Accenture: Half of the Banks are Not Making Visible Progress in Digital Transformation

by Fintech News Singapore June 25, 2019The US$1 trillion that traditional retail and commercial banks have invested globally over the past three years to transform their IT operations has not yet delivered the anticipated revenue growth, according to a new report from Accenture.

The report analyzed more than 160 of the largest retail and commercial banks in 21 countries to assess their level of digital maturity and determine if digital leadership is driving superior financial performance, including market valuation, profitability, top-line revenue growth and efficiency.

Among the key findings: Half (50%) of banks are achieving higher profitability and returns on equity, driven by greater operating leverage, but they’re not achieving differential revenue growth — instead competing for high market share of revenue growth in a slow-growth revenue pool.

While digital maturity is associated with high market valuations and a better return on capital for these banks, only 12% appear to be fully committed to digital transformation and investing in a digital-first strategy; the other 38% are in the midst of transformation, but their digital strategies lack overall coherence.

The remaining half (50%) have not made much visible progress in digital transformation at all and investors are showing a lack of confidence in their future prospects.

Julian Skan

“Our research shows that digital leadership drives superior economic performance, and that the gap between ‘the best’ and ‘the rest’ is widening at a pace that should concern banks struggling with digital transformation and overall competitiveness.”

The research analyzed where banks are on the digital maturity scale by looking at several factors: public communication to the market about their digital journey through earnings call transcripts, news releases and stated investment budgets; recognition of digital leadership by third-party industry analysts and observers; and Accenture’s subjective analysis.

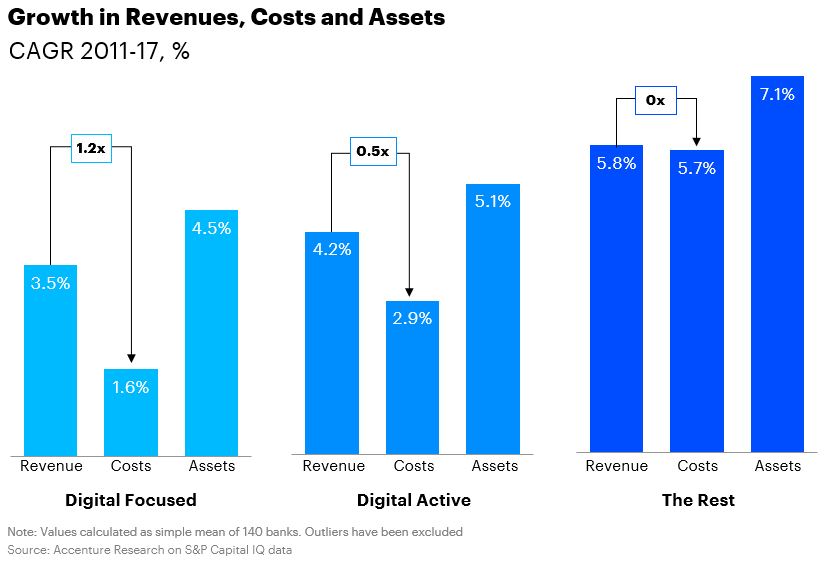

The report found that the real change being driven by digital investment is cost efficiency rather than revenue growth. While “Digital Focused” banks are the most profitable and highly valued, they are achieving higher profitability through better operating leverage — getting more out of every dollar of assets.

Positive operating leverage is strongly correlated with digital maturity for digital-focused banks. While these banks have the slowest revenue growth, they have constrained cost growth resulting in a gap of approximately 2 percentage points between revenue and cost growth every year over the last six years. The Digital Active group has also created a gap between revenue and cost growth, of 1.3 percentage points, while the banks in ‘the Rest’ segment created almost no operating leverage at all.

Alan McIntyre

“Digital-focused banks have taken the first step in building a future-ready bank, but they need to pivot their focus from efficiency and move to growth if they hope to close the valuation gap with fintech and big tech competitors encroaching on the banking business,”

said Alan McIntyre, a senior managing director at Accenture and head of its global Banking practice.

Image Credit: Pixabay