Fintech and Banks

There has been a strong growth in Fintech across the globe, sparking a digital revolution within the traditional financial service. Accenture has recently published a study – “The Future of Fintech and Banking: Digitally disrupted or reimagined?”. This study describes the impact of Fintech on banks and makes suggestions on how Banks should respond to this new development. The study was conducted in conjunction with the views from 25 influential financial service executives.

The key challenge that traditional financial services are facing is legacy technology and its ability to manage a large infusion of new talents.

“Legacy technology and the difficulty of deploying new technology fast is a big part of this issue. All of the respondents felt that legacy technology presented an issue to their organisation, but only just over half said their bank had a strategic approach to decommissioning this old technology.”

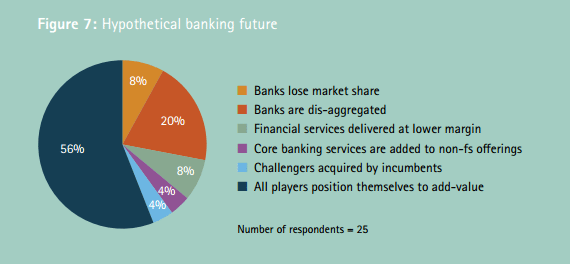

Nevertheless, majority of participants in the survey believe that financial services would survive and thrive.

Based on the study, Accenture found that the below 3 behaviours are crucial for traditional financial services to be able to benefit from the growth of fintech,

Openness

Provide access to outsiders to help generate new innovative ideas, cultivate the cutting edge solution. One of the success story is Fidor Bank who provides open APIs to third parties thus allowing customers to experiment and innovate as they would be able to work seamlessly with its core banking system.

Collaboration

The Report suggests that financial services can grow through forming alliances with complementary fintech players.

“Established players should look to collaborate more closely with those in different industries and with different outlooks to identify new ways to generate value.”

The main challenge for collaboration is the very different organisational cultures between fintech and banks, how they can effectively work together without hindering progress.

Investment

Start-ups with innovative business models often face capital issues, whereas Banks have lots of capital but behind in innovation. Hence, it is inevitable to see more of Bank’s innovation being generated through investment into fintech start-up.

This article first appeared on LinkedIn Pulse