Mobile Payments

Making Sense of Fintech Fraud in APAC

As technological advances significantly change people’s daily lives, the benefits from these advances essentially boil down to one aspect, convenience. Technology has allowed business and social activities to expand and remain primarily online. This includes transactional decisions from purchasing tangible

Read MoreE-Commerce Boom Propelling Digital Payments Adoption in Southeast Asia

Southeast Asia (SEA) is experiencing exponential growth in digital payments encouraged by a booming e-commerce scene. The region is now home to some of the world’s largest online marketplaces in some of the fastest-growing economies like Indonesia, Malaysia, Singapore, and

Read MoreSingapore Gears up for Next Phase of Growth for SGQR

Singapore has big plans for its national QR code payment standard. The country wants to establish its Singapore Quick Response Code (SGQR) as a top mobile payment method at physical stores, and is pursuing linkage opportunities with other national QR

Read MoreGoogle Wallet Is Now Available in Singapore as a Standalone App

Google Wallet is now available as a standalone app for the Singaporean users as a complementary experience to Google Pay. This digital wallet for Android and Wear OS standardises the way users save and access essential items such as vaccine

Read MoreThis Cybersecurity Report Analysed 35 Billion Transactions and Here Are Its Key Findings

Fraud patterns are changing considerably as consumer dependence on the mobile channel continues to increase. Over the past three years, the share of attacks on mobile channels, versus desktop, has risen steadily, moving from accounting for just about 40% of

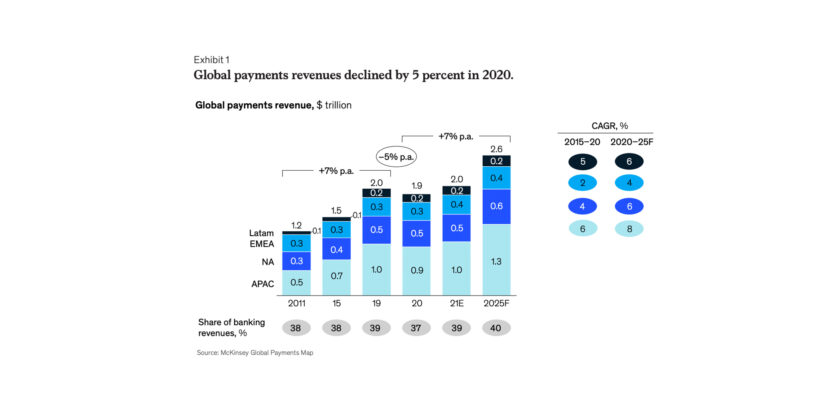

Read MoreMcKinsey: APAC Continues to Lead Global Payments Revenue Despite 2020 Decline

Despite a slight decline, Asia-Pacific (APAC) continued to dominate the global payments landscape in 2020. With approximately US$900 billion in revenue, the region accounted for 47% of global payments revenues, according to the 2021 McKinsey Global Payments Report. This year,

Read MoreNETS Appoints UOB’s Head of Group Tech and Operations as New Chairman

Network for Electronic Transfers (NETS), a Singaporean electronic payment service provider, announced the appointment of Susan Hwee, UOB’s Head of Group Technology and Operations as its new Chairman, her appointment takes effect from 1 September 2021 onwards. The chairmanship of

Read MoreRapyd Secures US$300 Million From Series E Fundraise To Support Its Expansion Plans

Rapyd, a Fintech-as-a-Service company which provides APIs that helps integrate local payments and fintech capabilities, announced a US$300 million Series E funding round led by Target Global. Joining the round are several new investors including funds managed by Fidelity Management

Read MoreMobile Transactions in Vietnam Projected to Surge 300% In the Next 5 Years

Between 2021 and 2025, mobile transactions in Vietnam are expected to surge 300% as Vietnam continues to leapfrog into the mobile channel, a new report by IDC and Backbase found. The second edition of Fintech and Digital Banking 2025 Asia

Read MoreRapyd Creates Venture Arm to Invest in Early Stage Fintech Startups

Rapyd, a global Fintech-as-a-Service company, announced the launch of Rapyd Ventures, its new venture arm that will focus on investing in early and growth stage businesses. The new venture arm will be led by Joel Yarbrough, MD of Rapyd Ventures

Read More