Fintechnews.PH picks every Friday for you the top 5 Fintech Philippines News of the week:

Follow the Fintech Philippines Facebook or Twitter channel to stay updated.

Also, you can subscribe to our monthly Fintech PH Newsletter here.

Here we go:

SEC warns investing in unregistered cloud mining deals after P900m Bitcoin scam

The Securities and Exchange Commission (SEC) warned the public against investing in unregistered cloud mining deals, following the arrest of a couple involved in a P900 million Bitcoin investment scam.

Cloud mining uses remote data centers to perform the complex calculations needed to produce or “mine” cryptocurrencies such as bitcoin and Ethereum.

In its advisory last April 10, SEC noted that numerous local and foreign companies were enticing people to take part in this investment scheme with promises of daily or weekly returns in mining proceeds as well as commissions for new recruits.

The Philippine National Police (PNP) has arrested Arnel and Leonady Ordonio promising easy wealth through Bitcoin and allegedly scammed more than 50 unknowing investors, amassing wealth worth P900 million in “raw capital”.

The central bank or Banko Sentral ng Piipinas (BSP) has already allowed the use of cryptocurrencies, but only for use in remittance activities. At present, only Coins.ph and Rebit.ph have local licenses for virtual currency but only in terms of remittance and not trading.

BSP processing 29 crypto exchange applicants

The central bank is evaluating 29 pending applications from virtual currency (VC) exchange firms even as it tightens its licensing for electronic money issuers (EMI).

EMI applicants are required to have a capital of about P100 million. There are currently two virtual currency exchanges registered with the BSP: Rebittance Inc and Betur Inc also known as Coins.ph, but only in terms of remittance and not crypto exchange trading.

Fintech transactions in PH to hit $11-M in 2021

Fintech transactions in the Philippine market is seen to double to $11 million in 2021 from last year’s $5.5 million, a report said.

According to the Banko Sentral ng Pilipinas (BSP), the value of local fintech transactions is expected to grow annually at a rate of 19 per cent over a four-year period.

There are currently 60 fintech startups in the Philippines comprised mainly of mobile payments and alternative finance, with 26 and 17 players, respectively, based on the central bank’s annual report.

AUB mulls own QR-based mobile payment system

Philippine-listed universal bank Asia United Bank (AUB) plans to launch within the year its own digital wallet to take advantage of its customer base.

Dubbed as “AUB Pay”, it will serve as AUB’s QR code-based payment system that can be used in the same merchants it partnered with China’s Tencent Holdings Ltd for WeChat Pay, according to Business World.

AUB vice-president and credit cards business head Maria Magdalena V. Surtida, said having their own digital wallet will be advantageous for its customer base, since they do not need to transfer their funds to the already established local digital wallets such as GCash and PayMaya.

Surtida added AUB’s partner merchants can accept payments from AUB Pay using the same platform for WeChat Pay.

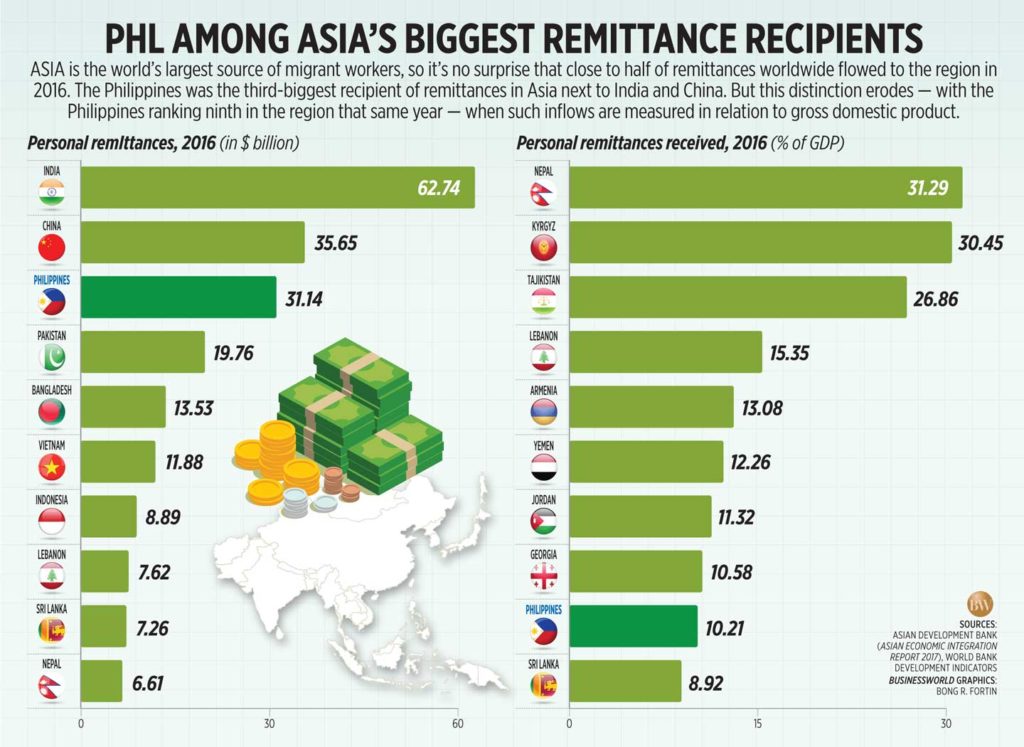

PH ranks 3rd biggest remittance recipient in Asia

The Philippines landed on third spot of Asia’s biggest remittance recipients based on its $31.14 billion personal remittances record in 2016, next to billion-populated nations India ($62.74 billion) and China ($35.65 billion).