Fintech Money Transfer Startups Eye Vietnamese Remittance Market

by Fintech News Singapore December 16, 2015Vietnam currently stands as one of the top ten remittance recipient countries in the world. In 2014, more than US$12 billion have been remitted to the country, making it the 9th largest remittance recipient, according to a World Bank report.

In Ho Chi Minh City (HCM) alone, one of the country’s leading destinations for remittances, it was estimated that more than US$3.7 billion have been injected by the end of October 2015, a year-to-year increase of 13%.

Inward Remittances to Vietnam are expected to hit all-time high.

By the end of the year, the State Bank of Vietnam’s HCM City branch, expects to see inbound remittances hit 5.5 billion USD, up 500 million USD against 2014.

Remittance currently accounts for 6.4% of Vietnam’s GDP and that amount isn’t expected to decrease any time soon considering that the overseas Vietnamese community is growing rapidly year after year.

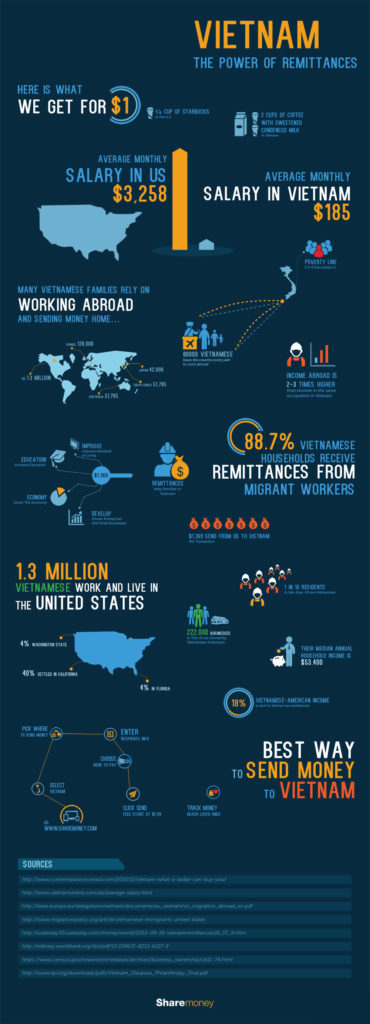

Sharemoney, a global online money transferring services that operates in Vietnam and other countries, estimates that 80,000 Vietnamese people leave the country each year to work abroad where they would typically earn two or three times more in income than in their native country. In Vietnam, the average monthly salary is about US$185 and one in five people live below the poverty line.

Hence, 88.7% of Vietnamese households receive substantial support from their relatives, Sharemoney found in recent researches.

According to Ismail Ahmed, CEO and founder of WorldRemit, “remittances help Vietnamese all over the world connect with their friends and family abroad.”

WorldRemit, a London-based money transfer service, has recently expanded to Vietnam, targeting the four million Vietnamese natives living and working abroad, the company announced last month.

Backed by early investors in Facebook, Spotify and Dropbox, WorldRemit provides users with an online service that allows them to send money abroad from a smartphone, tablet or computer.

Depending on how the money is being received, funds can arrive instantly (the case for cash pick-up, bank deposit to partner banks, or mobile money) or can take up seven days in the case of home delivery.

With the surge of financial technologies, it has become increasingly cheaper and faster to send money across the globe to loved ones. With their innovative business models, fintech startups will arguably help fuel financial inclusion particularly through mobile money accounts, according to the World Bank.

“Universal access to financial services is within reach – thanks to new technologies,” predicted Jim Yong Kim, World Bank Group President, back in 2013.

“As early as 2020, such instruments as e-money accounts, along with debit cards and low-cost regular bank accounts, can significantly increase financial access for those who are now excluded.”

Alongside WorldRemit, another online remittance service is Xoom, a startup that was acquired earlier this year by PayPal. Similarly to WorldRemit, Xoom recently launched operations in Vietnam, announcing in May 2015 a partnership with Sacombank, one of the largest banks in the country.

Through the partnership, Vietnamese immigrants living in the US can easily send money to their friends and family using their smartphones. During banking hours in Vietnam, customers can receive their funds at a Sacombank location instantly and don’t need to have a Sacombank account. In addition, door-to-door delivery is available to most cities and provinces, and takes a maximum of two days to arrive for provincial areas.

While WorldRemit can charge up to 5% in fees, Xoom would charge a competitive 2-3% fee.

Others have chosen the more disruptive path of using the Bitcoin network as a money transfer rail. Cash2VN, a product of domestic bitcoin exchange Bitcoin Vietnam, launched in June 2015 with the promise of enabling cheap and nearly instant money transfers to Vietnam.

By leveraging the bitcoin blockchain, Cash2VN provides much faster and fully transparent money transfers while charging as little as US$2 per remittance.

Cover image credit: Ho Chi Minh City Hall, Wikipedia.