Fintech Report 2016: Asia Fintech Funding Hits new High of US$2.6b in First Quarter 2016

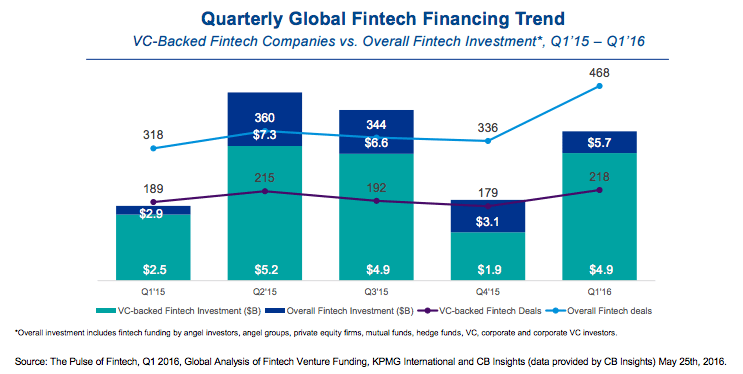

by Fintech News Singapore May 26, 2016After a significant pullback in funding in Q4’15, mega-rounds lifted quarterly investment into VC-backed FinTech companies by over 150 percent, according to the Pulse of FinTech, the quarterly global report on FinTech VC trends published jointly by KPMG International and CB Insights.

According to the new report, global investment in private FinTech companies totalled US$5.7 billion in Q1’16, with US$4.9 billion specifically invested in VC-backed FinTech companies across 218 deals, a 96 percent jump compared to the same quarter last year. The rise in funding was tempered by the fact that three mega-rounds accounted for 54 percent of VC FinTech investment in Q1’16. On a quarter-over-quarter basis, VC-backed FinTech deal activity rose 22 percent in Q1’16.

“Global VC investment into the technology sector may be experiencing a bit of a pause, however FinTech, propelled by some very large mega-rounds, has proven to be an exception to the rule,” said Warren Mead, Global Co-Leader of FinTech, KPMG International. “Investors are putting money into FinTech companies all over the world – from the traditional strongholds of China, the US and the UK – to up and coming FinTech hubs like Singapore, Australia and Ireland.”

Anand Sanwal, CEO at CB Insights, added: “While FinTech startups continue to attract large investment both in the US and abroad, and investors gravitate to areas yet untouched by much tech innovation including insurance, recent events and public market performance suggest that growth-stage FinTech fundraising will be harder to come by moving forward in 2016.”

Lyon Poh, Head of Digital + Innovation, KPMG in Singapore, noted: “In Singapore, we have seen a flurry of activities in line with the government’s push for financial institutions to adopt innovative technology. For example, many insurers are building innovation centres and programmes to rapidly identify and adopt FinTech solutions to bring innovation back into their core businesses. This has in turn encouraged more FinTech startups to come to Singapore and use it as a base for developing their propositions, and for fund raising.”

Key highlights from the Pulse of FinTech:

- Q1’16 saw a big rebound in funding to the FinTech sector, with total investment in FinTech companies hitting US$5.7B. Globally, VC-backed FinTech companies drew US$4.9B in funding, rising from just US$1.9B in Q4’15.

- VC-backed deal activity rose dramatically quarter over quarter. Q4’15 saw FinTech deal activity fall to the lowest point since Q2’14. This drop reversed course in a big way in Q1’16 as VC-backed FinTech deals rose to a new quarterly high of 218 globally.

- Larger deals spurred FinTech funding growth in Q1’16. Q1’16 saw 13 US$50M+ rounds to VC-backed FinTech companies, a slight rise from the 10 US$50M+ rounds in Q4’15, but a drop from the 18 mega-rounds in Q1’15.

- Asia saw funding to VC-backed FinTech companies jump to US$2.6B in Q1’16 from just US$0.5B in Q4’15. This dramatic rise came on the back of the US$1B+ mega-rounds to JD Finance and Lu.Com.

- Corporate participation in Asian VC-backed fintech deals fell to 31% in Q1’16, a 5 quarter low.

Chinese mega-rounds propel Asia FinTech funding

Following a drop off in Q4’15, FinTech investment in Asia reversed course in Q1’16 to hit a new high of US$2.6B.

China accounted for US$2.4B of Asia FinTech funding and 49 percent of FinTech funding across all geographies, primarily as a result of US$1B+ funding rounds to JD Finance and Lu.com.

Source: The Pulse of Fintech, Q1 2016, Global Analysis of Fintech Venture Funding, KPMG International and CB Insights on May 25th, 2016.

North America sees funding bounce back

North America saw both FinTech funding and deals rebound following a major drop in Q4’15, as VC-backed FinTech companies raised US$1.8B across 128 deals, an increase of 80 percent in funding quarter-over-quarter.

Deal activity to VC-backed FinTech companies in North America is on pace to reach a new high in 2016 at the current run rate, as the 128 FinTech deals registered over the three-month period was the largest quarterly total since Q2’15.

Europe FinTech deals rise; no spike in funding

Europe saw VC-backed FinTech deals reach a five-quarter high, rising from 37 in Q4’15 to 47 in Q1’16. Europe FinTech funding remained almost level with Q4’15’s total at US$0.3B. UK funding rounds to WorldRemit and LendInvest pushed UK funding to account for over half of Europe’s FinTech funding total.

CB Insights’ Sanwal commented: “FinTech investment in Europe has certainly been less overheated than in other markets, which has resulted in an increasing appetite for FinTech investments in the region by cross-border investors both from the US and Asia.”

Corporates participate in over 20 percent of deals for fifth straight quarter

Corporate investors continue to play a large role in the FinTech ecosystem, with global deals to VC-backed FinTech companies standing at 24 percent+ in three of the past five quarters. Of note, Europe saw an upswing in corporate FinTech investment during Q1’16 as corporate participation in deals to VC-backed FinTech companies rose from 8 percent in Q4’15 to 21 percent in Q1’16.

Brian Hughes, Co-Leader, KPMG Enterprise Innovative Startups Network and Partner, KPMG in the US said: “Q1’16 was a strong quarter for venture capital investment in the FinTech sector, characterized by 13, US$50M plus rounds to VC-backed companies globally, including billion dollar rounds by Lu.com and JD Finance. However, recent challenges at several high profile, publicly-traded FinTech companies, may well dampen private investor enthusiasm moving into Q2.”

Get the full FinTech report 2016, published jointly by KPMG and CB Insight.