in Singapore.

We loved serving our users as Credit Card Compare from 2008 to 2020. Since acquiring Finty in 2018, we’ve been preparing to offer more options to compare a broader range of products. Taking on the Finty name reflects who we are today: a company that provides the best offers, education, apps, and tools needed to save money and earn rewards.

GoBear is a financial services and data platform whose mission is to improve your financial health.

In the confusing and sometimes opaque world of insurance, Insurance Market acts as the pathfinder for consumers to find the insurance best suited to their needs.

Loan Owl, a leading loan comparison and matching provider, announced the expansion of its services aimed at small and medium scale enterprises (SME).

MoneySmart Group is South East Asia’s leading personal finance portal helping consumers compare loans, insurance, and credit cards.

Shenton Brokers makes it easy for you to compare and buy the insurance policies that best fit your needs and circumstances, at the most competitive price.

Launched in May 2015, SingSaver.com.sg is committed to helping consumers find the right financial product.

We create a single platform to provide product information that’s personalized to each SMEs business profile for easy comparison. Through Smart-Towkay, we will make it easy for SMEs to simplify and find alternatives in their business banking needs that are most suited to their business profile.

Symbo is an all-lines composite insurance broker with HQ in Mumbai, India. Our platform is powered by industry leading proprietary technology to facilitate.

We’re a team of analysts that reviews and analyzes data, facts and research for the most salient and relevant insights to help readers make decisions.

At Finastra our purpose is to unlock the power of finance for everyone. We build and deliver innovative, next-generation technology on our open Fusion software architecture and cloud ecosystem.

Mambu gives financial institutions a powerful competitive edge by allowing them to rapidly create, launch and service any lending or deposit portfolio through a modern SaaS banking platform.

Meniga is a digital banking platform that helps banks, businesses, and individuals manage their financial data.

OneConnect(“The Company”) aims to build the world’s leading technology-as-a-service platform for financial institutions.

Founded in 1993 and listed on the Swiss Stock Exchange (SIX: TEMN), Temenos AG is the world’s leader in banking software combining the richest packaged functionality and the most advanced cloud-native, cloud-agnostic, AI and API-first technology.

Tongdun Technology is a professional third-party intelligent risk management and decision-making service provider headquartered in Hangzhou, Zhejiang.

BRDGE is a MAS licensed digital lending platform that connects small and medium-sized enterprises in Singapore with retail and institutional lenders. Since 2014, we have been enabling growth for SMEs and creating wealth for lenders.

CoAssets is a real estate opportunity and crowdseeking platform that makes it easy for aspiring real estate developers and fundraisers to connect with investors on exclusive and undervalued investment opportunities.

The CapBridge Financial private markets solution helps companies and investors unlock value via a uniquely integrated primary syndication and secondary trading approach.

Capital Match is a leading lending and invoice financing platform for SMEs in Southeast Asia. We provide SMEs with affordable working capital from professional investors.

We are a peer-to-peer lending online platform that lets Singapore-based SMEs obtain financing from investors.

At Culum Capital, we aim to provide Singaporean SMEs with access to working capital funded by accredited investors.

eFund SME is a Singapore incorporated company, founded and wholly owned by Singapore business leaders. We connect businesses to investors who have the cash to liberate working capital.

Ethis is a global fintech company focused on Ethical crowd-investments and donations. We operate investment platforms approved by regulators in Indonesia, Malaysia, and Dubai, and also run a charity platform Global Sadaqah.

Finaku is a fintech startup focuses on collective investments into micro entrepreneurs, which aims to boost greater productivity & social impact.

FundedHere was founded in Singapore in 2015; it is the first MAS-licensed home-grown crowdfunding platform that offers equity and lending based crowdfunding to the masses.

Funding Societies | Modalku is the largest SME digital financing platform in Southeast Asia. It is licensed in Singapore, Indonesia and Malaysia, and backed by Sequoia India and Softbank Ventures Asia Corp amongst many others.

Fundnel is Southeast Asia’s largest private investment technology platform, powering private capital markets for the next generation of entrepreneurs and investors. It is headquartered in Singapore with a growing presence in 5 countries across the Asia Pacific.

FundTier is a licensed online crowdfunding platform that provides alternative financing to different tiers of businesses by connecting them with individuals and businesses looking for alternative investments.

HGX is a private exchange formed by an alliance of leading capital market intermediaries to facilitate cross-border issuance and trading of securities.

We are an alliance of leading capital market intermediaries and we welcome all licensed or registered market participants to join us.

Kapital Boost helps Asian small businesses grow BIG. Our Singapore-based hybrid crowdfunding platform levels the playing field by providing liquidity for goods and capital purchases for SMEs.

SimplyGiving is Asia’s award winning leading online social giving website providing non-profits and their supporters with powerful fundraising, crowdfunding & donation tools.

Peer-to-Peer (P2P) Financing is a new way for SMEs to obtain financing. At Smart Funding, we connect SMEs in Singapore who are seeking financing with global investors who want to make attractive returns while supporting Singaporean businesses.

Founded in 2015, Validus is Singapore’s largest SME financing platform for small businesses and accredited investors. Validus holds a CMS licence by the Monetary Authority of Singapore and has a presence in Indonesia, Vietnam and Thailand.

Arttha is the world’s most comprehensive unified banking platform, bringing together advanced microservices architecture and expansive interoperability that have been powering global banks and financial institutions to digitally offer banking services, manage payments across smart and USSD channels.

Backbase created the category-leading Engagement Banking Platform (EBP) that helps banks and credit unions to power the full customer lifecycle through a single, white-labeled platform, replacing their limiting, standalone point solutions.

We’re CREALOGIX, a global fintech organisation with over 500 employees globally. Our technology enables some of the world’s largest banks and wealth management firms to drive innovation – but it’s our people who make the difference.

At Finastra our purpose is to unlock the power of finance for everyone & redefine finance for good. We provide critical, leading solutions to the global financial services market.

Mambu is the only true SaaS cloud core banking platform. Our unique and sustainable composable approach means that independent engines, systems and connectors can be assembled in any configuration to meet business requirements and the ever-changing demands of your customers.

Meniga is a global leader of white-label Digital Banking solutions – serving over 100M banking customers across 30 countries. Meniga’s award-winning products enable the world’s largest financial institutions to dramatically improve their online and mobile digital environment, enriching the customer experience of over 100 million digital banking users across 30 countries.

Moneythor is a financial technology company developing banking software components designed to provide better digital banking for customers and enhanced marketing & analytics for banks. Its solutions enable financial institutions to deliver improved functionality and experience to their customers across their digital channels.

OneConnect(“The Company”) aims to build the world’s leading technology-as-a-service platform for financial institutions. The Company was listed on the New York Stock Exchange in 2019 (“OCFT”), National High-Tech Enterprise.

Sunline Wealth Management is an independent wealth management firm dedicated to help clients achieve their financial objectives with a dedicated service and personalized investment solutions. Our strategic location in Singapore allows us to be the ideal wealth management gateway to invest in Asia.

Our mission at Temenos is to power a world of banking that creates opportunities for everyone. Our passion for making banking better drives us to be the banking platform for all kinds of players in the industry – for large and small banks, for non-banks and fintechs, for partners and developers, for everyone.

Sunline Wealth Management is an independent wealth management firm dedicated to help clients achieve their financial objectives with a dedicated service and personalized investment solutions. Our strategic location in Singapore allows us to be the ideal wealth management gateway to invest in Asia.

Founded in 2013, Tongdun Technology is a professional third-party intelligent risk management service provider headquartered in Hangzhou, Zhejiang.

Ant Group, formerly known as Ant Financial, is an affiliate company of the Chinese conglomerate Alibaba Group. It aims to create the infrastructure and platform to support the digital transformation of the service industry.

GREEN LINK DIGITAL BANK (GLDB)

GLDB is committed to empowering MSMEs and technology enterprises globally in their growth journeys, so as to become their most trusted bank partner.

At GXS, we’re not just another bank. We’re on a mission to make banking better for everyday consumers and small businesses. Better is a journey and we’re here to stay the course.

MariBank is a digital bank licensed by MAS and is a wholly owned subsidiary of Sea Limited.

We are Trust, Singapore’s digital bank backed by a unique partnership between Standard Chartered Bank and FairPrice Group.

Agiliux is a cloud-based insurance software with extensive policy and claims management capabilities.

Aktivolabs was founded to provide a product that objectively measures the healthiness of our lifestyle in a meaningful way, to let us make informed choices on how we could and should live!

Aktivo is a leap forward in personal digital wellness, where each user’s lifestyle choices are met with an equally personalised awareness.

Ancileo empowers insurance distribution with B2B2C partnerships, using 360º technology solutions for insurers, re-insurers and affinity partners. Our platform provides plug and play, secure and customizable technology solutions that enables efficient insurance distribution through digital partnerships.

At Bandboo, members form communities and insure one another against any pre-defined risks. Unlike traditional insurance, insurance on our platform is based on peer-to-peer networks whereby people can get themselves insured without going to an insurance company.

We’re a Singapore-headquartered FinTech that’s revolutionising financial advice with online solutions that help simplify and demystify financial planning; making it possible for everyone, regardless of financial acumen, to make better financial decisions.

We make Life Insurance fantastically fun! Our platform helps you understand your own financial situation better so you always make the correct Life Insurance decisions with confidence. Your Financial Discovery Journey of a lifetime starts here.

CXA Group is Asia’s one-stop, predictive and data intelligence platform for better health, wealth and wellness choices. Through the CXA platform, employers can empower employees with access to personalised health and lifestyle offerings, with clear and quantifiable ROI for the business.

Droplet by Digital Income is the first rain insurance that protects you against price surge. Get back 60% of your ride fare when it rains, up to $50 a day!

eBaoTech® is a technology solution provider for global insurance industry. Our mission is to “make insurance easy”. We have clients in more than 30 countries across all continents, serving numerous insurers, agents, brokers, InsurTech startups and others in the insurance ecosystem.

World’s 1st Marketplace for Tradable Insurance Policies, leveraging on Blockchain Technology to disrupt the status quo. fidentiaX is a marketplace and repository of insurance policies for the masses that leverages on blockchain technology.

FitSense has mastered this digitally-enhanced environment for you and built a wellbeing ecosystem. A seamless, educational and engaging experience. We help and encourage people to adopt healthy habits and improve their health and wellbeing.

GetAssured for Business is Singapore’s first life insurance based employee benefits portal.

Gigacover delivers essential worker benefits to the self-employed economy. It has operations in Singapore and Indonesia.

At Hearti, we envision to redefine Financial Inclusion in South East Asia through the Micro-Financing and distributing Micro-Insurance products with our strategic partners.

Igloo is a full stack insurtech startup founded in 2016. It leverages big data, real-time risk assessment and end-to-end automated claims management to create innovative B2B2C insurance solutions for platform partners and insurers.

INSURANCE RISK EXCHANGE (IRX)

A Digital Marketplace to Transform the Global Commercial Insurance Industry. Advanced extensible secure digital technology with streamlined end-to-end processes to provide more competitive pricing while radically improving execution time, minimizing execution costs and permitting a new breed of insurance instruments and risks.

Insuree is a single point of contact for everything insurance-related. Empowering you with transparency & knowledge to make informed decisions. Insuree aims to disrupt the insurance industry with technology application, collaboration efforts, and data analytics to provide consumers with a holistic experience.

At Inzsure, we love Insurance. This is an industry that has provided a phenomenal and necessary service for eons and continues to do so today. By taking a Silicon Valley approach to this space, we believe we can change how corporate managers think about insurance permanently by establishing ourselves as a leading InsurTech firm and developing a ground breaking solution.

As The World’s First Secure Transit InsurTech, Jaguar Transit can help you with the pay-as-use Secure Transit solution that comes with all the Insurance that you need and a reduced requirement on your security set up.

Speak to us today. Be one of our pioneer clients.

PolicyPal is an insurtech company that empowers consumers to start their financial journey through gamified reward-based learning.

The digital marketplace for Traded Endowment and Life policies in Singapore. We assist policyholders in obtaining better encashment value for insurance policy that they wish to surrender.

Telematics SDK and Platform to collect, process, and analyze telematics data. We enhance drivers’ safety and performance via embedded services for developers.

Singlife was built because we believe that the world needs a better kind of insurance company: using the smartest technologies to make insurance totally digital, with automated efficiencies to make it more convenient and affordable.

We are a Singapore-registered FinTech Company certified by SFA as an InsurTech provider. We provide quick and fast insurance comparisons across the different insurers that insurance brokers’ partnered with.

We are a Singapore-registered FinTech Company certified by SFA as an InsurTech provider. We provide quick and fast insurance comparisons across the different insurers that insurance brokers’ partnered with.

SNACK by Income is a first-of-its-kind platform in the insurance space that lets people use spare change to build up their coverage with lifestyle activities. In just 6 months, SNACK has issued more than $30m sum assured in micro-policies.

Surer is a cloud-based, web platform with a market-first technology in the region, that helps all parties in the General Insurance segment automate processes and drive network collaborations, enabling them to provide better service and support to their clients. As at May ’20, Surer is certified by the Singapore FinTech Association.

Surety.AI is the insurtech platform for insurers, brokers and ecosystem partners. It provides API connectivity to optimise all aspects of the insurance value chain.

At Sync, we’re building a robust sales and marketing platform for Southeast-Asian Financial Sales Professionals and Leaders to Attract, Convert, and Engage!

Making insurance as easy, clear and honest as possible is what Tiq is all about. We are the digital channel of Etiqa Insurance, an award-winning digital insurer in Singapore, with a wide range of insurance to suit your needs. Easy to buy, fast to claim.

Vouch Insurtech is an insurance platform for private communities. We partner with major insurers to offer Singapore’s first “No-Claim Rebate (NCR)” cash back for car insurance.

The technology venture founded by ZhongAn Online, a global leader in online insurance, and backed by Softbank’s Vision Fund.

37cap executes a combination of strategies to generate alpha in the digital assets space. We run liquid market-neutral funds, and we also invest in tokens and in companies at the bleeding edge of decentralization.

At 360F, our purpose is to revise the financial advisory system. We enable any distributor to deliver the best solutioning possible and win the customer’s trust.

additiv is a market-leading system of intelligence for digital wealth management. Established in 1998, additiv partners with the world’s leading financial institutions to help them capitalize on digitization.

AGDelta is an award-winning, Asia-based B2B2C FinTech firm, with centres of excellence in Hong Kong and Singapore, that makes financial investments, services and advice more accessible, safer and smarter, by digitising the wealth ecosystem.

AlgoMerchant revolutionizes the way people invest by providing fully AI-driven solution for stock traders and portfolio managers.

A regional robo-advisor headquartered in Singapore. It is one of the earliest robo-advisors to be licensed by MAS to provide full digital investment advisory and management services to retail and corporate investors.

Since 2009, ayondo has stood for innovation. Whether you use ayondo to develop and implement your own strategies and gain followers, or take advantage of top traders’ signals, our proprietary, award-winning technologies help you efficiently and reliably while trading.

Bambu is a Fintech company. We are B2B, which means we only develop tech for financial institutions. Our platform helps users save and invest for their future.

Bankograph is a capital management company focused on bank asset securitisation opportunities in Frontier Markets.

BetaSmartz is a B2B Investment Management FinTech business that equips financial institutions with digital tools and automated investment, operational and administrative solutions across the back, middle and front office enabling them to more efficiently manage clients and their wealth, reducing cost and increasing scale.

Bondlinc is a Wealth Management solutions provider certified by the Singapore Fintech Association, and has attained several industry accolades including the Best Regulatory Reporting Solution and Most Innovative Solution by the Asian Private Banker.

Bondevalue is a Singapore based Fintech company that focuses on Asian bond markets. Unlike equities which have already been digitally disrupted, bonds have remained unchanged for decades, with private bank clients unable to access live prices. We envision using our deep domain expertize to level the playing field for them via the simplicity and convenience of an App.

Canopy is a Singapore based fintech that offers account aggregation, portfolio analytics, and client reporting solutions to financial institutions, wealth management professionals, and high net-worth individuals. We are proud to have Credit Suisse as a client and investor.

Singapore’s first robo advisory service. CONNECT by Crossbridge is Asia’s first and largest functioning digital advisory service for Accredited Investors

At Covalent Capital, our objective is to create shared systems and platforms which deliver Cost, Process and Information efficiency to the Debt Markets.

dollarDEX is an online investment platform by Aviva that makes investing in unit trust easy and affordable for all. dollarDEX is a trademark owned by Navigator Investment Services Ltd which is a firm licensed by the Monetary Authority of Singapore (MAS).

Eigencat is a start-up Fintech supported by the University of Singapore (NUS) enterprise which has built a modular digital investment platform for use in the Wealth Space.

Endowus is a Singapore-based financial technology company that empowers people to take control of their financial future. The firm’s proprietary systems provide data-driven wealth advice in constructing personalised solutions.

Enfusion is a leading global provider of native SaaS-based investment management technology solutions and services that enables clients to operate from a single golden source of data from the front-office to the back.

Everest Fortune Group is an Award-Winning Research House and Singapore FinTech Company (Cert No. 20060004). We use our modular cutting edge technology to deliver custom tailored solutions to Brokers, Traders and Portfolio Managers.

Expersoft Systems provides leading-edge software solutions and services for wealth management and retail banks, asset management companies, family offices, and other financial service providers.

Fincast is a financial services technology company, with offices in Australia and Singapore, that creates applications for investment advisers, wealth management groups and financial institutions.

Fraxtor is a blockchain enabled real estate crowdfunding platform, which allows investors to buy fractional units of real estate with a mouse click.

funderbeam is a cross-border, transparent, easy-to-use platform for funding and trading connects smart companies with smart capital.

The mission of GrabInvest is to give EVERYONE access to SIMPLE, TRANSPARENT, and AFFORDABLE investment solutions.

HiHedge is your personal automated investment advisor. We regularly help you invest with simple methods with great results while still managing risks like the best.

Hydra X builds next-gen trading and financial marketplace technologies to enable access to multiple venues and assets.

Bespoke FinTech solutions, including trading software, algos, risk management systems, macro research, technical analysis, realtime alerts, trading education, and much more.

We are a leading digital securities finance & investment platform for real estate and private equity. InvestaX is a digital financing and investment platform licensed by the Monetary Authority of Singapore. We are removing friction for fundraising and trading in private securities markets. Our services are primarily focused on Real Estate & Private Equity.

Headquartered in Los Angeles with a global presence, InvestCloud develops first-class, financial digital solutions, pre-integrated into the cloud. By empowering investors and managers with a single version of the integrated truth through its unique digital platform, InvestCloud creates beautifully designed client experiences and intuitive operations solutions using an ever-expanding library of digital modular apps. The result? Powerful products for individual investors and institutions alike, assembled on-demand to meet clients’ specific needs.

InvestingNote is a Singapore based company that provides financial platform that aims to promote Singapore’s investor awareness by creating a social network dedicated for Singapore stock investors, a place where the retail stock investors meet the professionals traders to exchange investing ideas.

iSTOX is the first MAS-licensed integrated issuance, custody and trading platform for digitised securities.

Kristal.AI is a Digital-First Private Wealth Platform giving investors access to curated portfolios from the world’s top Portfolio Managers. Licensed in 3 countries, Kristal.AI is now present in Singapore (MAS), Hong Kong (Type 4 & Type 9), and India (SEBI – RIA).

We’re the international arm of one of the most valuable unicorn Lufax (LU.com) and a member of the world’s largest insurance company Group, Ping An.

PIVOT is a transparent digital investment management system based on the fundamentals of Markowitz’s Modern Portfolio Theory.

Quantifeed provides a digital investment solution to financial institutions and their clients. Our platform allows users to explore, customize, invest & manage portfolios of stocks, bonds, funds and other asset classes.

RealVantage is a co-investment platform that provides investors access to cross border real estate at lower investment quantum.

Sherpa Funds Technology (SFT) is a Singapore based Company that provides game-changing technology to Investors, Fund Managers and Traders.

Simple2Trade is a Singapore based FinTech at the leading edge of enterprise SaaS development.

Smartkarma is a collaborative marketplace that is radically changing the way market participants create, distribute and consume investment insights.

Snap is a technology company focusing on areas of Artificial Intelligence, Fintech and Blockchain. We aim to be always at the forefront of technologies and seek to break new grounds all the time.

Source Central is modernizing the institutional real asset marketplace. Designed exclusively for the world’s largest and most sophisticated investors and asset managers, Source Central provides a secure two-sided network based on interactive real asset fund data.

Spark FX provides a robust trading platform that helps payments players to achieve better profitability. The platform was developed to bridge gaps between product offerings and actual user needs, and plays a facilitative role between liquidity providers and takers.

Spiking is a real-time social trading platform for investors in a stock market. The company provides in-house applications and optimized cloud-based mobile solutions.

At SquirrelSave, we invest the right way. We manage risks before chasing returns. Managing risks require big data analytics, real-time 24/7. We use artificial intelligence (AI) & machine learning to design a globally diversified investment portfolio with the highest predicted return matched to your risk profile.

StashAway is the digital wealth manager that intelligently navigates macroeconomic data, not the market ups and downs.

Syfe is the digital wealth manager for investors who expect more – greater transparency, smarter personalised portfolios, and better investment outcomes.

Sygnum Bank is the world’s first regulated Digital Asset Bank and a digital asset specialist with global reach.

Torre Capital is a regulated fintech platform in a major global financial center enabling 100% transparent access and allocation to global institutional grade alternative investment opportunities.

Traderwave Pte Ltd is a financial technology company that develops and provides an intuitive charting web application that allows global traders to shortlist, analyse and monitor trades from any computer that has internet access.

Headquartered in Singapore, Tradesocio provides digital technology that enables financial institutions worldwide to access, manage and offer unique investment management and brokerage solutions to their customers.

Investing has never been easier with VI. Centred on FinEduTech, VI App’s unique stock analysis makes investing Smarter, Faster and Easier than ever before by delivering powerful insights.

WeInvest is Asia’s first end-to-end Digital Wealth Platform and offers solutions to Banks & other financial institutions.

The global leader in wealth information and insight, Wealth-X partners with leading prestige brands across the financial services, luxury, not-for-profit and higher-education industries to fuel strategic decision-making in sales, marketing and compliance.

WIZE is an all-in-one Wealth Management solution offered by TeamWork, a Swiss company founded in 1999.

Xen is a next-generation platform for private investments, opening up privileged opportunities to a wider array of investors at a below-market fee.

ABLR

Consumer credit is broken; we’re trying to fix it. The Ablr team is focused on utilising technology, design and data to humanize consumer credit.

AND Global Pte. is a Singapore based fintech company that manages startups developing AI powered financial products.

Atome is a leading “buy now, pay later” brand that splits consumers’ bills into three equal, zero interest payments over time.

Benefit.X equips Small Businesses with Corporate Cards and Digital Loan Options while complimenting their business operations with a cutting-edge Benefits and Human Resource Management (HRM) solution.

Bluecell is the region’s first online platform and Lending-as-a-Service integration for SME financing.

Headquartered in Singapore, Capital C Corporation is a holding conglomerate that capitalises on fintech, as well as the best emerging technologies in the market, to provide financial services to the under-served in both Singapore and South East Asia.

Cash In Asia Pte Ltd (CA) is a Singapore B2B financing platform powered by AI and data analytics, that provides a one-stop solution for responsible, transparent and flexible financing for micro, small and medium enterprises (MSMEs) in Asia Pacific.

Capital & Credit Risk Manager (CCRManager) is a global digital platform for the secondary trading of trade finance obligations, and will help banks to address balance sheet, ROE and cost challenges.

Credit Culture, a subsidiary of DEY Private Limited, is the first Fintech company to provide digital solutions for personal loans in Singapore.

CredoLab develops bank-grade digital scorecards for banks, lenders, pay later, e-commerce and ride-hailing players, and any other industry at the intersection of financial services.

FinAccel is a financial technology company that leverages deep data analytics across users’ digital footprint to automate credit risk scoring and access to credit in Southeast Asia, the 7th largest economy in the world.

Finaxar leverages technology to provide fast and flexible business funding, aided by their simple, transparent pricing structures and integration with cloud accounting platforms.

Providing revenue based financing to help your business fly! Founder-friendly financing to help your online business grow.

Singaporean Fintech developing credit cards and credit lines for freelancers in Southeast Asia using data and AI.

Genie Financial Services is the next generation financial solutions provider that uses technology to change the conventional ways of financing.

The Omni-Channel Digital Commerce Platform Get is the digital commerce platform that empowers microentrepreneurs with technology in order to be competitive in the future economy.

GreenArc Capital (GAC) is an impact investment firm dedicated to fostering sustainable growth and inclusive finance through scalable credit solutions in select emerging markets.

Helicap is a FinTech Investment Platform specialising in the alternative lending space in Southeast Asia & Oceania.

hoolah is Asia’s leading omni-channel buy now pay later platform. Headquartered in Singapore we are live in Singapore, Malaysia and Hong Kong and expanding rapidly.

ILEX (Institutional Lending Exchange)

iLex is a fintech start-up creating the first all-to-all electronic market and trading platform for corporate loans, delivering an augmented network and targeted deal opportunities for loan market participants using its proprietary matching engine.

Incomlend is an online multi-currency invoice exchange for businesses and private capital.

InvoiceInterchange offers you a fast and flexible way to finance your business and allows companies like yours to grow, pay bills or overcome seasonal cash flow fluctuations by freeing up cash locked up in invoices due 30, 60, or even 90 days.

Jenfi is a financial technology company that provides revenue-based financing to rapidly growing businesses in Asia.

Lend East is a credit platform focused on providing structured financing solutions to address inefficiencies in alternative lending markets in Asia.

Lendela is a technology company that connects customers with banks and lenders, offering APAC’s most attractive platform for consumer credit management.

Cash flow is the lifeblood of every business. And at Nufin Data, we believe every enterprise, big or small, anywhere in the world, should have the chance to maximise their growth potential.

NuPhi is world’s first end-to-end EXIM management cloud software. It’s an innovative All-in-One platform to create, track, share & manage all shipments, automate, digitalise workflow, documentation, advance license management, etc.

oCap is a technology-driven provider of financing solutions for businesses. Our mission is to create opportunities for businesses by offering access to sustainable, flexible and affordable financing solutions.

At OctiFi we are reinventing digital credit to make it more accessible for all consumers. We are using modern technology to re-imagine the checkout experience and make it easy for businesses of all sizes to offer responsible credit to their customers.

Oriente was established in 2017 by the co-founders of revolutionary internet companies Skype and LU.com who saw an opportunity to build a better, more equitable financial system for underserved consumers in Asia’s fastest-growing economies.

Rely is a ‘buy now pay later’ service that enables customers to buy what they want today and split the purchase amount into interest-free payments.

Ryalize is an employee financial wellness platform that provides employees with instant access to a portion of their earned but yet unpaid wages.

Triterras is a trade finance leader leveraging advanced financial technology to solve deep-rooted challenges in the trade industry and unlock opportunities in global trade finance.

TurnKey Lender offers a solution for intelligent end-to-end lending software, decision management, and risk mitigation solutions and services.

Uprise is a fintech company in Asia providing transparent and responsible financing to help start-ups and small businesses grow.

Headquartered in Singapore, Aspire is a Y-Combinator backed technology organization that serves small businesses with convenient & inclusive financial services.

BigPay is one of ASEANs fastest growing fintech companies. We’re on a mission to challenge traditional banking by democratizing and decentralizing financial services across SE Asia.

MatchMove is one of the world’s fastest growing and most disruptive fintech companies in digital payments and next-generation banking.

InstaReM was founded in 2015 with a mission to improve the cross-border payments experience for consumers in the APAC region.

When Revolut was founded in 2015, we had a vision to build a sustainable, digital alternative to traditional big banks. Our mission now is to help our customers improve their financial health, empower them to have more control, and promote financial cohesion across the communities in which we operate.

People on every continent around the world are choosing TransferWise to help them live, travel and work internationally. We’re the fairest, easiest way to send money overseas.

YouTrip is a multi-currency mobile wallet with a prepaid Mastercard® that offers zero transaction fees across 150+ currencies at wholesale exchange rates.

2C2P is a global payments platform helping businesses securely accept payments across online, mobile and in-store channels. The company is headquartered in Singapore and operates across Southeast Asia, North Asia, Europe and the US.

ACI Singapore is affiliated to ACI – The Financial Markets Association, the global umbrella body of financial markets associations.

Acromobile powers your payments and automates related processes, you focus on running your business. Complete security with Tokenization. A payments app for Salesforce. A CRM and reporting system for Cybersource.

Adyen (AMS: ADYEN) is the payments platform of choice for many of the world’s leading companies, providing a modern end-to-end infrastructure connecting directly to Visa, Mastercard, and consumers’ globally preferred payment methods.

Aleta Planet provide end-to-end technology solutions for Financial Institutions and corporates. We focus on a client specific, solutions-oriented approach and have successfully delivered highly regulated, licensed (by Monetary Authority of Singapore) and secured leading edge technology solutions.

Alipay is the world’s leading open digital daily life services platform operated by Ant Group.

Alldebit Pte. Ltd. is an online and in-store payment company specializes in Direct Debit and QR code alternative payment solutions, head quarter in Singapore.

Alpha Fintech has developed the world’s first omni-channel solution access platform that consolidates the entire payments, risk and transaction world on one platform, the AlphaHub.

Apple Pay is a mobile payment and digital wallet service by Apple Inc. that allows users to make payments in person, in iOS apps, and on the web using Safari.

AsiaPay is a world-class electronic payment service, solution, technology provider, and merchant aggregator in Asia.

In Asiatop Loyalty, we have the vision to disrupt the loyalty rewards market and hand back the control of rewards rules to the public.

AttractPay Ltd. is the first authorized acquirer of Alipay in New Zealand providing fast and safe payment acceptance service to New Zealand merchants.

We provide low cost, plug-and-play solutions to provide cashless payments and interactive capabilities for both new and legacy machines.

Vertical Payment Solutions Pte Ltd is a provider of leading edge payment and automation solutions for schools and universities in the Asia Pacific and the Middle East region.

CardUp is a secure platform that brings value to both individuals and businesses by improving the way they pay and get paid, access credit and manage payments.

Founded in 2011, Coda Payments’ mission is to make world-class digital entertainment accessible to everyone.

DTC (Digital Treasures Centre)

Digital Treasures Centre Pte Ltd (“DTC”), an enterprise solutions provider incorporated in Singapore in 2019.

Headquartered in London, payment service provider and direct card acquirer ECOMMPAY is an authorised payment institution (API) regulated by the Financial Conduct Authority (licence number 607597).

EedenBull is a fintech company, built by experienced banking, payment, and technology professionals. We help banks create new products and services to increase revenue, customer loyalty and brand affinity. We operate globally, but implement locally.

Episode Six provides a next-generation financial technology platform for creating innovative and differentiated financial and payments products for consumers and businesses, enabling financial institutions, fintechs and other innovative companies to serve their customers better.

EZ-Link is the leading smartcard issuer in Singapore with the EZ-Link card valued as a key catalyst in Singapore’s transformation into a globally reputed cashless society.

Fave is Southeast Asia’s fast growing fintech platform providing payments & loyalty solutions to offline merchants to grow and connect with their customers in a whole new way.

FlexM is a Fintech company registered in Singapore focusing on financial inclusion of the unbanked / underbanked segment in Asia and Europe.

Flywire is a high-growth vertical payments company trusted by organizations around the world to deliver on their customers’ most important moments.

FOMO Pay is the one-stop mobile payment processing solution which enables merchants & banks to accept a full suite of new payment methods including NETSPay, mVISA, Grab Pay, WeChat Pay, Singtel Dash, RazerPay, etc.

FOMO Pay is the one-stop mobile payment processing solution which enables merchants & banks to accept a full suite of new payment methods including NETSPay, mVISA, Grab Pay, WeChat Pay, Singtel Dash, RazerPay, etc.

Google Pay is a digital wallet platform and online payment system developed by Google to power in-app and tap-to-pay purchases on mobile devices, enabling users to make payments with Android phones, tablets or watches.

GPS (GLOBAL PROCESSING SERVICES)

Global Processing Services (GPS) is the trusted and proven go-to payments processing partner for today’s leading challenger brands, including Revolut, Starling Bank and Curve.

GrabPay is an eWallet within the lifestyle “super app” app, Grab. It is the largest ride hailing app in Southeast Asia and has over 100 million users.

One stop payment processing and commerce platform for direct to consumer & small business owners in Singapore.

Huawei Pay is an easy and secure way to make payments with your Huawei or Honor devices. Add your bank cards to Huawei Pay to pay in stores with just a tap.

IDEMIA, the global leader in Augmented Identity, provides a trusted environment enabling citizens and consumers alike to perform their daily critical activities (such as pay, connect and travel), in the physical as well as digital space.

With iPaymy for Business, SMEs can pay rent, salaries, invoices, and even corporate tax using the credit cards they already have in their wallet today. SMEs love iPaymy because it works like a credit card, but pays like cash.

Jewel Paymentech is a financial risk technology company founded in 2014 with a mission to develop intelligent risk solutions for the banking and electronic payments industry.

JunoTele is a mobile payments technology company, operating out of Silicon Valley of India, Bangalore. With our recent foray into the Fintechworld, we are working hard to help India realize the Digital dream.

Legatus Global will provide a crypto to fiat and fiat to crypto settlement platform with propriety digital wallet.

Liquid Group is a regional mobile payment services group headquartered in Singapore, with a presence in Malaysia, Thailand, and Indonesia.

Maesh uses PayNow and its bank-grade security to receive payments from your customers. And since we use bank apps, not credit cards, you can worry much less about fraud.

As a high-level, powerful, credit-worthy and law-abiding mobile payment service provider and payment system provider, MCT Pay adheres to the principle of “fund security core, leading technology and comprehensive and thoughtful service”.

Providing software solutions to small medium businesses in Singapore since 2008. MerchantPlay is the web-based point of sale system that makes it simple to sell to your customers, and keep them coming back to your store.

MPayment is a specialist payment solutions provider, e-commerce enabler and e-marketing solutions company.

Nearex aims to empower people by simplifying proximity transactions such as Micropayments using mobile technology.

Numoni Pte Ltd is a financial technology (Fintech) company incorporated in Singapore in 2012. Our mission is to provide technology-based solutions with customer convenience as the primary objective.

Founded in 2011, Ondot provides more than 4,500 banks and credit unions with a digital card services platform that drives cardholder engagement.

OnlinePay.com is a product where personalized m-wallet meets a convenient checkout solution optimized for both online and offline merchant’s needs.

Opal provides SMEs with a unified account of financial business solutions – payments, financing, insurance, multi-currency wallets.

Payoneer’s mission is to empower businesses to go beyond – beyond borders, limits and expectations. In today’s digital world, Payoneer enables any business of any size from anywhere to access new economic opportunities by making it possible to transact as easily globally as they do locally.

PayPal Holdings, Inc. is an American company operating an online payments system in the majority of countries that support online money transfers, and serves as an electronic alternative to traditional paper methods like checks and money orders.

We deliver multi-functional, user-friendly payment solutions to suit any business, supported by robust and dynamic security systems.

Poccupine’s payments technology aims to help online merchants to navigate through all of this by protecting them from e-commerce fraud and allowing them to collect payments through local payment methods – digital, mobile and more.

Pure Commerce provides on-demand financial services to banks & merchants around the world. The Pure Commerce service suite allows merchants to transact in a wide range of currencies, creating a better shopping experience for merchant & customer alike.

Qbero is a digital platform to enable a seamless flow of money between the ecosystem of consumers, retailers and banks.

Rapyd does for fintech what the cloud did for IT. Our Global Payments Network connects your company to all the ways the world likes to pay and the infrastructure to create your own fintech solutions, like ewallets, cards and financial services.

Reap is a technology company dedicated to fuelling the ambitions of small businesses. We deliver corporate payment solutions to improve the way small businesses operate today and prepare them for the challenges of tomorrow.

Red Dot Payment (RDP) is an online payment service provider headquartered in Singapore. The fintech company provides online payment gateway systems, payment consulting and merchant acquisition services for businesses that require the processing of online credit card transactions.

Samsung Pay is a mobile payment and digital wallet service by Samsung Electronics that lets users make payments using compatible phones and other Samsung-produced devices.

We are established as a payment company specialized in digital payment and IoP in Singapore providing know-how to business to enable digital transformation.

SmartPesa develops payments and agency banking solutions for merchants and banks across the globe, taking care of the tech so they don’t have to.

soCash solves cash management for banks using technology. We are a fast growing fintech, based out of Singapore. Our platform enables cash circulation without the need for vintage supply chain of cash.

Unlimited cards. Automated local payments. Cheapest overseas transfers. All your payables in 1 dashboard. If you would like to save 200 hours of payments processing time and $1,000 of bank charges every month, try Spenmo.

UNPay (www.unpay.com), a new Fintech open platform provider with its regional office headquartered in Singapore, is dedicated to aggregating mainstream electronic payment modes across the globe.

UNPay provides sellers worldwide with a one-stop intelligent aggregation payment platform that aims to unify multiple collection channels and simplify complicated payment account verifications.

Verrency is a global payments innovator that has a mission to put financial institutions back at the centre of the innovation.

Wallet Engine is an embedded finance gateway for cross-border apps.

WeChat Pay has become a part of daily life. With WeChat Pay enabled on mobile phone, users can make transaction payments at anytime and anywhere.

Founded in 2015, Xfers aims to accelerate financial access within Southeast Asia by enabling businesses to accept payments and send money.

Youtap was established in 2007 and provides banks, payment service providers, retail conglomerates, and mobile operators around the globe with the future of digital banking, payments, and financial services software and solutions.

Advisers use our solution to know their clients really well, propose and illustrate well rounded plans, providing the best client experience. We had been featured on channel 8 and is also the Insurtech winner of the Asia Trusted Life Agents & Advisers Awards 2020.

FinancialRuler is a Singapore based financial planning platform. We aim to help the rest of us to understand and budget finance, plan for retirement while achieving financial goals and milestones.

fundMyLife is a platform that intelligently connects consumers with financial advisers based on the financial planning questions that they ask. Consumers can also browse financial advisers’ profiles and client reviews that establish credibility and expertise.

GoalsMapper™️ is the first fintech / insurtech company in Singapore with the vision to redefine financial planning, through its real-time, scenario-based and customer-facing financial planning software.

Limitless is a white-labeled mobile app for automated micro-investments. It allows for spending-based investments into a portfolio of a low-cost funds with every card transaction. This product is particularly appealing to freelancers (Gig Economy).

MoneyOwl is a financial adviser and fund management company licensed by MAS that helps people make wise money decisions.

Nugget is a fast growing startup that believes personal finance should be simple and accessible.

OnTrack is a powerful purpose-built engine, combining extensive evidence-based research around psychometrics, financial market behaviour, regulatory contexts, and human realities.

Seedly is Singapore’s largest personal finance community for young adults and Singaporeans. Join the SeedlyCommunity and take control of your personal finances today!

AiDA is a leading provider of AI and machine learning solutions for the banking and insurance sector. We serve tier-one banking and insurance customers in Singapore, Malaysia, Thailand, Indonesia, Philippines, Hong Kong and Vietnam.

Apiax is a Swiss RegTech that builds digital solutions to help financial institutions be compliant with complex regulations worldwide.

Apvera leverages adaptive analytics to understand user behavior and the interactions they have between applications they use and the company’s network.

Apvera leverages adaptive analytics to understand user behavior and the interactions they have between applications they use and the company’s network.

Artius Global is a leading and innovative provider for regulatory compliance founded and headquartered in Singapore.

Backpack is a personalized conversational AI messaging platform that allows enterprises to turn their back-office workflows into conversations.

BASIS ID brand was built in effort to give companies a tool to speed up operational processes, provide ultimate security and to form trustworthy relationships through compliance with regulatory requirements.

BlueMeg is led with extensive complementary expertise in corporate services, governance, finance, legal, cyber-security, IT infrastructure, and engineering.

Complying with modern regulations can be time consuming, frustrating and filled with risk. CENTENAL creates interactive algorithm based software to help compliance professionals easily understand and implement the requirements of modern complex regulations.

COMPLIY

Compliy is a global Regtech100 company simplifying and automating compliance and risk management workflows for compliance and business teams in APAC.

At ComplyAdvantage, we believe that compliance doesn’t have to be painful. Businesses need real-time financial crime insight to put them in control.

At Cygnetise, we enable organisations to easily manage their signatory lists and bank mandates. All whilst decreasing the risk of signatory fraud.

We are first in your inbox with the most important media news of the day—keeping you smarter and one-step ahead.

Datarama is the one-stop information source for complex risk/opportunity assessment and due diligence in emerging markets.

Dathena is a deep-tech company that provide an A.I. Driven Data Discovery and Classification platform, bringing a new paradigm to data privacy and security solutions.

Deep Identity is an innovation leader in providing comprehensive and unique solution to address identity governance and administration (IGA), compliance management and data governance requirements.

Founded in 2013, Elliptic pioneered the use of blockchain analytics for financial crime compliance. We are the leading provider of crypto compliance solutions globally.

FinChat web-based and mobile-based compliance tools where business chats are captured and monitored while private chats remain private.

Founded in 2011, Handshakes has grown into an award-winning DataTech company. We enable our clients to make safer, more informed decisions by delivering meaningful insights, harnessed from reliable data.

At Horangi, we’re passionate about building a safer cyberspace and creating software that solves challenging cybersecurity problems.

Instacheck offers mobile KYC software and bespoke compliance consultation to NBFIs, including brokerages, exchanges, lenders and traders, money changers and remittance firms.

IoTech Lab was established in 2018 in Singapore. We provide AML/KYC, Transaction Monitoring and Fraud Prevention solutions, in a modular PaaS (Platform as a Service) for digital businesses (Finance and FinTech, Digital assets, Gaming, Legal and Real Estate) worldwide.

When identity matters, trust Jumio. Jumio’s mission is to make the internet a safer place by protecting the ecosystems of businesses through a unified, end-to-end identity verification and eKYC platform.

Established in 2015, Know Your Customer provides next generation digital on-boarding solutions to financial institutions and regulated organisations around the world.

At Lymon, we take pride in providing one-stop compliance solutions to our clients. Trusted by financial institutions since 2013, we understand the challenges that businesses face in a fast-paced world.

Singapore’s best-design RegTech solutions: powered by AI & internationally Singapore’s best-design RegTech solutions: powered by AI & internationally scalable.

MCO provides compliance management software that enables companies around the world to reduce their risk of misconduct.

Merkle Science provides blockchain transaction monitoring and intelligence solutions for cryptoasset service providers, financial institutions and government agencies to detect, investigate and prevent money laundering, terrorist financing and other criminal activities.

We are compliance technology specialists. Our platform is founded on broad experience and deep expertise; and our products increase efficiency and minimise risk by successfully combining big data technologies with AI and machine learning

NetGuardians is an award-winning Swiss FinTech helping financial institutions in over 30 countries to fight fraud.

OneSpan enables financial institutions and other organizations to succeed by making bold advances in their digital transformation.

PayShield was founded in 2018 by payment industry veterans Daryn Griggs and Bruce Parker. Today, PayShield remains committed to delivering industry-transforming eCommerce fraud and chargeback management solutions.

RADICALi is a regulatory technology firm backed by the Singaporean government’s deep-tech investment arm (amongst others). It helps compliance professionals in financial services address regulatory change proactively via our SaaS solution: MICA.

Refinitiv is one of the world’s largest providers of financial markets data and infrastructure, serving over 40,000 institutions in approximately 190 countries.

Registered as a member of the Singapore Fintech Association, the Regtank team is made up of seasoned professionals from various financial institutions and technology firms who are familiar with the highest standard of compliance in one of the most competitive financial centres in the world.

RisikoTek – We Automate, Detect and Uncover. We combine financial crime typologies, entity resolution technology and advanced data analytics to understand the complex relations across global networks of companies, individuals, transactions and behaviors.

A PayPal incubated company focused on generating data-driven insights to increase e-commerce conversions.

Silent Eight is a technology company leveraging AI to create custom compliance models for the world’s leading financial institutions. Founded in Singapore and with global hubs in New York, London, and Warsaw, we are deployed in over 150 markets.

The Secured ID is a RegTech company. We build and connect digital identity techonology into financial institutions to assess the various risks associated with digital identities.

Tookitaki combines machine learning, distributed systems and business expertise to create building blocks of sustainable compliance management.

Uppsala Security built the first crowdsourced Threat Intelligence Platform known as the Sentinel Protocol, which is powered by blockchain technology.

U-Reg is a Singapore-registered FinTech Company certified by the Singapore FinTech Association as a AI and KYC-AML RegTech provider.

V-Key is a global leader in software based digital security, and is the inventor of V-OS, the world’s first virtual secure element.

Vesta is a leading FinTech company and the forerunner in guaranteed e-commerce payment solutions.

VoxSmart helps businesses see their communications data in a clear and compliant way to effectively mitigate business risks by delivering critical insights and business intelligence in near real-time.

Known as the FACE OF ASEAN by our partners, WISE AI strives to become the most respected AI company in Southeast Asia by making people’s lives better and safer.

ZignSec is a B2B2C regulatory technology company that develops and operates an identity verification platform enabling instant verification of people in more than 240+ countries through a single integration.

Chynge applies financial technology including artificial intelligence and machine learning, big data, cloud computing, distributed ledger technology (DLT), and facial recognition to create new business models, new financial products, and new customer experiences to change the way we consume financial services.

CurrencyFair solves the pain experienced by anyone that needs to send money abroad. Expats, overseas home-owners, and SMEs typically pay large spreads (up to and even exceeding 5%) and high international transfer fees of around €25 on every payment.

EMQ operates a global financial settlement network that provides a faster, more affordable and transparent cross-border settlement solution for businesses around the world, while adhering to complex regulations and compliance standards in different markets.

KOKU is an FX-tech-enabler who empowers small to large non-bank money transfer operators such as remittance houses and liquidity providers by enabling them to easily tech up and advance their business operations, to provide cheaper, quicker and digital-first remittance and FX services to their customers around the world.