New Google, Temasek Report Explores Southeast Asia’s Massive E-Commerce Opportunity

by Fintech News Singapore June 1, 2016Southeast Asia (SEA) is the world’s fastest growing Internet region and is expected to grow to more than US$200 billion by 2025, a trend mostly driven by the growth of first-hand e-commerce market, online media and online travel, according to a new research report by Temasek and Google.

The report, entitled ‘E-Conomy SEA: Unlocking the $200 billion digital opportunity in Southeast Asia,’ suggests that the total first-hand e-commerce market in SEA is expected to reach ~US$88 billion by 2025, significantly outpacing the growth of offline retail.

The report, entitled ‘E-Conomy SEA: Unlocking the $200 billion digital opportunity in Southeast Asia,’ suggests that the total first-hand e-commerce market in SEA is expected to reach ~US$88 billion by 2025, significantly outpacing the growth of offline retail.

The number of transactions should be the biggest growth driver as more people will gain access to the Internet and as the availability of products online increases.

Online travel, including hotels, airlines and rides booking, is expected to reach ~US$90 billion by 2025. Hotels and airlines will compose 85% of total online travel market and low cost carriers will drive the majority of growth due to their prominence in SEA. Online rides on the other hand (Uber, Grab, etc.) are expected to reach ~US$13 billion driven by the growing number of riders.

As of online media, the market should contribute ~US$20 million by 2025 with ads and gaming becoming highly profitable sectors.

The two companies name three key factors that will be driving SEA’s Internet economy: the region’s burgeoning young population with ~70% under the age of 40, the lack of large retail establishments, and the rapidly growing middle-class.

“This is an important demographic as they spend a lot of their time on online and do much more with the Internet,” Rajan Anandan, Vice President & Managing Director of Google, Southeast Asia & India, said.

“With 260 million users already, Southeast Asia’s countries (Philippines, Indonesia, Singapore, Thailand, Malaysia and Vietnam) are beginning to have a critical mass of Internet users. We’re seeing an additional 3.8 million new Internet users every month.

“By 2020, Southeast Asia will have 480 million Internet users, and that’s a very big number.”

Challenges to overcome

While the SEA Internet opportunity is huge, there will be a number of challenges that will need to be overcome, notably in terms of investments.

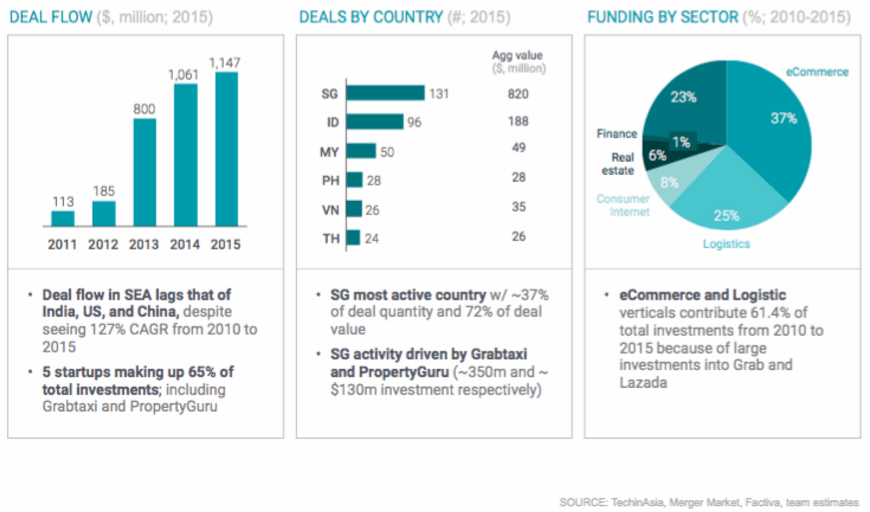

Although deal flow is growing, the activity is concentrated to Singapore and Indonesia with the majority of funding going to a few prominent startups.

The research report points out five key challenges which must be addressed through public and private-sector initiatives.

New tech-focused educational programs need to be instated as the lack of senior develop and CXO-level talent causes startups to rely on expat talent from China and US.

There is still no scalable e-payment alternative, hence the increase of ‘Cash on Delivery’ transactions which in turn increases risk and cost for merchants.

Internet infrastructure: Due to regulatory and geographical constraints, Internet speeds and penetration rate are low.

Logistics infrastructure: Road and rail networks need to be improved since they are critical to ensure a fast and efficient delivery system.

The lack of trust makes consumers wary of making transactions online due to security concerns such as fraud.

Get the full ‘E-Conomy SEA: Unlocking the $200 billion digital opportunity in Southeast Asia’ report: http://www.slideshare.net/economySEA/economy-sea-by-google-and-temasek

Featured image: Shopping cart icon on keyboard key by rvlsoft, via Shutterstock.com.