Security a Bigger Concern for Online Shoppers Than User Experience

by Fintech News Singapore September 24, 2021The COVID-19 pandemic has forced both consumers and merchants to embrace online channels and digital payments at an accelerated pace, a shift that presented new sets of challenges, including rising fraud and security risks.

Separate surveys conducted by payment network Visa and online fraud specialist Vesta found that online merchants and shoppers are most concerned about security.

In Singapore, Indonesia and the Philippines, 41%, 33% and 32% of online shoppers, respectively, named safety and security amongst their top worries, according to the Vesta survey, which polled more than 4,300 online shoppers in these three markets.

Top concerns of online shoppers, Source: Vesta Online Payments Sentiments survey, 2021

Similarly, the Visa Back to Business global research study found that a third of consumers have stopped shopping at a store or with a brand due to a fraudulent charge, indicating that managing security risks has become critical for businesses.

The Visa research study, which surveyed 2,250 small business owners and 1,500 consumers in markets including Hong Kong and Singapore, indicates that online businesses are well aware of the need to ensure data privacy and security.

40% of Singapore small and micro businesses (SMBs) and 44% of Hong Kong SMBs surveyed named data privacy and security as one of their top concerns, above the global average of 33%. Nearly half (47% versus 39% globally) said that security and fraud management software is amongst the top critical investment areas needs to meet consumer expectations.

Rising fraud in Asia-Pacific (APAC)

In APAC, the rapid shift to online channels has sparked an upward trend in cybercrime and pushed the cost of fraud higher.

A recent study by data and analytics services provider LexisNexis Risk Solutions found that, in Australia, Hong Kong, India and Japan, the cost of every fraudulent transaction ranges between 3.51 and 3.87 times the actual value of a lost transaction. All four countries have higher costs than the regional 2019 average that involved other APAC markets at 3.40.

According to the research, fraud is becoming more insidious for a number of reasons, including the growing use of digital transaction channels and payment methods, the challenges businesses face when assessing fraud with these transactions, and poor fraud detection and prevention techniques adopted by online merchants.

In the e-commerce space, card not present (CNP) fraud, a type of card scam in which the customer does not physically present the card to the merchant during the transaction, has skyrocketed since the beginning of the pandemic.

In 2020, CNP fraud accounted for US$6.4 billion in losses, up from US$5.5 billion in 2018. Juniper Research projects that between 2018 and 2023, retailers will be losing up to US$130 billion in digital CNP fraud.

Consumers embrace contactless payments

Addressing fraud risks has become a pressing priority for businesses given that the new digital habits formed at the start of the pandemic will likely stick post-COVID-19.

A majority of global consumers (68%) surveyed by Visa said that COVID-19 has permanently changed how they will pay for things now and the future, with a preference for safer and more touchless ways to pay. In the next three months, 60% of consumers expect they will use contactless payments whenever possible.

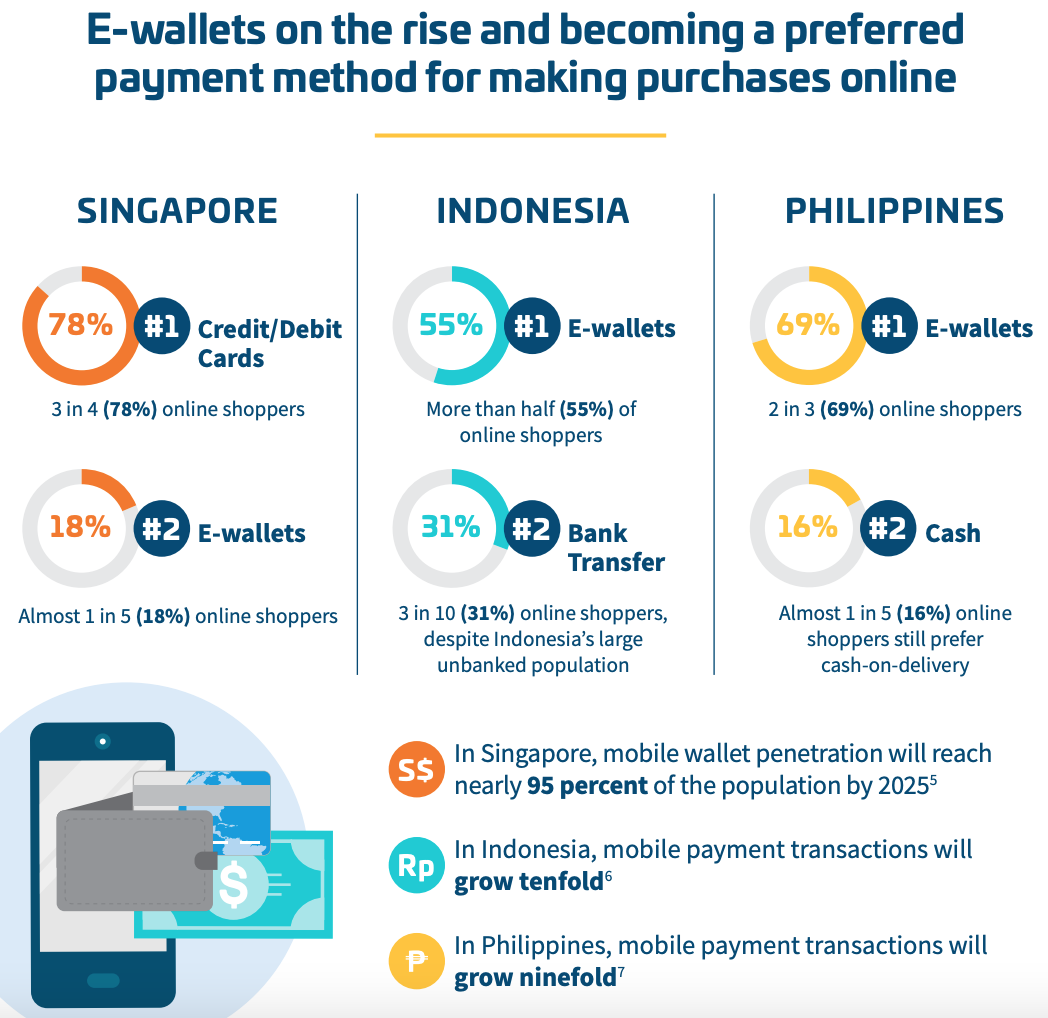

In several Southeast Asian countries, e-wallets are already the preferred payment method for making purchases online. In Indonesia, more than half (55%) of online shoppers surveyed by Vesta indicated favoring e-wallets, a figure that surges to 69% in the Philippines. Singaporeans still prefer credit/debit cards, but by 2025, it’s estimated that mobile wallet penetration will reach nearly 95% of the population.

The rise of e-wallets for online purchases in Southeast Asia, Source- Source: Vesta Online Payments Sentiments survey, 2021

Featured image credit: Photo by Mikhail Nilov from Pexels