More Filipinos Turn to Digital Banking Amidst COVID-19 Lockdown

by Fintech News Philippines March 24, 2020Rizal Commercial Banking Corp. (RCBC) logged a 259% increase on new sign-ups on its online banking service in the first three days of the implementation of the enhanced community quarantine (ECQ).

Bank data show a daily average of 1,116 new enrollments from March 17 to March 19. This is more than double the average daily enrollment of 431 recorded in the same month before the enforcement of the ECQ.

The biggest number of new sign-ups at 1,155 was observed in March 17, the first day of the Luzon-wide quarantine.

Lito Villanueva

“The online and mobile banking facilities of RCBC are ready and viable alternative for clients to access the services of the company during this extraordinary time,”

said Lito Villanueva, RCBC’s executive vice-president and chief innovation and inclusion officer.

“Our customers can now bank from home using all our digital channels offering free fund transfers through InstaPay and PESONet including send cash function for their beneficiaries without bank accounts,”

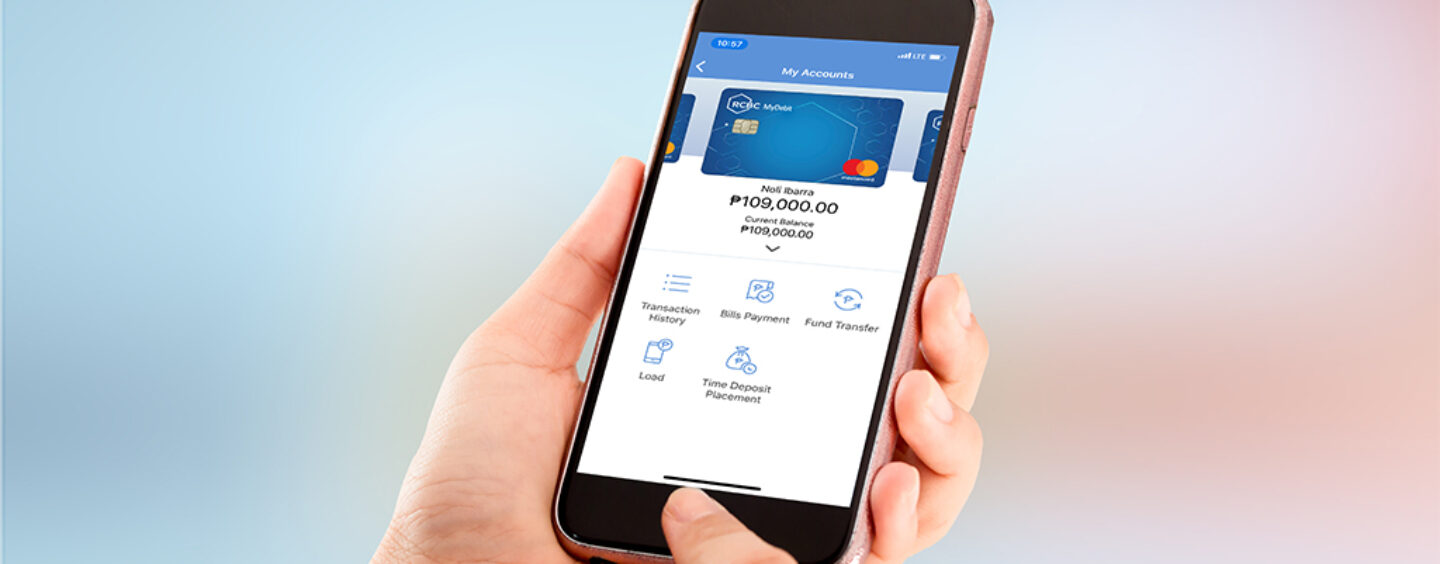

Villanueva added. A mobile application is also available for download for RCBC customers with smartphones and tablets.

Features available to online and mobile clients include balance inquiry, fund transfer, bills payment, remittance inquiry, send cash service, including card-less ATM withdrawal which are essential during the ECQ period.

The use of digital banking platforms is also in line with the appeal of Bangko Sentral ng Pilipinas Governor Benjaming Diokno to the public to keep from hoarding cash during the month-long lockdown to contain the COVID-19 pandemic.

RCBC was among the first banks to offer free electronic fund transfers through InstaPay and PESOnet.