Cambodia Fintech Startup Report, Fintech Startup Map and Infographic

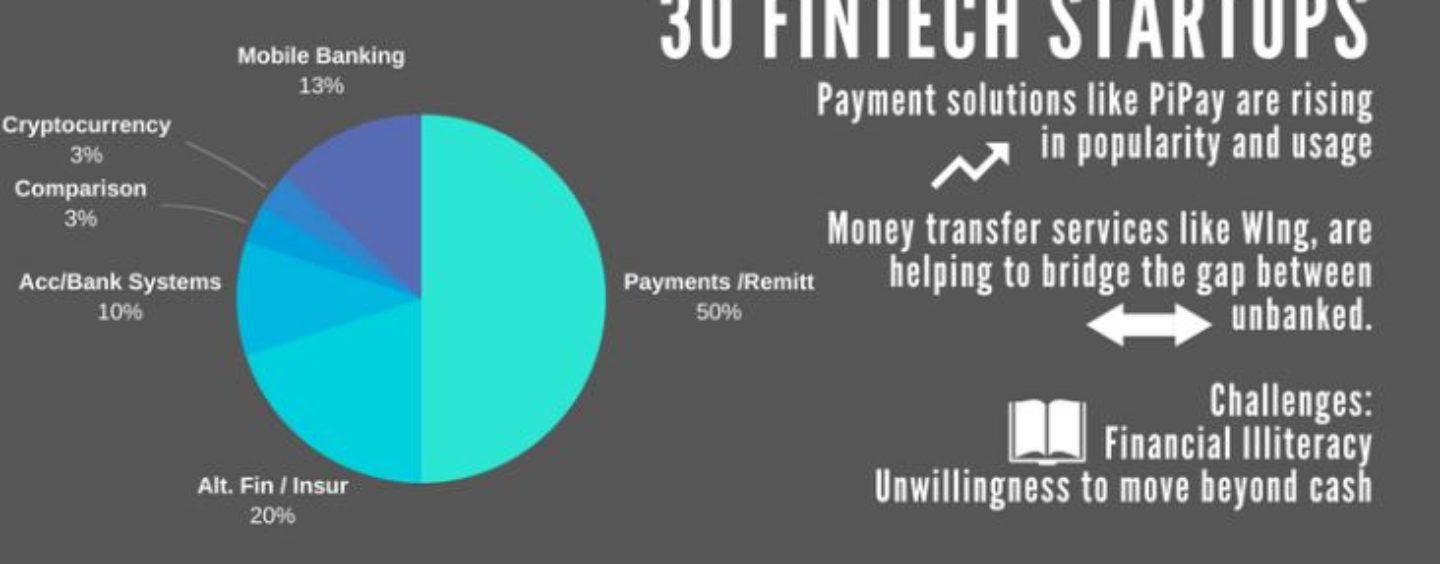

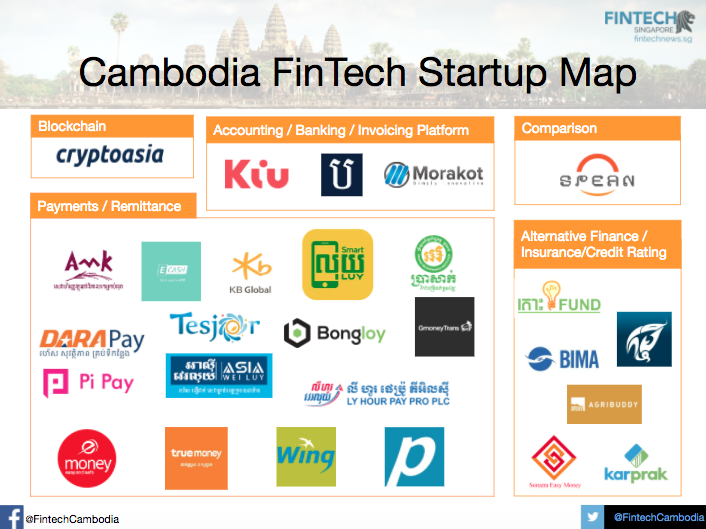

by Fintech News Singapore October 13, 2017With some 25+ startups, Cambodia’s fintech startup landscape remains modest but is nevertheless growing steadily, according to a new report.

Unsurprisingly, payment and remittance is the most crowded space with 16 startups. These include Wing, a mobile banking services provider targeted at the unbanked, PayGo, a digital wallet, TrueMoney, mobile payment provider, and Prasac, one of the largest microfinance institutions (MFIs) in Cambodia.

Cambodia also has startups tackling other spaces including alternative finance such as TosFUND, a non-profit crowdfunding, and Karprak.com, an online peer-to-peer lending platform; insurtech like Bima; credit rating like Agribuddy; accounting services such as Banhji, and blockchain technology such as CryptoAsia.

Download the Report here

During the Inspire ASEAN event, which occurred a few weeks ago in Phnom Penh, fintech experts shed light on how the industry is rising.

At the event, Vincent Ling, deputy general manager at UnionPay International Southeast Asia, said that despite fintech is still a relatively new in Cambodia, the concept is growing rapidly in popularity.

“As fintech gains more traction and attention, financial institutions are looking closer at the opportunities and trends within the sector,” said Ling. “The regulators are also trying to understand more about the new players disrupting the market and shifting paradigms.”

Thomas Pokorny, CEO of PiPay, a fintech startup providing a payment and lifestyle application solutions, said that in spite of the industry’s tremendous growth potential, educating people about these new technologies remains a challenge.

“The fintech sector is ready, but one of the biggest challenges remains educating people to encourage them to transition from cash payments to cashless wallets,” said Pokorny. “It will take a few months, or perhaps years. Step by step, people will adopt the new technologies.”

Echoing Pokorny’s statements, Sim Chankiriroth, CEO of Banhji, said that the relatively small size of the market was the biggest obstacle for prospective investors.

“The market is still small and the fintech sector in the country is not strong when it comes to innovation. The key lies in replicating models that have proved successful in other countries,” he said. “If done the right way, Cambodia still has an opportunity to become competitive within the region.”

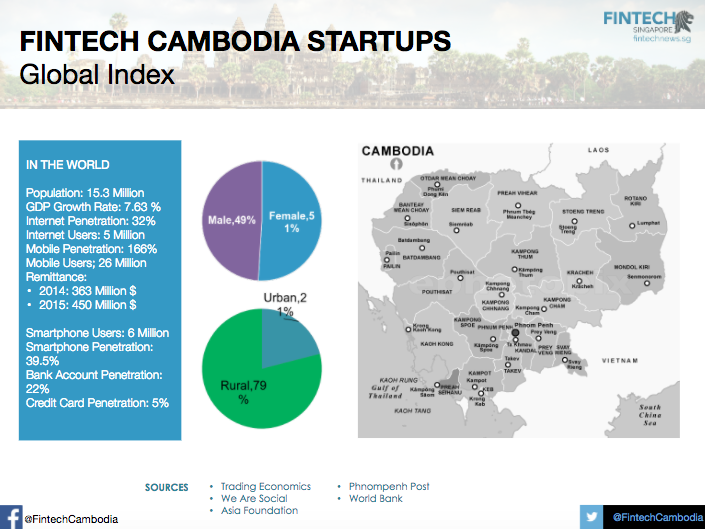

Cambodia has a population of 15.3 million people with some 5 million Internet users. Most importantly, Cambodia has a mobile phone penetration rate of 166%, and a smartphone penetration rate of 39.5%.

With almost 80% of the population not having a formal bank account, and a credit card penetration rate of 5%, experts and industry participants have praised the potential of fintech to improve financial inclusion.

Download the Report here

According to Chea Serey, director general of National Bank of Cambodia (NBC), fintech and digital finance could be a “game changer” for Cambodia as it enables financial service providers such as MFIs “to reach more remote areas at a lower cost in a safer way and at a larger scale.”

She said the central bank was looking to support MFIs and digital finance, which together were increasing financial inclusion and lowering poverty rates.

Pen Chanda, chairman and CEO of Bongloy, a Cambodian online payment gateway, said he was optimistic about the future of fintech in Cambodia, notably for its potential to improve financial inclusion.

“With a high mobile adoption rate and strong internet coverage, technology will play a key role in building financial inclusion in Cambodia,” said Chanda. “Digital can reduce the costs needed to serve customers in provincial areas where there are high operational efficiencies, and hopefully translate into lower interest rates.”

“Going forward, we will see more financial institutions embracing the solutions provided by fintech companies to develop new products and provide a better experience for their customers.”

Download the full Fintech Cambodia Startup Report HERE

Fintech Cambodia Infographic

Other resources you might be interested in

Curious about other Asian Fintech Startup Maps and Report? Here’s a handy guide looking at the fintech startup maps in Asia by country.

and the fintech startups report in Asia by country.