UOB Joins in the Wave of Digital-Only Banks With the Launch of TMRW in Thailand

by Fintech News Singapore February 15, 2019The year 2019 seems to be the year when the banks jump into the digital only bank bandwagon, with CIMB announcing the launch of its digital-only bank in both Philippines and Vietnam.

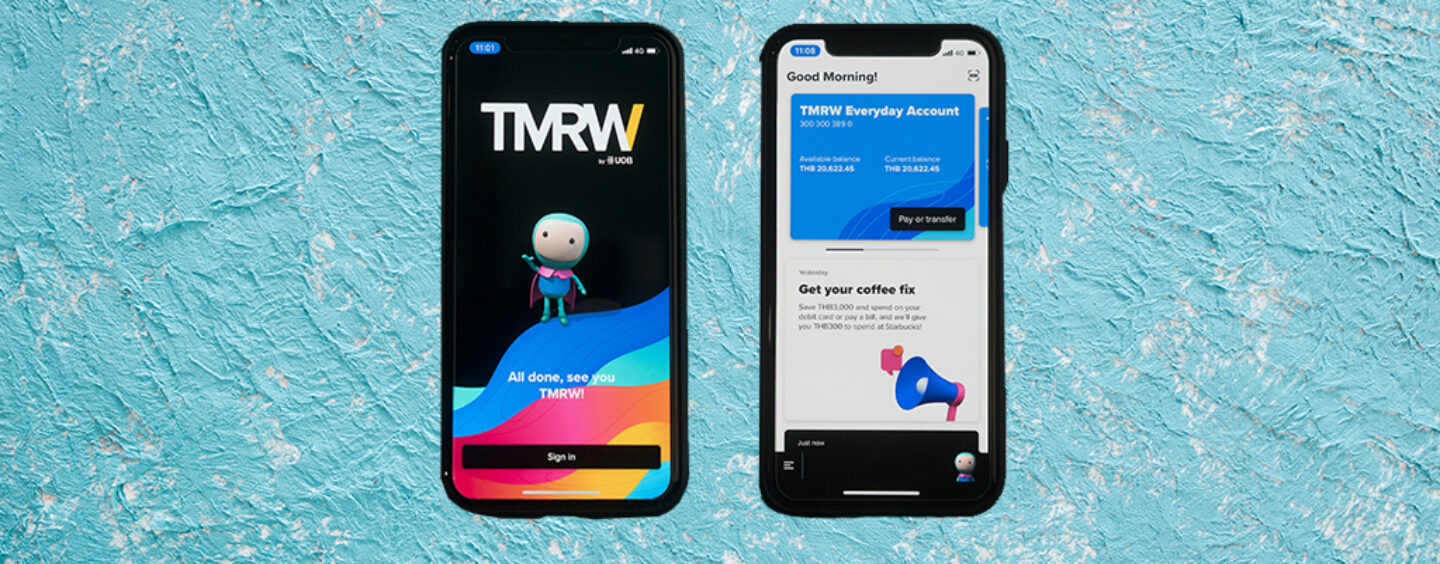

UOB is the latest to join the fray, the bank has announced that they have launched TMRW, a digital-only bank that operates purely on the mobile phones of its customers in Thailand.

This latest string of banks favouring digital-only bank versus investments into branch in new markets is perhaps inspired by the DBS’ earlier success with Digibank in India.

According to a press release issued by UOB, TMRW aims to make banking simpler, more transparent and more engaging for its customers through the use of data.

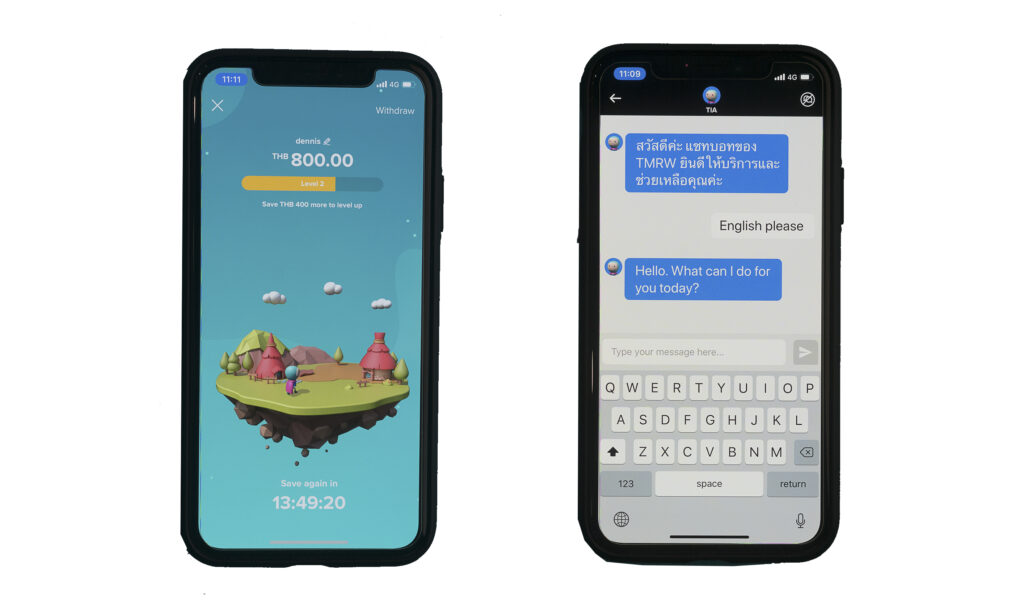

The digital bank translates transaction data into actionable insights that make the banking experience interesting and fun while enabling customers to be smarter at saving and spending.

As customers spend more time with TMRW, the mobile-only bank becomes even more familiar with their wants and needs in order to serve each one better, for example the instead of having a traditional app menu — TMRW will personalise functions and information based on the user’s usage.

TMRW also comes equipped with a virtual chat assistant within the app, within it there’s a call function which enables users to get further customer support without toggling the app.

Dr Dennis Khoo, Head of Group Retail Digital, UOB, said that TMRW was created from scratch with the sole purpose of meeting the financial needs of ASEAN millennials.

Dr Dennis Khoo, Head of Group Retail Digital, UOB, announces the launch of TMRW, an ASEAN digital bank powered by UOB

“While ASEAN is known for its diversity, there remains a set of fundamental expectations by the digital generation when it comes to digital services, such as simplicity and an engaging user experience. So we took the time needed to understand our millennial customers and how and why they engage withobile apps and digital services the way they do.

“Having a mobile-only digital bank enables us to explore new frontiers when it comes to designing a user interface based on customers’ banking behaviour and needs and to be sensitive to the nuances of each market. What this means is that TMRW will not be a static one-size-fits-all app, but a digital bank that will continue to learn to create increasingly simple, transparent and engaging experiences for TMRW’s customers in each of our ASEAN countries,”

Dr Khoo said.

Featured image credit: Freepik