Explosion of Data Fuels Demand for Regtech Amidst Growing Regulatory Complexity

by Fintech News Singapore August 27, 2021The proliferation of data and an ever-so complex regulatory environment are driving the rise of regtech, forcing financial institutions to look for new ways and tools to comply, experts said during a panel discussion.

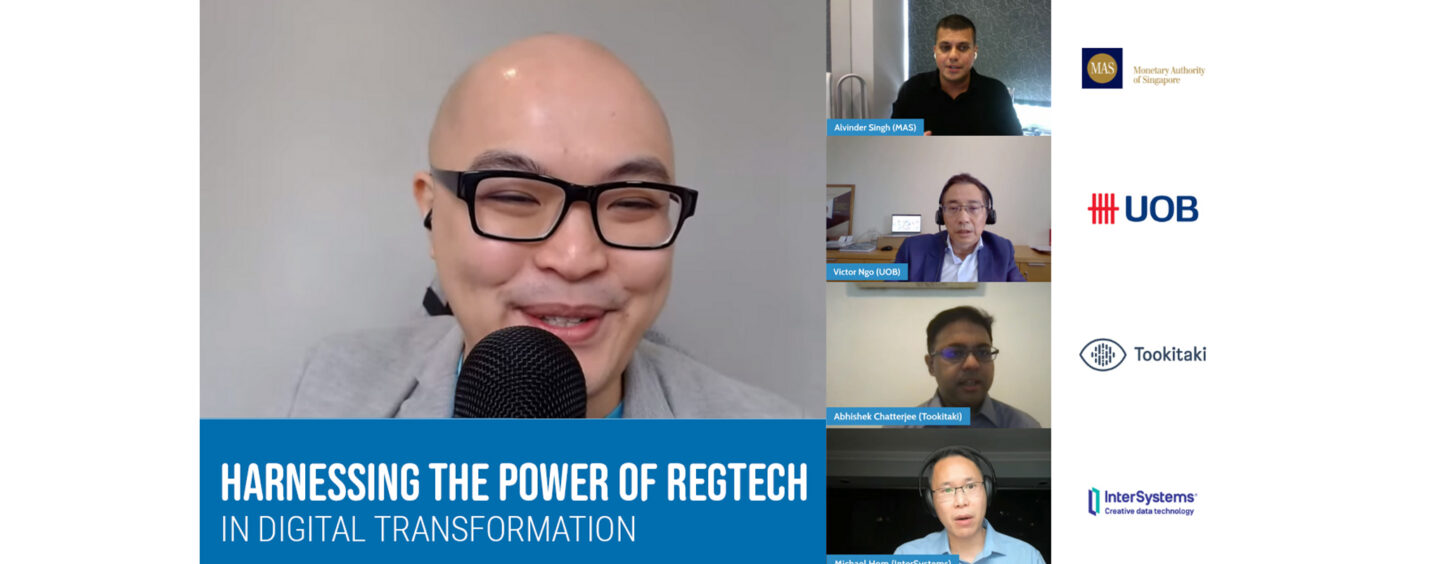

During Fintech Fireside Asia’s latest virtual session, top executives and officials from the Monetary Authority of Singapore (MAS), regtech provider Tookitaki, United Overseas Bank (UOB) and data technology vendor InterSystems came together to discuss the rapidly evolving regtech landscape and the key trends driving the sector.

Michael Hom, Head of Financial Solutions at InterSystems, said that as the financial services sector becomes more digitalised and data-driven, the advantages of tech-driven compliance monitoring compared to less automated alternatives are becoming evident.

Michael Hom, Head of Financial Solutions at InterSystems

“As the world becomes ever more digitally-oriented … and moves faster, the way we monitor and control need to change,” Hom said. “We have to move from purely detecting, maybe meditating, to ultimately preventing because everything is moving faster.”

Explosion of data driving regtech adoption

Alvinder Singh, Deputy Director of MAS’ Financial Technology and Innovation Group, said that demand for regtech is closely linked to the need of market participants and supervisors to process large amounts of data.

Alvinder Singh, Deputy Director – Financial Technology and Innovation Group, Monetary Authority of Singapore

“Data is the key driver of this: one, is the large amount of data that’s being produced; and two, is the large amount of data that needs to be analysed. Humans alone cannot do this,” Alvinder said. “The [tremendous] volume of data that needs to synthetised, … especially now that you’re using unstructured data and so on, this cannot only depend on humans.”

Echoing Alvinder, Michael said that the key to a successful regtech strategy relies heavily on data, adding that regulation and compliance are just one of the many use cases where an organisation’s data are put to work.

“As an organisation, you want to use your data appropriately for many different things whether that’s decisioning, reporting, insights, artificial intelligence (AI) and so forth,” Michael said. “We just see regulatory as another user or service that will play upon your data strategy.”

Abhishek Chatterjee, Founder and CEO of Tookitaki, noted the increasingly complex regulatory landscape as a major driver for regtech adoption. He cited digital assets as an example and the new regulations being introduced on a regular basis.

Abhishek Chatterjee, Founder and CEO of Tookitaki

Michael added that another point of complexity was the fact that rules vary from one jurisdiction to another. This means that, oftentimes, organisations have to rely on multiple regtech tools and providers.

“The amount of knowledge and understanding that you need to have [about these tools and providers] within those regulations forces it to be outsourced. Because there’s just so many people that have the capabilities and resources internally,” Hom said. “What came out of that is the spawning of a lot of regtechs that a lot of firms are utilising, at least in the US.”

Rising awareness and adoption

From a regtech provider’s standpoint, Abhishek said that awareness and education have risen significantly in the financial sector, a trend that goes hand in hand with accelerated adoption of technology across the broader industry.

Another trend he’s observed is the booming demand for tech-enabled compliance solutions from fintech companies and neobanks.

“Two years back, I don’t think compliance was considered one of the most important areas of fintechs and neobanks, but if you talk to every neobanks’ CEO now, they will say that compliance is a big area of focus for them,” Abhishek said.

“Adoption of regtech compliance by these new age, fintech companies is a huge trend that we will see. Especially when these companies come in, we will also see a trend towards cloud-based, software-as-a-service (SaaS)-based products … fintechs are tech-driven, they tend to be leaner in team and tend to be moving very fast.”

At UOB, Victor Ngo, the bank’s Head of Group Compliance, said that they’ve been using a combination of analytics, AI, and automation to tackle financial crime effectively while optimising resources.

Victor Ngo, Head of Group Compliance, United Overseas Bank (UOB)

“We have tapped machine learning (ML) to enhance our risk mitigation capabilities which are complemented by robotic process automation (RPA),” Victor said. “We have also applied AI to two risk dimensions within our AML framework – transaction monitoring and name screening.”

UOB has also partnered with Tookitaki to co-create and implement an AI-powered solution for transaction monitoring, a solution that has allowed it to analyse quickly the large volumes and high velocity of transaction data that UOB processes daily, Victor said.

“Financial crime has become more sophisticated and complex over the years, further exacerbated by the pandemic,” Victor said.

“While banks and financial institutions have existing preventative measures in place to tackle financial crime, regtech can bolster their defense against illicit activities. At UOB, we have achieved 96% prediction accuracy in high priority cases by tapping AI in transaction monitoring and name screening.”

A fairly nascent industry

To boost regtech adoption and development, MAS launched in April the Regtech Grant scheme. The scheme covers two tracks: the pilot track, where financial institutions are able to seek funding of up to S$75,000 to pilot potential regtech solutions before full-scale integration; and the production level project track, where financial institutions can seek funding of up to S$300,000 to develop larger-scale customised products.

So far, interest in the Regtech Grant scheme has been high, Alvinder said, noting that they’ve received more than 10 applications, among which two were already approved.

“The quality of the proposals that are coming in and the use cases are impressive,” Alvinder said. “There is a good variety of use cases: monitoring, data collection, and several anti-money laundering (AML) use cases.”

Based on the applications MAS has received, Alvinder said there’s a clear preference for in-house development, noting a desire to remain in control, and a lack of efficient regtech tools available on the market.

“[Financial institutions] want a lot of control of their tools, and one of the feedbacks we get is that the tools are just too complicated for them,” Alvinder said. “The person evaluating the tool could be from the tech team, but the person using the tool is not from the tech team but rather the compliance team. So it’s just too complicated for them and they don’t need something that sophisticated.”

Regtech is a wide sector that encompasses many areas, Alvinder said, and while much development has been made in regards to know-your-customer (KYC), AML and transaction monitoring, tools and solutions for areas like capital management and liquidity are still lacking.

“Those are very important and yet we don’t see that many tools,” Alvinder said. “Then on regulatory reporting, I will say upfront that I’m not impressed with most of the tools that I see. They don’t really meet the requirements for regtech reporting, etc.”

“This is actually good news because it means that the ecosystem is still wide open for a majority of players. Even the existing players have plenty of room to improve their tools. The last thing you want is an oversaturated ecosystem.”