DBS Report: Fintech, A Challenge And An Opportunity For Banks

by Fintech News Singapore October 28, 2016Fintech investment more than doubled in 2015 and the sector currently counts 19 unicorns; players that are in a position to challenge banks. Despite the apparent threat, fintechs also bring the opportunity for small and medium-sized banks to partner with innovative players and take on bigger banks, according to a new report by DBS.

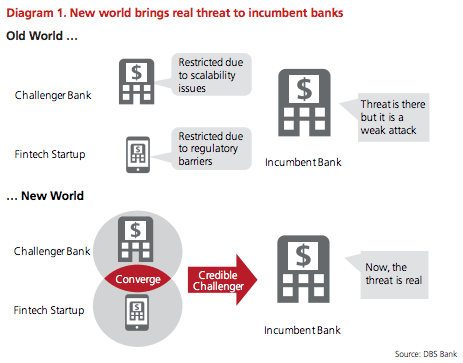

In the document, titled ‘Digital Bank: New Avatar – Banks Watch Out for Banks,’ DBS points out the opportunity for smaller banks to partner or acquire fintech startups to overcome their smaller physical presence and limited banking functionalities and launch attacks at the bigger and incumbent banks. These players will become the real threats for incumbents, the report claims.

There are two ways in which banks can respond to the changing environment:

1) serve existing products digitally so that they are faster, cheaper and easier; and/or

2) adopt a customer ecosystem approach which integrates banking into customers’ daily lives.

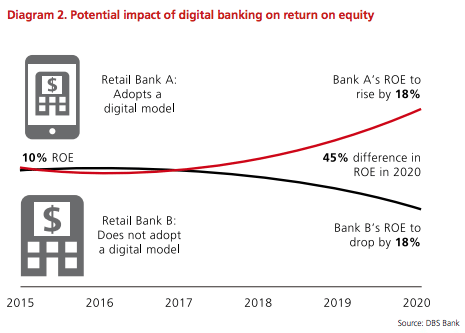

Banks that fail to adapt and adopt a digital model may see a drop in return-on-equity (ROE) by around 18% over a five-year timeframe, mainly due to pressure from fintech firms and progressive banks, the report claims.

DBS cites the example of Commonwealth Bank, BBVA and Barclays which have all adopted technological platforms based on application programming interface (API). Others have invested in innovation labs, running hackathons and accelerator programs in a bid to transform the mindset within their organizations.

The fintech threat

Fintech firms are attacking all products and lines of traditional banks, each focusing on a few products and services to address the unmet needs of customers or offering services with greater convenience and/or at lower cost.

In 2015, fintech companies attracted over US$13.8 billion in venture capital through 653 deals. Payments and lending in particular have attracted the most number of investments.

According to the report, there are about 6,500 fintech startups in world: 2,500 from Asia and 4,000 from the UK and US.

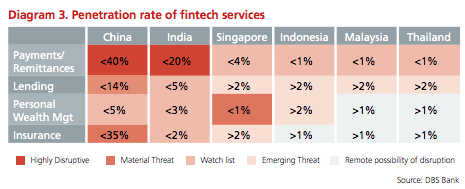

Adoption has been noticeable in emerging markets, notably in China and India. In China, service portal Tencent is used by over 500 million people for daily communication, payments and wealth management. Another notable Chinese player is Alipay, the largest mobile payment company in the world. This has enabled China’s fintech sector to lead by huge margins in Asia Pacific.

In India, Paytm has become a common name in the payments space with over 122 million users.

Bank/fintech collaboration

As the financial sector becomes more and more crowded and competitive, the report points out the need for collaboration between startups – which are often struggling to grow –, and challenger banks – which are often finding hard to expand their services internationally.

“[In the new world]… challenger banks are acquiring or collaborating with fintech companies to deploy technology, which had been a key bottleneck,” the report says. “It had become much easier for challenger banks to reach a wider customer base without having to expand their physical footprint.”

It cites the case of BBVA which acquired US-based online direct bank Simple for US$117 million, immediately providing the Spanish bank access to over 100,000 US customers. BBVA has also acquired a 30% stake in Atom, the first mobile-only bank in the UK, which launched its services in early 2016. The bank’s latest deal was the acquisition of Holvi, an online bank based in Finland serving entrepreneurs and SMEs in Europe.

“The banking industry is on the cusp of disruption,” the report says.

It concludes:

“There are many ways existing banks can respond to this ‘fintech attack’, from providing their services digitally to completely reinventing their business models (since the same range of technology is broadly available). Fintech companies are not only competitors but also potential partners that enable banks to harness technology.”

Featured image: DBS branch in Hong Kong, Wikipedia.