Drastic Shifts in Behavior is Boosting Mobile Banking in Southeast Asia

by Fintech News Singapore February 17, 2016Digital banking has become a serious business trend as Asian consumers are becoming more and more comfortable with using mobile and Internet channels for banking services.

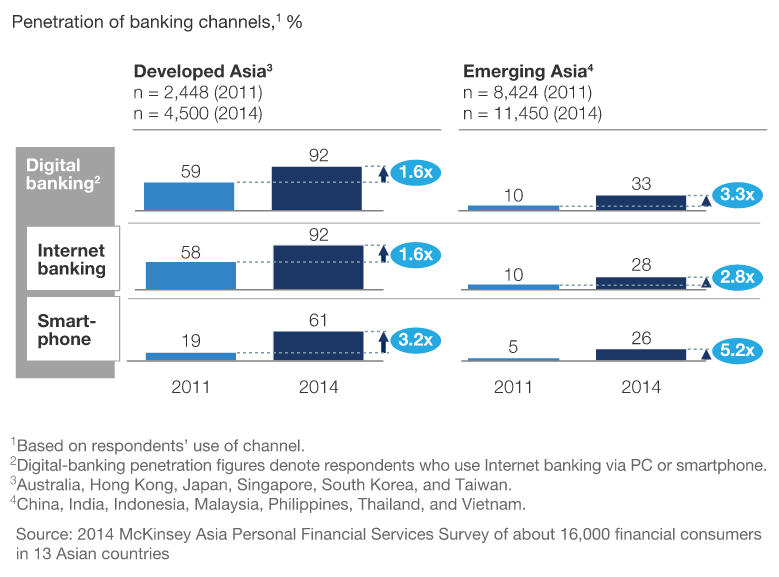

According to a report from McKinsey, the use of mobile and Internet channels for banking has increased on average more than 35 % between 2011 and 2014. Correspondingly, the firm noted a drop in branch usage of 27% across Asia. At a few leading banks, nearly 20% of key product purchases are now completed online.

In 2014, McKinsey surveyed some 16,000 financial consumers in 13 Asian markets and found “drastic” shifts in behavior, highlighting a serious trend: “Asian financial-services consumers are going digital, and fast.”

Mobile banking: what for?

Several factors have contributed to the rapid rise of digital banking, including the rapid increase in Internet and smartphone adoption, and the growth in e-commerce.

In Asia, mobile commerce (m-commerce) is booming. In a report released in October last year, Forrester estimates that the base of smartphones – the first and only way for many people to access the Internet – will grow to 230 million by 2017.

The growth of m-commerce will ultimately support growth of online payments over time, and already, cross-border m-commerce accounts for a chunk of mobile payments in Southeast Asia.

In Singapore, 55% of online consumers shop on their mobile phones, with a significant share of sales coming from cross-border orders. In Malaysia as well, similar trends have been recorded, according to Forrester.

In Thailand, telcos such as True offer virtual cards. In Indonesia, fintech startups like Codapay allow users to buy digital content via phone credit.

Ultimately, the growth of digital banking has led to a rise in investments in online and mobile marketplaces. These include Carousell in Singapore and Tarad in Thailand. On Tarad, specifically, 35% of purchases are made via mobile.

Alongside m-commerce, the mobile channel has been extensively explored for peer-to-peer payment with a focus on remittances for emerging markets.

In 2014, the Philippines saw inbound remittances reach US$28 billion. Filipino migrant workers across the globe are increasingly turning to telcos and fintech startups such as Xoom, Remitly, and MatchMove to send money home due to lower fees compared with traditional money transfer services such as Western Union.

Key to success for mobile banking

Asian governments have been fairly supportive, encouraging mobile payments and fintech development to increase competition, bring innovation into financial services and provide sources of funding for small and middle-sized businesses.

The Malaysian government has committed over US$240 million to the Domestic Investment Strategic Fund for the development of new financial products. The Monetary Authority of Singapore is allocating some US$160 million to grow the country’s fintech sector.

Accordingly, governmental support has led to the emergence of an increasing number of new entrants, and today, financial technology startups are coming up with cutting-edge tech, innovative business models, to serve end-consumers better and provide cheaper alternatives.

“Over the next five years, the banks that grow beyond their domestic markets to become strong pan-regional champions will be those that embrace technology innovation,” predicts EY.

In a report entitled “Banking in Asia-Pacific: Size matters and digital drives competition,” EY argues that new regulatory conditions, dynamic trading environments and changing customer preferences have started to shift business models across all banking segments.

To seize the opportunities in the Asia-Pacific region, EY suggests that banks need to:

Invest in digital channels to meet customer needs: “Banks must find the right balance between self-service and providing the ‘human touch to sell higher value products and services.”

Invest in technology-driven models to reduce costs and drive efficiencies but also to respond to new entrants from the fintech sector using technology to provide faster and cheaper solutions for customers.

Focus on areas of strength and specialist areas of expertise: Banks should withdraw from business lines and markets where scale or competitive advantage is lacking. International banks, in particular, need to “re-assess what is core versus non-core for their business in the region.”

Innovate the customer experience in retail banking by using data analytics to provide personalized, proactive services.

Innovate with direct models such as online-only banks.

Simplify and standardize operating models to transform cost structures and equip banks with a single customer view and detailed profile of accounts and interactions that are vital to delivering an engaging customer experience.

Use mobile to enable financial inclusion. Mobile solutions offer the potential to reduce the cost of obtaining banking services in emerging markets and increase penetration rates.

“Banks have the opportunity to partner with these players and, in so doing, gain access to more sophisticated and detailed customer data,” EY writes.

“Already, some banks are moving in this direction, either partnering directly with new entrants or establishing fintech hubs and accelerator programs that incorporate collaboration with startups.”

Trust and Collaboration

An important point about mobile and online banking is trust. Many people in upcoming emerging markets such as Vietnam or Cambodia do not trust the banking online system. This is a big challenge for banks and gives room for players such as Samsung, Apple, Facebook or other fintech companies. Also some new mobile-only concepts such as Timo in Vietnam, where you can open a bank account in a coffeshop, could help to build trust.

In an upcoming 2 days conference in Singapore, experts will discuss the Future of Digital Banking in Asia. Get more information here

While collaboration can be a challenge, the successful formation of partnerships between market participants in the mobile financial services industry is “a crucial aspect in the effective rollout of low-cost mobile financial services to increase access to finance in underserved markets,” according to the International Finance Corporation.

Image credit: M-Pesa transaction via http://afritorial.com/m-pesa/

A relevant example is M-Pesa, a mobile-based money transfer service that launched in Kenya in 2007 by Vodafone for Safaricom and Vodacom, the largest mobile network operators in Kenya and Tanzania.

The service, which allows users to deposit, withdraw, transfer money and pay for goods and services (Lipa na M-Pesa) easily with a mobile device, has spread quickly, becoming in 2010 the most successful mobile phone-based financial service in the developing world.

Featured image: Mobile phones by Rido, via Shutterstock.com.