This Cybersecurity Report Analysed 35 Billion Transactions and Here Are Its Key Findings

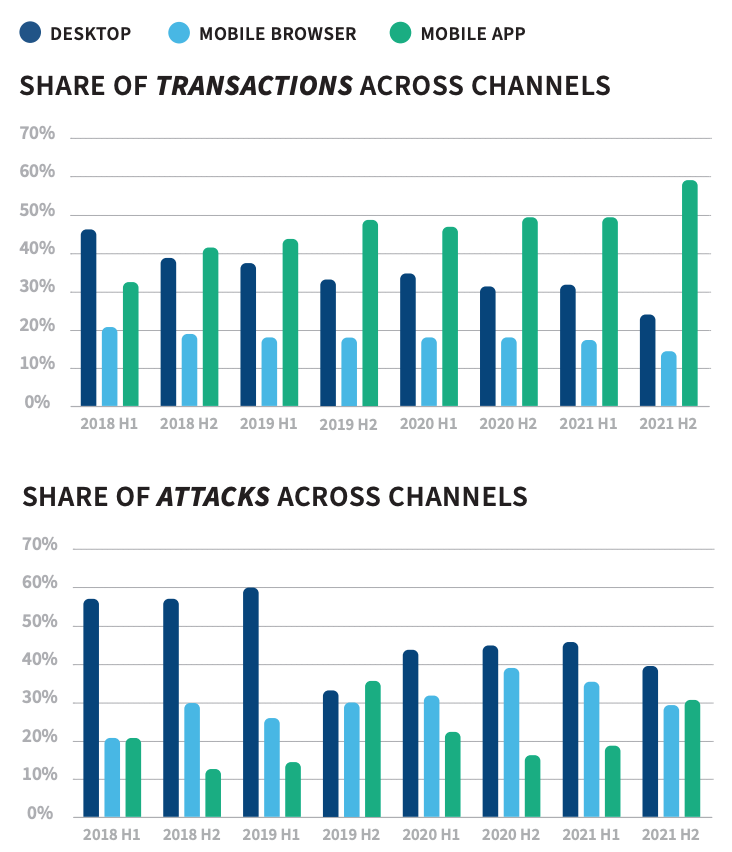

by Fintech News Singapore April 11, 2022Fraud patterns are changing considerably as consumer dependence on the mobile channel continues to increase. Over the past three years, the share of attacks on mobile channels, versus desktop, has risen steadily, moving from accounting for just about 40% of all attacks in H1 2018 to about 60% in H2 2021, data from the LexisNexis Risk Solutions Cybercrime Report, July to December 2021, show.

The research, which analyzed 35.5 billion transactions over the six-month period, found that users’ shift to mobile channels has driven fraudsters and cyber criminals towards mobile apps and mobile browser. In H2 2021, attacks on mobile app logins globally increased 138% year-on-year (YoY), while attacks on mobile payments grew 63%.

This trend comes as consumers are favoring mobile channels over desktop to conduct financial transactions. In H2 2021, the mobile share of transactions in the LexisNexis Digital Identity Network, a fraud detection tool, reached 75% for the time, effectively becoming the predominant means by which consumers transact.

This is to the detriment of desktop-based transactions which continued to decline in H2 2021, sliding from a 45% market share in H1 2018 to just 25%.

Share of transactions and attacks across channel, Source: LexisNexis Risk Solutions Cybercrime Report, July to December 2021, March 2022

The shift to mobile-based transactions can be observed across all major markets, but data from LexisNexis Risk Solutions show that it is emerging markets that are truly leading the way. This is because in most emerging markets, consumers have leapfrogged the PC era altogether to embrace mobile devices.

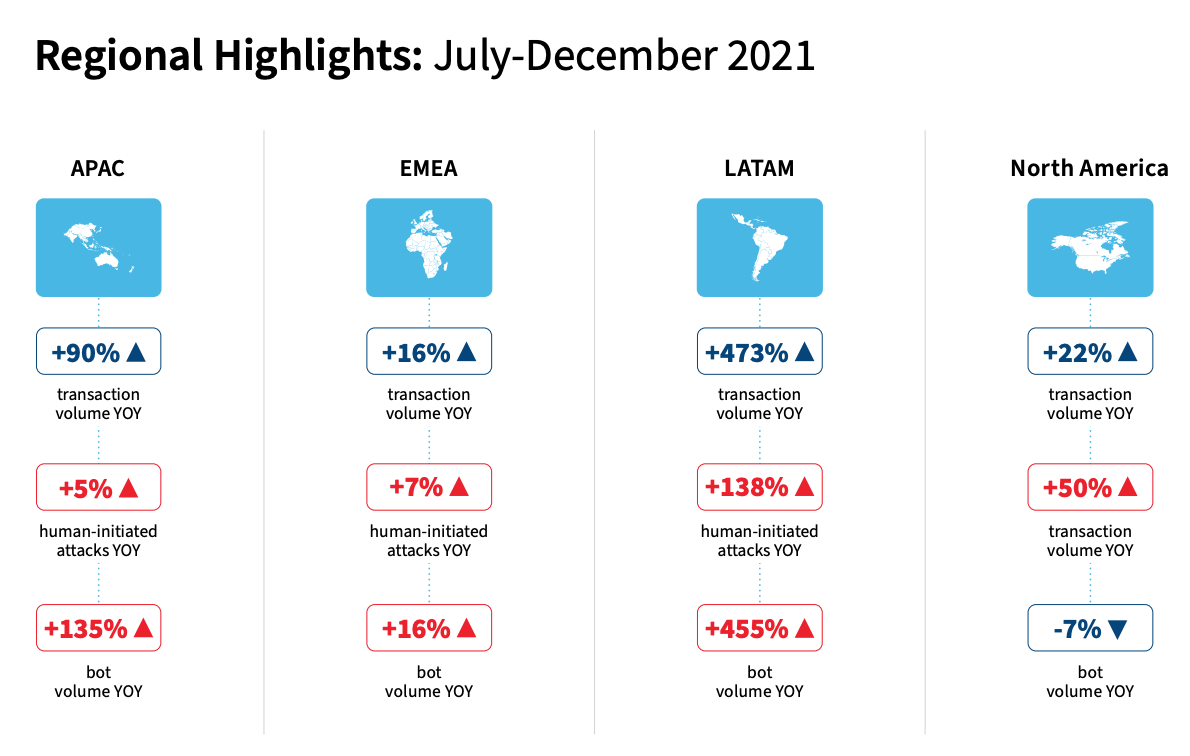

Across all major regions, it is Latin America that recorded the strongest growth, with digital transaction volume jumping 473% YoY to reach 5 billion. Asia Pacific (APAC) ranked second, just volumes increasing 90% YoY to 3.1 billion amid booming adoption of neobanking, cryptocurrency and buy now, pay later (BNPL) arrangements.

Looking at cyber threat trends, the report says that in H2 2021, APAC continued to see a large increase in bot attacks, which jumped by a staggering 135% YoY. Human-initiated attacks grew as well but more modestly at 5%.

Regional highlights, transaction and attack patterns, Source: LexisNexis Risk Solutions Cybercrime Report, July to December 2021, March 2022

Findings shared in the LexisNexis H2 2021 Cybercrime Report are consistent with other research published recently, which claim that digital banking adoption has accelerated drastically over the past few years amid the COVID-19 pandemic.

In fact, a 2021 survey by McKinsey said digital banking reached a new level of maturity in APAC last year with penetration approaching 90% across the region.

The International Data Corporation (IDC) has just released its predictions for the years to come for APAC’s financial services and payments industry (excluding Japan). Among other things, the firm expects greater adoption of artificial intelligence (AI) and cloud computing across the financial sector, as well as rising usage of real-time payments and BNPL arrangements amongst customers.

By 2024, 40% of banking institutions in APAC excluding Japan will use AI-based sentiment analysis to improve customer experience, the firm estimates, while by 2025, it’s projected that 50% of APAC banks will have deployed their data warehouses and analytics operations in the cloud.

But rapid adoption of cutting edge technologies is also creating new risks. By 2031, research firm Cybersecurity Ventures predicts that ransomware will cost victims US$265 billion annually, with a new attack every two seconds.