Tag "financial inclusion"

India Turns 350,000 Postmen Into Bankers To Serve Customers In Remote Areas

Across the country, over 350,000 postmen are offering doorstep financial services to people in even the remotest parts of India. They are equipped with a mobile phone and a hand-held biometric scanner to perform tasks of bankers including opening savings

Read MoreWhat Have We Learned from Sandboxes and Innovation Offices?

If properly regulated, technology-enabled financial services such as mobile payments, peer-to-peer (P2P) lending, alternative credit scoring, and new forms of savings and insurance, can accelerate the rise in financial inclusion for the 1.7 billion people worldwide who do not have

Read MorePLDT’s Voyager Seals US$40M Investment from IFC

Voyager Innovations, the fintech arm of the Philippines’ top digital telecommunications firm PLDT Inc, has sealed a US$40 million investment from International Finance Corp (IFC), and IFC Emerging Asia Fund with both acquiring a minority stake in the company. Voyager

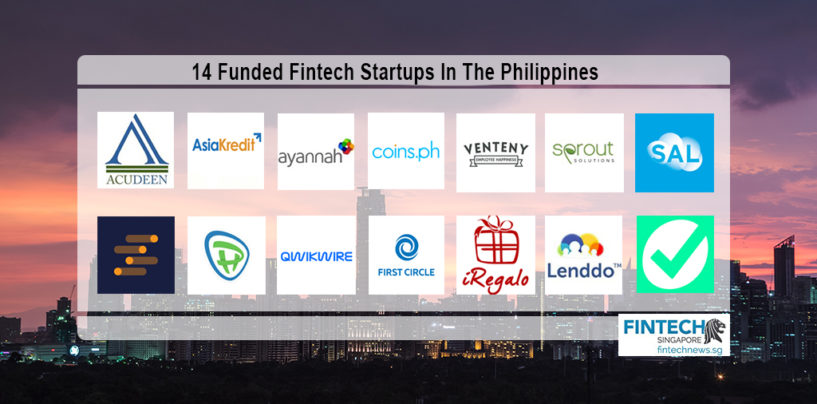

Read MoreTop 14 Funded Fintech Startups In The Philippines

Fintech startups have been popping up in the Philippines these past few years and many of them have attracted angel investors, venture capital firms, including people in the private debt space, seeing potential in their platforms meant to boost financial

Read MoreFintech for Financial Inclusion in Vietnam

Fintech companies, which leverage technology and digital platforms to provide financial services at lower cost and wider, better access, have a key role to play in Vietnam where only 59% of the population have a formal bank account. A paper

Read MoreWorld Bank Global Findex : Indonesia Leads in Financial Inclusion Progress

The latest Global Financial Inclusion Index (“Findex”) database released today by the World Bank finds that Indonesia’s financial inclusion has made the most progress, across East Asia and the Pacific, in bringing its citizens into the formal financial system in

Read MoreHow Real-Time Payments Can Support Financial Inclusion

In developing countries, digital banking platforms and real-time payments have been driving financial inclusion, providing the underbanked and financially excluded with affordable and convenient financial services, according to a new report by Vocalink, a Mastercard payments company. The report, titled

Read MoreTop 100 Financial Inclusion Companies According to IFC

Through innovative business models, products and use of cutting-edge technologies such as artificial intelligence (AI), Big Data, digital identity and the Internet-of-Things (IoT), fintech companies are making significant progress in promoting financial inclusion, according to a new report co-authored by

Read MoreGrab Drives Fintech Ambitions with Grab Financial

Following Grab’s previous announcement on GrabPay and acquisition of Kudo, Anthony Tan, Co Founder and Group CEO announced the company’s ambitions to further strengthen their play in the fintech ecosystem through Grab Financial during his keynote at Money 20/20. Grab Financial will encompass

Read MoreNew Peer-To-Peer Lending Players In Vietnam

A new company called Lendbiz was recently set up in Hanoi. The company offers a peer-to-peer lending platform targeted at small and medium-sized enterprises (SMEs) in Vietnam. Lendbiz joins other peer-to-peer lending platforms in Vietnam such as Timma, Vaymuon and

Read More