Bring Colour Back to the South East Asian Payments Landscape

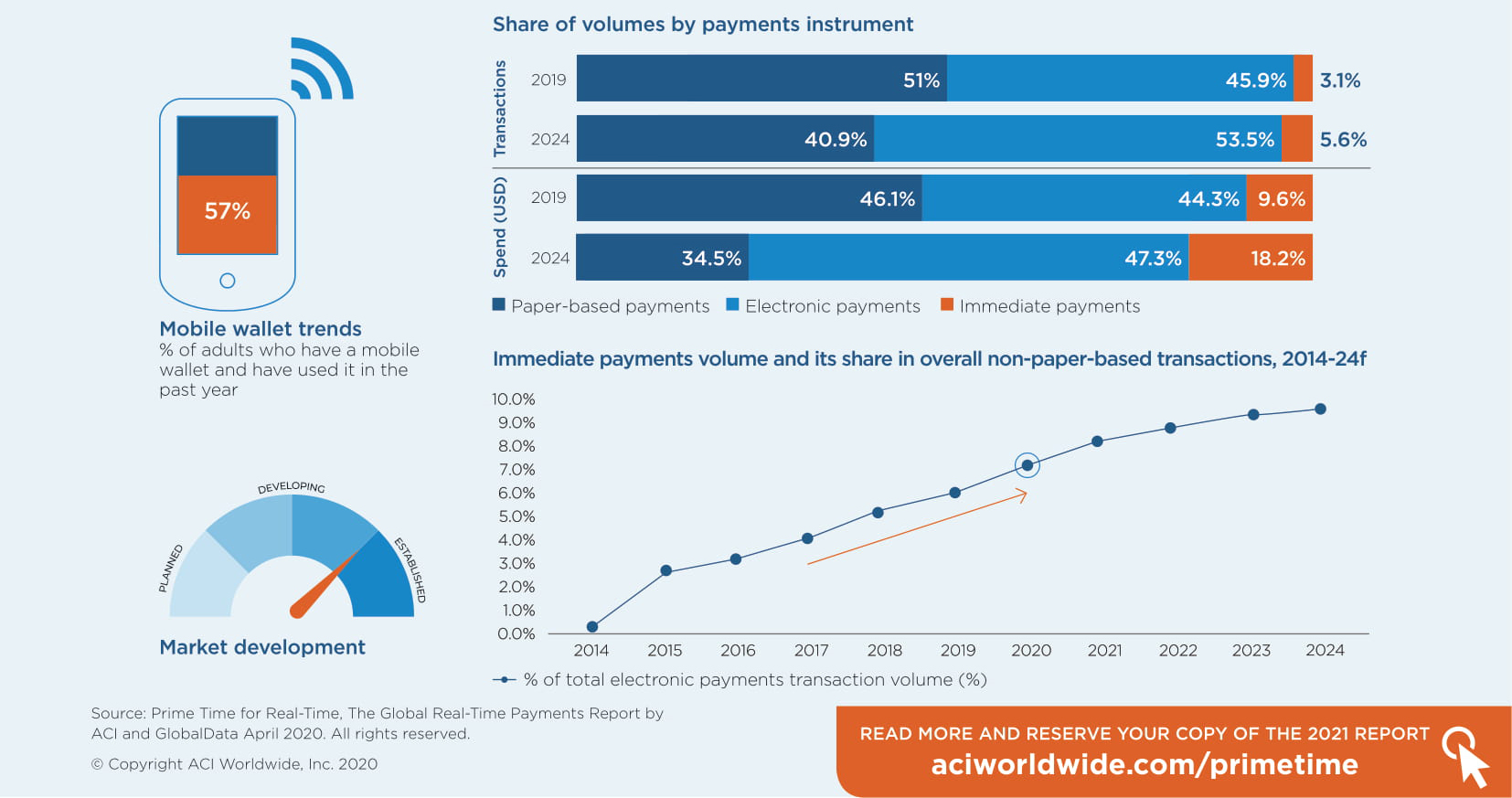

by Leslie Choo, Managing Director- Asia & Japan/Korea, ACI Worldwide August 24, 2020For the global banking and finance industry, Southeast Asia (SEA) has established itself as a key region in terms of innovation and growth opportunities in real-time payments. Underlying this is the fact that SEA’s internet economy is projected to triple in size by 2025 and reach US$300 billion, making it one of the fastest growing digital economies globally.

Taken as a single entity, SEA also represents one of the world’s five largest economies, but of course it doesn’t have the deep integration within the bloc that benefits larger economies, such as India or China. Neither does the SEA region benefit from a single currency, like the Eurozone, which also has overarching regulatory bodies.

Leslie Choo, Managing Director- Asia & Japan/Korea, ACI Worldwide

This has meant that deeper financial services integration, which is seen as an important catalyst for growth and trade within the region, tends to be driven by market forces.

A new paper from ACI Worldwide and market research and consulting firm Kapronasia, titled ‘Envisioning a pan-regional, real-time payments ecosystem in Southeast Asia’, shows that the foundations for an effective cross-border, real-time payments network have already been laid through individual countries’ pursuit of payments modernization and robust domestic real-time networks.

As Southeast Asia looks to bounce back from the aftershocks of the COVID-19 pandemic, the paper has identified real-time payments as a key enabler, with ISO 20022 and QR codes as critical components.

The Current State of Payments Regionally

Despite the lack of uniform regulations and disparate economic priorities across the region, it’s clear that the needs of businesses and consumers are propelling SEA towards the realization of a multi-country, real-time network.

Standardized, instant and seamless payments will help enable intra-regional economic activity at a lower cost – and encourage future growth. The COVID-19 pandemic puts this into even sharper focus; we’ve already seen some dramatic shifts in attitudes towards digital payments, especially growing enthusiasm for “touchless” payments that support social distancing measures.

The trend towards digital payments is also being amplified in the wake of social distancing and work-from-home requirements in place across the region. Real-time payments play an integral part within this growing digital finance ecosystem, especially as we see contactless technologies like QR codes being leveraged by real-time central infrastructures.

The simplicity and accessibility of QR-code payments is going to be critical for individuals and SMEs across SEA seeking economic viability, while QR codes will also provide an essential “on ramp” to drive usage and participation in real-time schemes.

There is also something to be learned from China, as its re-opening was heavily reliant on many of the digital finance products and services that can be “layered” over real-time payments rails, such as credit scoring, lending and wealth management.

Why Digital Overlay Services Are Making a Splash

We are seeing payment players paying increased attention to ancillary overlay services, which are added to mobile apps, web portals, social media and other channels to cater to keep pace with current customer demands and evolve with their changing needs.

The new services enable banks, intermediaries, and merchants to add a range of functionalities to support a high-volume, data-rich digital payments ecosystem.

A multitude of use cases can be addressed through the digital overlay services, including the delivery of a seamless end-to-end solution for contactless and secure QR code payments, extending to merchant-initiated payments using dynamic QR codes.

Flexible person-to-person payment services are also enabled, based on proxy/alias (i.e., phone number or email) for added security. One of the fastest-growing real-time digital overlay services globally is the Request to Pay function.

Taking Stock of Key Country Developments

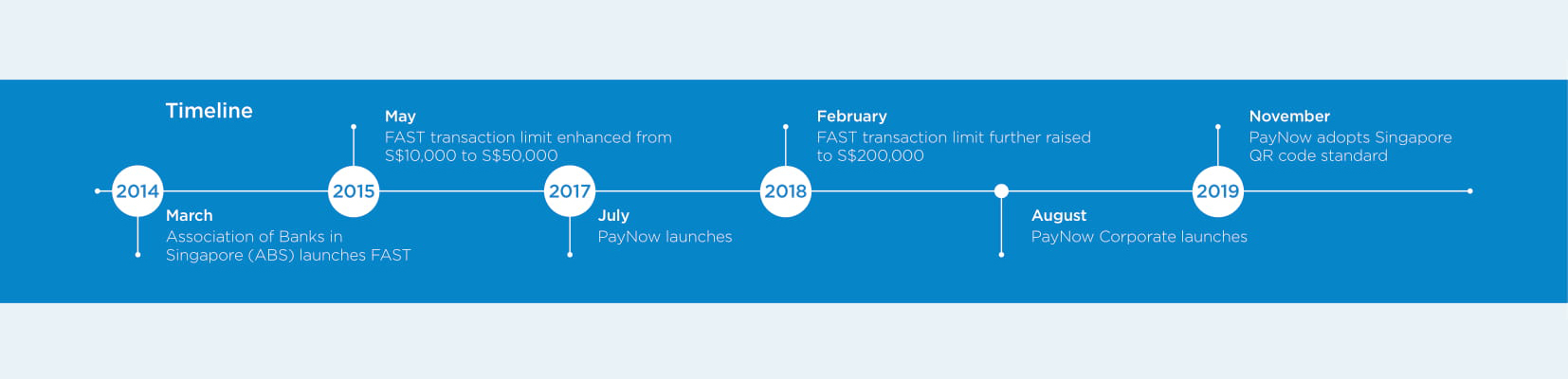

Southeast Asia is a hugely diverse region – culturally, economically, politically and linguistically – but despite these challenges, we’re seeing a few countries start to emerge as “frontrunners” in the use of digital overlay services. PayNow in Singapore, PromptPay in Thailand, and DuitNow in Malaysia.

These countries are all making significant strides in payments modernization. The increased adoption of the ISO 20022 standard across SEA will also help enable communication between these domestic networks, so this is going to be a key piece of the puzzle.

Malaysia’s Real-time Retail Payment Platform (RPP) is a multi-year effort to modernise the country’s payments infrastructure, creating an integrated ecosystem to drive digital adoption.

DuitNow, an instant credit transfer service allowing users to transfer funds based on the more easily remembered mobile number or national ID, was the first RPP payment services launched on the platform, in early 2019.

Adoption of ISO 20022 from the outset has been instrumental in driving innovation and transaction volumes on RPP, including Credit Transfer, DuitNow’s QR-code payments and a range of digital overlay services.

RPP, which is operated by PayNet, also benefits from standard connectivity between participants and the central hub, aiding seamless integration and onboarding as well as ongoing compliance.

According to another report from ACI Worldwide, Prime Time for Real Time, Thailand is also expected to see phenomenal growth in real-time payment transaction volumes, with projected growth from 2.6 billion in 2019 to 12.5 billion in 2024.

This has been heavily driven by the Bank of Thailand’s financial inclusion initiatives, with PromptPay launched in 2016 by the National ITMX as part of its National e-Payment initiative. The service can be used across a variety of channels including ATMs, bank counters, mobile banking, internet banking and other payment apps.

A number of bilateral MOUs (memoranda of understanding) have already been signed between domestic central infrastructures in SEA, part of the push for greater collaboration, and now we’re starting to see concrete steps towards interoperability.

Malaysia’s PayNet and Singapore’s NETS officially launched real-time, cross-border debit card payments in late 2019. Now, they are building on this with cross-border instant credit transfers and QR-code payments.

Similarly, Thailand’s PromptPay system aims to develop interoperable QR-code payments with neighbouring Cambodia. Retail payments will lead commercial or wholesale payments, but I suspect further consolidation will see high- and low-value payments leveraging the same real-time rails.

The Development of a Pan-Regional Payments Network

Consumers across Asia have been quick to adopt real-time payments because of the convenience and functionality they offer, delivered through a broad range of overlay services. Without the legacy payment systems that can impede innovation in mature markets, Southeast Asian countries are in an ideal position to leverage their robust domestic central payment infrastructures as a basis for cross-border linkages driven by existing market forces.

Ongoing payments system modernization, including adoption of ISO 20022, will lead to further bilateral cross-border linkages – and eventually, this will coalesce into a larger payments network.

Of course, payment players will also need to take stock of developments beyond SEA to predict cross-border opportunities. Japan, for example, has one of the world’s longest-serving real-time payment systems, having launched the Zengin system in 1973 for domestic interbank fund transfers.

While it has been upgraded many times over the years and is now in its seventh generation, merchants and fintechs are currently unable connect to Zengin directly. It will be interesting to see how Japan will update its central infrastructure to be more flexible, including the use of mobile IDs and QR codes, as well as the implementation of ISO 20022.

Malaysia’s PayNet, through its drive to innovate and what it has already achieved, is also well situated to play a key role in the development of the regional network. If it were to build on its existing interoperability with Singapore and include Thailand to create a tripartite real-time network, this would quickly become the model for others in the region to follow, including SEA’s largest economy, Indonesia.

Although these countries have the most developed financial services industries, rapid digital transformation and payments innovation in smaller economies like Vietnam and the Philippines do make it possible to envision a true pan-regional, real-time ecosystem.