The Crypto Wild West: Scam Coins, ICOs And The Crypto Bubble

by Fintech News Singapore September 29, 2017Cryptocurrencies have surged in popularity as an increasing number of investors are turning to the new asset class, attracted by the high potential returns.

In particular, initial coin offerings (ICOs) have proven to be a successful method for blockchain and cryptocurrency startups to raise funding. At the same, they provide investors with access to highly liquid assets that could potentially double or triple in value in a very short amount of time.

An ICO is a fundraising method in which a startup raise capital by selling a percentage of its newly issued cryptocurrency or tokens in exchange for legal tender of other cryptocurrencies (usually bitcoin or ether). These tokens are later listed on cryptocurrency exchanges and available for trading.

The price of bitcoin has surged in value since its introduction in 2009, rising from just a few cents a coin to nearly US$4,000 today. This year alone, bitcoin rose more than 306%.

Bitcoin’s surge in value has led the digital currency to make headlines and attract more and more people who are looking to make a quick buck.

But it has also attracted scam artists who have come up with creative ways to steal people’s bitcoins or lure them into fraudulent schemes by promising extravagant returns.

These scammers are now surfing on the ICO craze, elaborating schemes that are literally too good to be true.

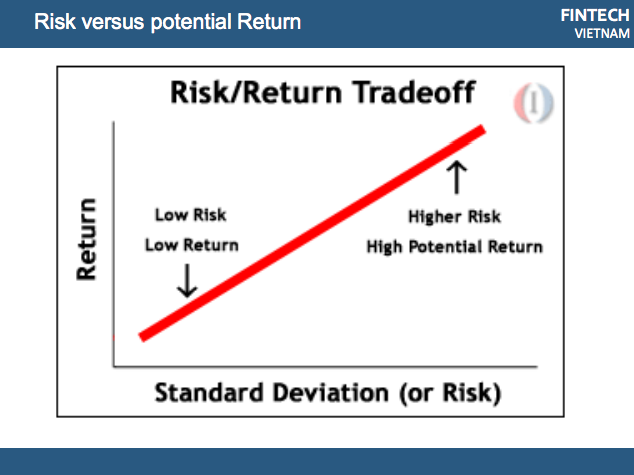

There are several golden rules when it comes to investing. First, it is crucial to keep in mind the risk/return tradeoff.

The risk/return tradeoff is the principle that potential return rises with an increase in risk. Low levels of uncertainty or risk are associated with low potential return, whereas high levels of risk are associated with high potential returns.

There is always a risk/return tradeoff in investing, and in the case of ICOs and cryptocurrencies in general, the high potential returns also means very high levels of risk.

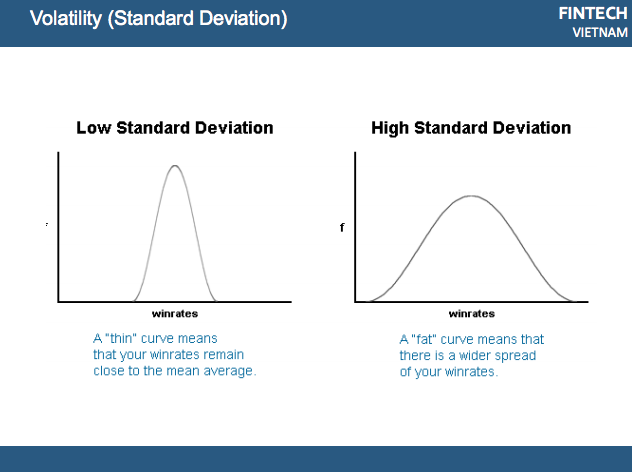

The volatility of an asset gives you a good indicator on the risks related to investing in this particular asset.

Standard derivation is a statistical term that measures the amount of dispersion around an average. Standard derivation is also a measure of volatility.

The larger the dispersion is, the higher the standard deviation.

Chartists typically use the standard deviation to measure expected risk and determine the significance of certain price movements.

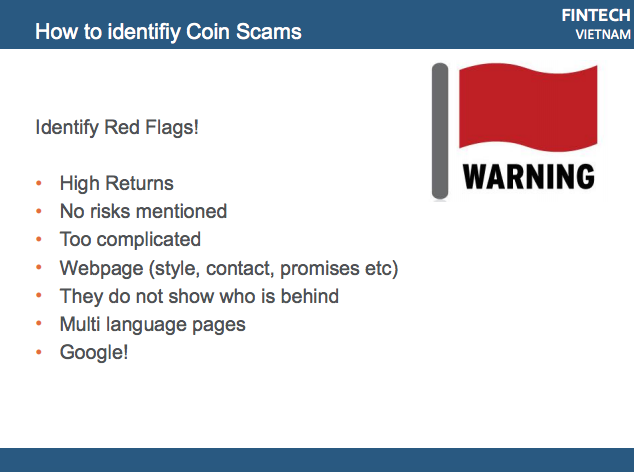

A scam becomes successful when people are overly greedy, choose to ignore obvious red flags, and when there is a knowledge gap.

But what is a ponzi scheme anyway?

Before putting your money anywhere, it is crucial to have knowledge and expertise. If you do not understand the technology, the business model, the market, etc.: do not invest in it!

Also, you need to look for the red flags. These include the promise of unrealistic returns, no mention of the risks affiliated with investing in a particular project, the model is too complicated, and the lack of transparency when it comes to key information such as the people leading the project.

ICOs, which have raised nearly US$2 billion in 2017, are now attracting the interest of celebrities such as Jamie Foxx, Boxer Floyd Mayweather, rapper The Game, and Paris Hilton, who have all recently promoted ICOs on social media.

Many experts and industry observers are worried about the growing celebrity endorsements, believing that it might be sign of a bubble.

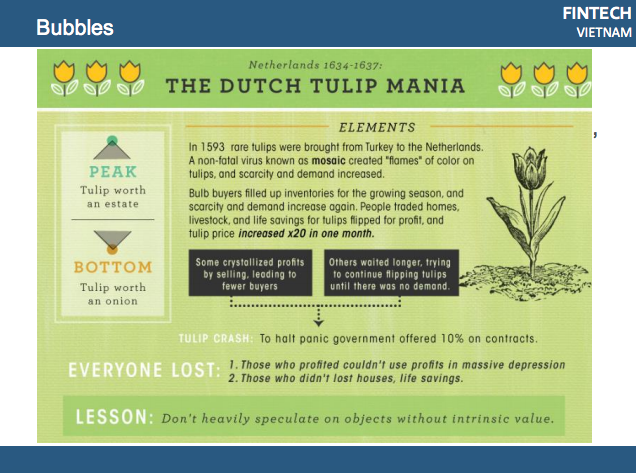

For several financial analysts, the cryptocurrency craze is very similar to the Tulip mania of nearly 400 years ago.

The Tulip mania was a period in the Dutch Golden Age during which contract prices for bulbs of the recently introduced tulip reached extraordinary high levels and then dramatically collapsed in early 1637.

The Tulip mania is generally considered the first recorded speculative bubble.

And it most certainly wasn’t the last…

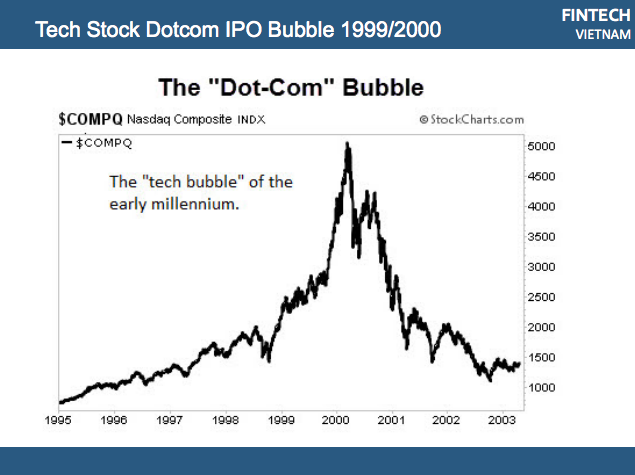

One bubble that’s not far behind us is the the dot-com bubble, also known as the Internet bubble, a period of excessive speculation that occurred roughly from 1997 to 2001.

In three years, the NASDAQ Composite index had reached its peak, rising over 233% during that short period of time. It then took another three years for it to fall back to where it started.

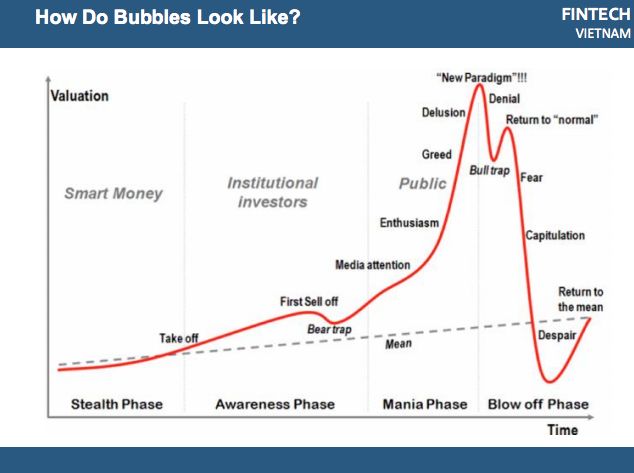

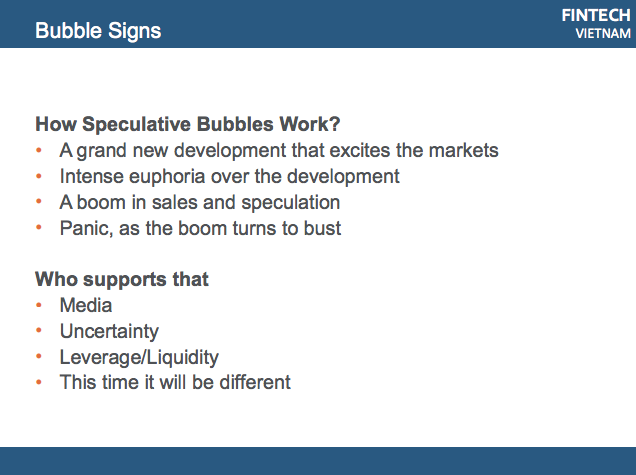

One of the major problems with bubbles is that they are often conclusively identified only in retrospect, once a sudden drop in prices has occurred.

However, there are several signs you can look for if you suspect there might be a bubble that’s being formed in a particular market.

So are we in a cryptocurrency bubble? A lot of experts and industry participants believe so.

After all, the cryptocurrency market had a capitalization of JUST US$7 billion in early 2016. Today, it is worth more than US$135 billion – that’s a 1,828% increase in less than two years.