Australian Fintech Investment Sees a Staggering 252% Jump in 2019

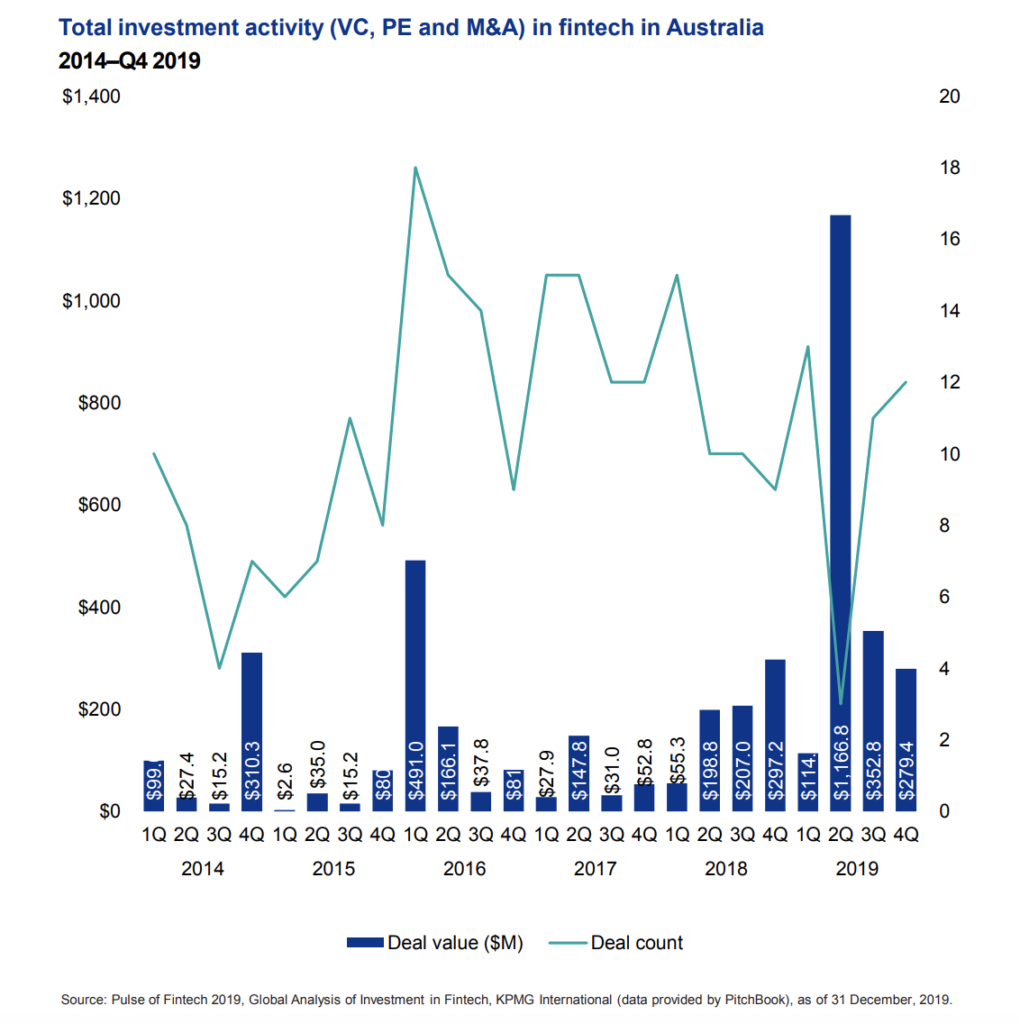

by Fintech News Singapore March 4, 2020Investment in Australia’s fintech sector smashed previous records in 2019, jumping to US$1.913bn spurred by the acquisition of Property Exchange (PEXA) and the US$280 investment in neobank Judo, according to the Pulse of Fintech H2’2019, a bi-annual report on global and regional fintech investment trends published by KPMG.

The report tracks venture capital, private equity and mergers & acquisitions across global fintech markets and shows that Australia bucked the global investment trend, which saw 2019 fall just shy of 2018’s record with US$135.7bn invested across 2,693 deals.

Notable venture capital deals in Australia included neobank Athena’s US$43.4 mil Series C round, Grow Super’s US$11.8 mil Series B funding round and Cover Genius’ US$10 mil Series C round.

Dan Teper

Dan Teper, KPMG Head of Fintech – Australia, commented:

“2019 was a break-out year for Australia’s fintech ecosystem, with large-scale M&A activity driving the result alongside significant VC investment in emerging players. There is a depth of innovation across multiple areas of fintechs, including banking and lending, proptech, insurtech and superannuation – and this is increasingly being recognised by investors and corporates.

“As we move forward, we would hope to building on the momentum of 2019, in particular as Australia further develops our digital banking regime and open banking regulations,”

he added.

Globally, many niche areas of fintech continued to grow and evolve throughout 2019; in particular, proptech investment grew from USUS$1.9bn in 2018 to a record US$2.6bn in 2019, while fintech-focused cybersecurity investment more than doubled from US$316.9 mil to US$646.2 mil.

Blockchain and cryptocurrency investment continued to fluctuate, falling from US$6.3bn to US$4.7bn year-over-year, although Facebook’s announcement of Libra and the People’s Bank of China’s announcement of accelerated research and experimentation on digital currency and electronic payments have helped breathe new life into the space.

Global fintech investment fell short of 2018’s record year, with US$137.5bn invested in 2019 compared to US$141bn in 2018.

Global fintech M&A rose from US$91bn in 2019 to a record-high of US$97.3bn in 2019, despite a strong drop in the number of M&A deals from 622 to 426.

In 2018, Asia saw a massive high of fintech investment, primarily due to the record-breaking US$14bn raise by Ant Financial. When compared to all years prior to 2018, fintech investment in Asia remained relatively steady in 2019 with US$12.9bn invested.

The largest deals in Asia during 2019 included the US$1.7bn Series G raised by India’s Paytm in H2’19. India saw a record-breaking US$3.8bn of fintech funding in 2019, driven by a record Q4’19 (US$2.3bn) which included Paytm’s US$1.7bn raise.