Posts From Fintech News Singapore

SoftServe to Showcase Generative AI Innovations at Money20/20 Asia

SoftServe, a global IT consulting and digital services firm, is set to present its latest generative AI (Gen AI) technologies at the upcoming Money20/20 Asia conference. The event, scheduled for 23-25 April in Bangkok, Thailand, will highlight innovative applications of

Read MoreNium Appoints Alexandra Johnson as Chief Payments Officer

Nium, a real-time cross-border payments platform, has appointed Alexandra Johnson as its first Chief Payments Officer. This strategic addition aims to strengthen the company’s global banking and payment operations. Johnson will lead Nium’s efforts across various markets, focusing on strategy,

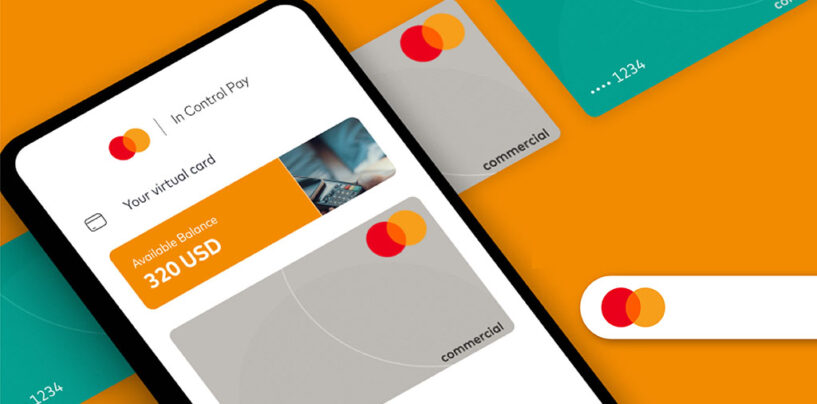

Read MoreMastercard Launches Mobile App for Adding Virtual Cards to Digital Wallets

Payments giant Mastercard has launched a new mobile app that allows virtual commercial cards to be added directly to digital wallets, enhancing contactless payment solutions for businesses. This app is a development aimed at providing financial institutions with more options

Read MoreTop 5 Most Promising AI Companies in Asia According to CB Insights

Market intelligence platform CB Insights has released its selection of this year’s 100 most promising artificial intelligence (AI) companies, from this list we filtered the top AI companies in Asia. These companies, which were picked based on CB Insights datasets

Read MoreThai PM Launches Digital Wallet to Disburse US$14 Billion in Q4 Economic Stimulus

Prime Minister Srettha Thavisin has officially launched a new digital wallet scheme in Thailand aimed at benefiting approximately 50 million citizens to energise the country’s economy. Initial reports indicated that the launch would be in May. According to Thailand Business

Read MoreSingapore Pledges S$35 Million in Sustainable Finance Skills Development

The Monetary Authority of Singapore (MAS), in collaboration with the Institute of Banking and Finance (IBF) and Workforce Singapore (WSG), has launched the Sustainable Finance Jobs Transformation Map (JTM). This initiative outlines the necessary skills updates for the local financial

Read MoreFinancial Sector Dominates LinkedIn’s ‘Best Workplaces’ in Singapore

LinkedIn has released its Top Companies list for 2024, identifying the 15 best workplaces for career growth in Singapore. Financial institutions dominate this year’s rankings, emphasizing the sector’s focus on employee experience and adaptability in integrating artificial intelligence. The analysis,

Read MoreiCapital Marketplace Debuts in Singapore and Hong Kong

iCapital, a global fintech firm, has introduced its iCapital Marketplace in Hong Kong and Singapore. This platform is designed to streamline access to a diverse range of alternative investments for wealth managers and advisors. By utilising the company’s proprietary technology,

Read MoreFintech Sees Growth Amidst Declining Declining Private Equity Activities in APAC

The Asia-Pacific (APAC) private equity (PE) market faced significant challenges in 2023 due to concerns about slowing economic growth, rising interest rates and ongoing geopolitical tensions, Bain & Company’s latest report, the Asia-Pacific Private Equity Report 2024, says. The report,

Read MoreCrypto.com Plans ‘Thoughtful’ Hiring After Laying off 20% of Workforce Last Year

Crypto.com’s CEO Kris Marszalek outlined the digital-asset exchange’s plans to expand its workforce, in a recent Bloomberg interview. This comes after a period of downsizing in early 2023, where the company cut 20% of its staff following a downturn in

Read More