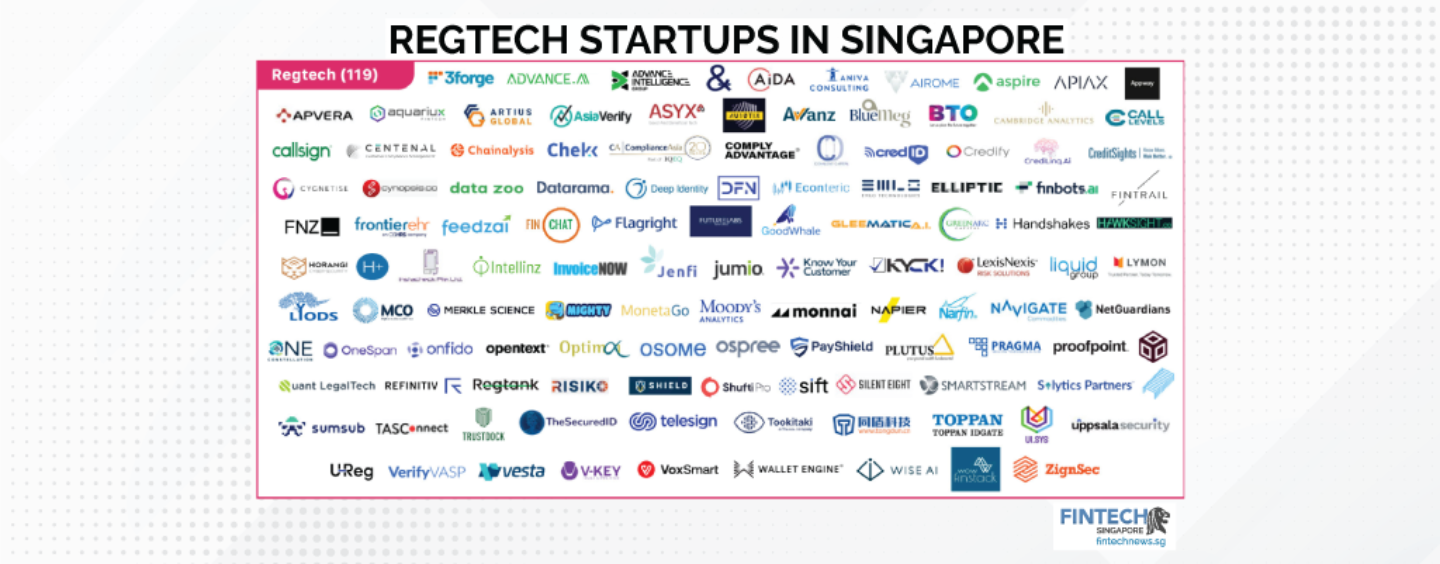

Regtech Startups in Singapore

Discover 119 RegTech Startups in Singapore – Streamlining Compliance, Securing Financial Services, and more.

List of Regtech Startups in Singapore

3Forge provides a high-performance low-code development platform used to rapidly build enterprise applications.

Advance.AI is a Singapore-based startup which combines the best domain knowledge in big data, artificial intelligence and credit scoring to bring the next-gen data-centric platforms to transform traditional and emerging industries across the Asia Pacific.

Headquartered in Singapore, Advance Intelligence Group is an AI-driven technology company focussed on transforming financial services and retail industries.

AiDA is a leading provider of AI and machine learning solutions for the banking and insurance sector in Asia.

Aniva Consulting is a professional consulting company with multi-year experiences in financial and payments industry, providing its services in the area of AML/CFT, capital markets and payments licensing, account opening with payment institutions or corporate administration.

Airome Technologies is a Singapore-based developer of cybersecurity solutions for digital banking and e-document management systems.

Aspire is the all-in-one finance software for growing businesses. Headquartered in Singapore, the company serves over 15,000 startups and SMBs in Southeast Asia, helping them save time and money.

Apiax is a Swiss RegTech company that provides digital solutions to help financial institutions comply with complex regulations worldwide.

Apvera helps businesses protect their networks from known and unknown threats by detecting anomalies in user behavior and data flow.

Artius Global is a Singapore-based provider of regulatory compliance solutions, including substantial shareholding disclosure.

AsiaVerify (UNSD Information Technology Pte Ltd), is a RegTech company offering instant verification services that enable users to streamline workflow for KYB, UBO, KYC, AML as well as addressing other compliance challenges.

ASYX is a financial supply chain management firm based in Indonesia and Singapore, specializing in software solutions and services for both the physical and financial supply chain.

AU10TIX

AU10TIX, an identity intelligence leader headquartered in Israel, provides critical, modular solutions to link physical and digital identities so that companies and their customers can confidently connect.

BlueMeg is a fast-growing SaaS company that provides the world’s first entity management and governance platform. It helps businesses save time and money by automating complex corporate governance tasks.

BetterTradeOff is a Singapore-headquartered FinTech that’s revolutionising financial advice with an online solution that helps simplify and demystify financial planning.

Cambridge Advisers is a regulatory compliance and corporate advisory firm based in Singapore, with service coverage across Asia Pacific.

Call Levels is a Singapore based Fintech Startup, operating across consumer and business verticals. Their core product is a market monitoring mobile application, “Call Levels”, that services more than 500,000 investors globally.

Callsign is pioneering digital trust through proprietary technology that uniquely mimics the way humans identify each other in the real world.

CENTENAL provides software to help compliance professionals understand and implement complex regulations.

Chainalysis builds trust in blockchains to promote more financial freedom with less risk. Backed by Benchmark and other leading names in venture capital.

Chekk is an award-winning customer interaction Software-as-a-Service (SaaS) platform, co-founded and led by industry experts (Pascal Nizri and Benjamin Petit)

ComplianceAsia, now part of IQ-EQ, is a leading Compliance Consultancy Firm with a distinguished legacy in the Asia-Pacific region. Since 2003, they have been at the forefront of providing regulatory and compliance consulting services to financial institutions.

ComplyAdvantage is a real-time financial crime risk detection platform that helps businesses stay compliant with Sanctions, AML, and CTF regulations.

Covalent Capital (Issue New Bonds, the New Way) started in 2017 specializing in primary capital market solutions.

Credify is creating the future of embedded finance through a suite of award-winning self-sovereign identity, secure data passporting technologies, and a powerful privacy-first financial services cross-offering platform.

CrediLinq is a technology infrastructure company that is enabling B2B platforms to offer embedded finance to their customers.

CreditSights, Covenant Review, and LevFin Insights bring together best-in-class research, covenant analysis, and news on one platform, with a unified interface and login.

Cygnetise is a blockchain-based platform that helps organizations manage their signatory lists, bank mandates, and other sensitive data securely and efficiently.

Cynopsis is a daily media news newsletter that helps executives stay informed about the digital and traditional media landscape. It is known for its qualified and engaged audience, making it a valuable resource for businesses and candidates.

Data Zoo is a global identity solution powering modern verification experiences for digital businesses around the world.

Datarama is a RegTech platform that helps businesses assess risk and opportunity in emerging markets. It combines advanced technology with human analysis to streamline the traditional risk-consulting model, making compliance checks cheaper and faster.

Deep Identity provides comprehensive and innovative identity management, compliance management, and data governance solutions. Its layered approach enables better visibility and controls, automating compliance management in a cost-effective manner.

Data Finnovation is a modern financial information provider, offering bigger, richer fundamental data and analytics.

Bridging the gaps of technology and payments. Building the tech infrastructure of everything from onboarding, KYC, transaction monitoring, to integrating with banks and payout partners across the globe.

Elliptic is a leading provider of crypto compliance solutions, helping businesses to protect themselves from financial crime.

FinbotsAI, an Accel Portfolio company, is leading innovation in Artificial Intelligence & Machine Learning with a mission to make the power of AI accessible to all FIs.

FINTRAIL is a financial crime compliance consultancy focused on the needs of leading banks, FinTechs and other regulated institutions.

FNZ is the global wealth management platform, integrating modern tech with business and investment ops, all within a regulated financial institution.

Frontier eHR is a cloud-based HR software for HRMS, payroll, talent management, leave, claim, time attendance and HR analytics.

Feedzai is the market leader in fighting financial crime with AI. Their RiskOps platform leverages machine learning and big data to prevent and detect financial crime for some of the world’s largest banks, payment providers, and merchants.

FinChat is a web-based and mobile-based compliance tool that monitors business chats while keeping private chats private. It allows employees to engage with clients through popular messaging apps while staying audit-compliant, secure, and mobile.

Flagright is a global leader in the fight against financial crime, providing a unified solution that seamlessly blends cutting-edge AI technology with deep expertise in Anti-Money Laundering (AML) compliance and fraud prevention.

Established by the former Partners of McKinsey New Ventures and accomplished veteran entrepreneurs, FutureLabs Ventures is a top-tier corporate venture studio & venture capital firm.

Handshakes is a DataTech company that helps clients make safer, more informed decisions by delivering meaningful insights from reliable data.

Horangi is a cybersecurity company that builds partnerships with its customers to develop and implement security strategies that help them achieve their objectives.

Instacheck is a mobile KYC software and compliance consultation provider for NBFIs. It offers instant KYC checks on companies and persons against cautioned lists under UN, US OFAC, UK, EU, CA, AU, and SZ. It is a bite-sized solution that is appropriate for small financial firms.

Intellinz is a leading Online B2B platform that helps business owners to Buy, Sell & Invest securely with KYC Due Diligence.

Founded by Jeffrey Liu and Justin Louie, Jenfi is an alternative revenue-based financing company for digital-native businesses and startups for Southeast Asia.

Jumio is an identity verification and eKYC platform that helps businesses fight fraud, onboard customers faster, and meet regulatory compliance. It uses AI, biometrics, machine learning, and liveness detection to verify identities from over 200 countries and territories.

Know Your Customer provides next-generation digital onboarding solutions for financial institutions and regulated organizations around the world.

LexisNexis Legal & Professional is a leading global provider of legal, regulatory and business information and analytics that help customers increase productivity, improve decision-making and outcomes, and advance the rule of law around the world.

Lymon provides one-stop compliance solutions for financial institutions, helping them navigate the constantly changing regulatory environment.

Liquid Group is a fintech company, headquartered in Singapore and licensed as a Major Payment Institution (MPI). Regulated by the Monetary Authority of Singapore (MAS) to conduct Account and E-money Issuance, Merchant Acquisition, as well as Domestic and Cross-Border Money Transfers.

Lyods is a FinTech solution provider of Web3.0 technology on Artificial Intelligence, Big data analytics and Blockchain for business.

MCO provides compliance management software to help companies reduce their risk of misconduct. Its SaaS-based platform is easy to use and extensible, and it can be deployed quickly and cost-efficiently.

Merkle Science provides blockchain transaction monitoring and intelligence solutions to cryptoasset service providers, financial institutions, and government agencies.

Moody’s Analytics provides financial intelligence and analytical tools supporting their clients’ growth, efficiency and risk management objectives.

Monnai delivers transformative consumer insights infrastructure that enables businesses to navigate the four key pillars of the customer lifecycle: KYC, trust & fraud risk, credit decisioning, and collections.

Napier is a compliance technology platform that helps businesses increase efficiency and minimize risk by combining big data, AI, and machine learning. It is user-friendly and scales to meet the needs of any business, regardless of sector.

Founded in 2020, Narwhal Financial Services Pte Ltd (Narfin™), is a Singapore headquartered FinTech spin-off from Singapore Management University (SMU) with 2 grants awarded from SMU and SMART (Singapore-MIT Alliance for Research & Technology).

Navigate Commodities monitors the movement & consumption of dry bulk commodities over land & sea using the most powerful technologies available.

NetGuardians is an award-winning Swiss FinTech that helps banks fight fraud with AI. It prevents fraudulent payments in real time, reduces false positives by up to 83%, and helps banks detect new fraud cases.

One Constellation Offers A Comprehensive Compliance Solution That Includes (KYC), (KYB), And (KYW) Checks, As Well As Risk Scoring, Onboarding Processes, And Reporting.

OneSpan is a RegTech company that enables financial institutions and other organizations to succeed in digital transformation by establishing trust in people, devices, and transactions.

Onfido is an AI-powered identity verification company that helps businesses onboard customers remotely and securely.

OpenText is a world leader in Information Management, helping companies securely capture, govern and exchange information on a global scale.

Headquartered in Singapore, Optimai is a multiple award-winning Financial Technology specialist building the next generation platform to make investments Simpler, Smarter & Safer.

Osome is an online bookkeeping and accounting firm that sorts all the boring admin for your business so you can focus on growing: They cover all industries, with specialisation in E-commerce business.

Ospree is a Software-as-a-Service cloud platform that offers powerful, integral B2B solutions to create full-stack compliance ecosystems in only a few steps and without technical complications.

PayShield is a RegTech company that provides AI-powered eCommerce fraud and chargeback management solutions. It was founded in 2018 by payment industry veterans Daryn Griggs and Bruce Parker.

Pragma is a CREST approved global provider of cybersecurity solutions. They help organisations strengthen cyber resilience and safeguard valuable information assets with a pragmatic approach.

Proofpoint provides the most effective cybersecurity and compliance solutions to protect people on every channel including email, the web, the cloud, and social media.

Organisations produce many paper or electronic documents which need to be trusted and processed outside the organisation. Qryptal enables these documents to be instantly verifiable and amenable for automated processing.

Quant LegalTech solves the inefficiencies prevalent in the Legal & Regulatory space with plug & play technology solutions.

Refinitiv is a global financial markets data and infrastructure provider that helps businesses drive performance in trading, investment, wealth management, and more.

Regtank is a Singapore-headquartered RegTech company that simplifies compliance for the next generation.

RisikoTek automates, detects, and uncovers financial crime using AI and data analytics to understand complex global networks and identify suspicious patterns.

SHIELD helps world-leading enterprises build trust and safety by stopping fraud and abuse. Their products span fraud prevention, network security, credit intelligence, and identity verification.

Shufti Pro is an AI-powered digital identity verification solutions provider offering KYC, KYB, and AML services in 200+ countries and territories.

Sift is the leader in Digital Trust & Safety, empowering digital disruptors to Fortune 500 companies to unlock new revenue without risk.

Silent Eight is a technology company leveraging AI to create custom compliance models for the world’s leading financial institutions. Founded in Singapore and with global hubs in New York, London, and Warsaw, they are deployed in over 150 markets.

SmartStream is a recognised leader in financial transaction management solutions that enables firms to improve operational control, reduce costs, build new revenue streams, mitigate risk and comply accurately with regulations.

Solytics Partners is a global analytics firm focused on solving client problems through an amalgamation of advanced analytics, new-age technologies, and deep domain expertise.

Staple has developed an ML tool that reads, interprets and extracts structured data from documents faster, more accurately and more affordably than any human can, at scale.

Headquartered in Singapore, TASConnect is a working capital solutions SaaS platform connecting complex enterprise ecosystems to deliver economic value with visibility and control.

Founded in Japan in 2017, TRUSTDOCK is leading the way in holistic eKYC solutions for seamlessly facilitating trusted business relationships and transactions.

The Secured ID is a RegTech company that uses digital identity technology and facial recognition to help financial institutions assess the risks associated with digital identities. This reduces fraud and helps to ensure that people are who they claim to be. The Secured ID’s verification processes can be customized to fit each financial institution’s risk levels and needs.

Telesign provides Continuous Trust™ to leading global enterprises by connecting, protecting, and defending digital identities through our powerful AI.

Tookitaki is a regtech startup that uses machine learning and distributed systems to create sustainable compliance management solutions. Its AMLS and RS suites have been used by FIs globally to prevent money laundering and automate large-scale banking reconciliations.

Founded in 2013, Tongdun Technology is a professional third-party intelligent risk management service provider headquartered in Hangzhou, Zhejiang.

TOPPAN IDGATE, a member of the TOPPAN group since 2020, is a software company born to provide the bank grade security, strong authentication solutions.

At UNIFIED INTELLIGENCE®, they are committed to providing the most secure and reliable data privacy solutions.

Uppsala Security built the Sentinel Protocol, a crowdsourced threat intelligence platform powered by blockchain technology. It helps organizations meet their crypto security needs and comply with cybersecurity standards.

U-Reg is a Singaporean FinTech company that provides AI-powered KYC-AML RegTech solutions. Its platform automates the exchange of regulatory documents and structures KYC data using machine learning and artificial intelligence.

Established in 2019, VerifyVASP strives to provide a best-in-class travel rule solution for virtual asset service providers (VASPs) to facilitate their compliance with the travel rule requirements across jurisdictions.

V-Key is a global leader in software based digital security, and is the inventor of V-OS, the world’s first virtual secure element.

Vesta is a leading FinTech company that provides guaranteed e-commerce payment solutions. It pioneered fully guaranteed card-not-present (CNP) payment transactions and has expanded its data science and machine learning capabilities globally.

VoxSmart is a RegTech company that helps businesses mitigate business risks by extracting critical insights from communication data in near real-time.

WISE AI is a leading AI company in Southeast Asia, with offices in Singapore, Malaysia, and Thailand. It provides facial recognition, eKYC, and Smart City solutions to customers from various industries.

Based in Singapore but with the ultimate goal of serving the global market, WOWfinstack is making its entrance with a single-minded aim to completely disrupt and reinvent the concept and practice of digital payments, along with other key areas of financial technology.

ZignSec is a B2B2C regulatory technology company that develops and operates an identity verification platform enabling instant verification of people in more than 240+ countries through a single integration.

Image by Freepik