Bot Attacks Are on the Rise in APAC and They Are Targeting Online Shoppers

by Fintech News Singapore October 11, 2021Asia-Pacific (APAC) continues to see higher attack rates in comparison to global figures, a trend that’s been sustained by the ongoing digital shift induced by COVID-19.

According to LexisNexis Risk Solutions’ latest biannual Cybercrime Report, H1 2021 was marked by surging bot attacks activities, rising attacks towards e-commerce platforms, and a shift towards mobile channels.

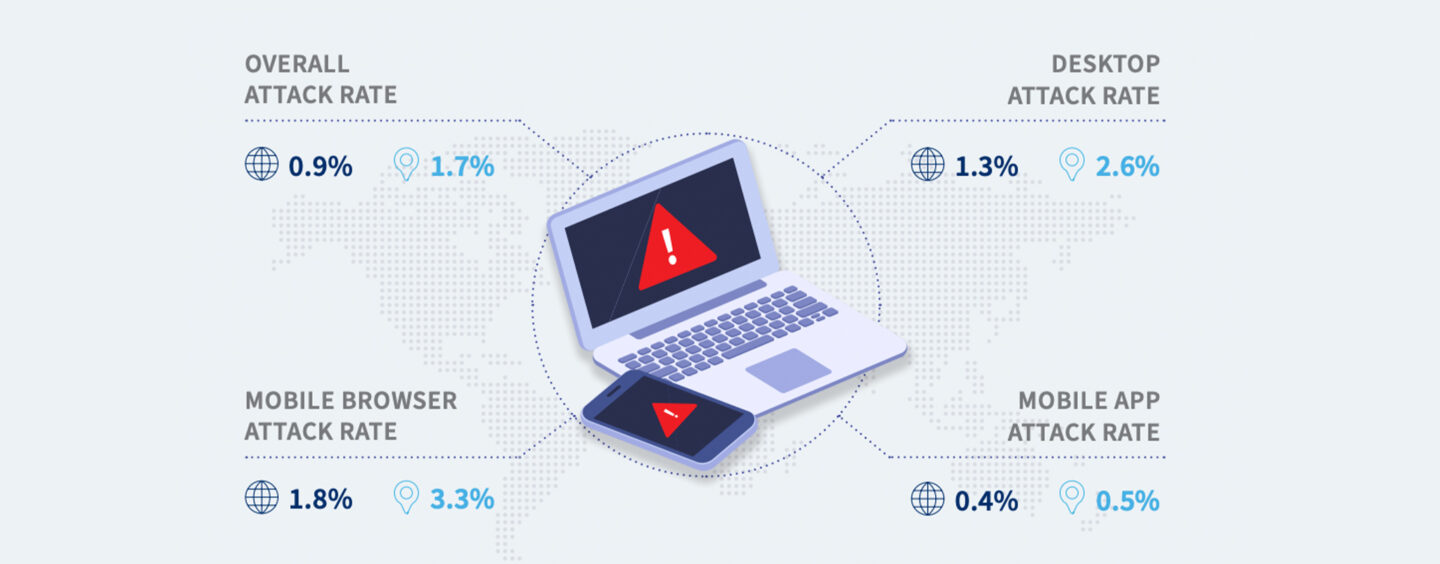

The study, which draws on cybercrime attacks detected by the LexisNexis Digital Identity Network from January to June 2021, found that although attack rates have decreased across all channels year-over-year (YoY), the region continues to score above the global averages.

APAC position against global figures, Source: LexisNexis Risk Solutions Cybercrime Report H1 2021

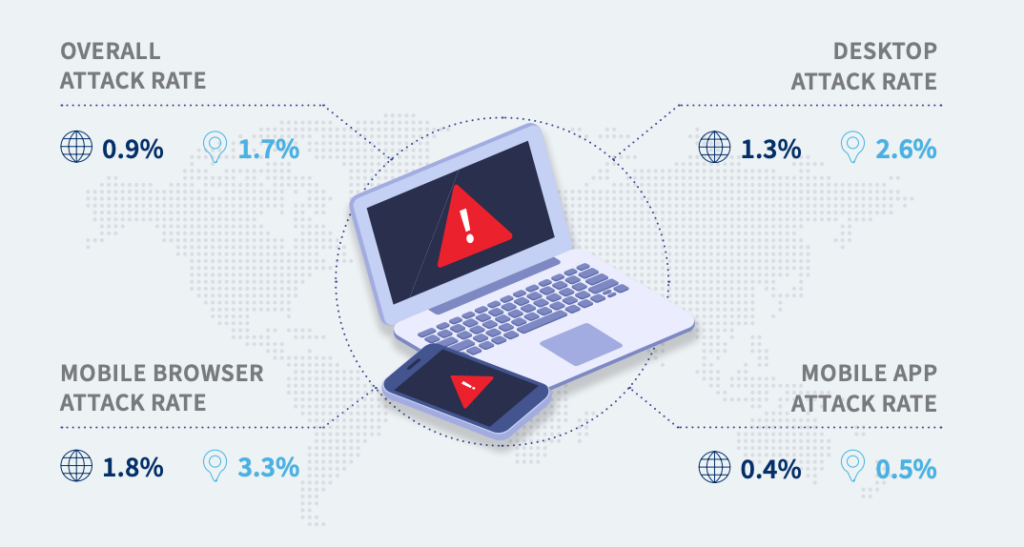

In the first half of the year, automated bot attacks surged globally but were particularly prevalent in APAC where the rise was stronger. In H1 2021, bot attacks grew by a whopping 86% in APAC, compared to a global growth rate of 41%, a surge that was driven by the several extremely large attack peaks seen towards the end of March 2021, the report says.

Daily attack rates across all regions, Source: LexisNexis Risk Solutions Cybercrime Report H1 2021

One particular trend that emerged in H1 2021 is the rise of attacks targeting e-commerce platforms, where fraudsters would attempt to hack into trusted user accounts to access card-on-file and make large purchases.

This trend comes on the back of booming e-commerce activity resulting from COVID-19 lockdowns.

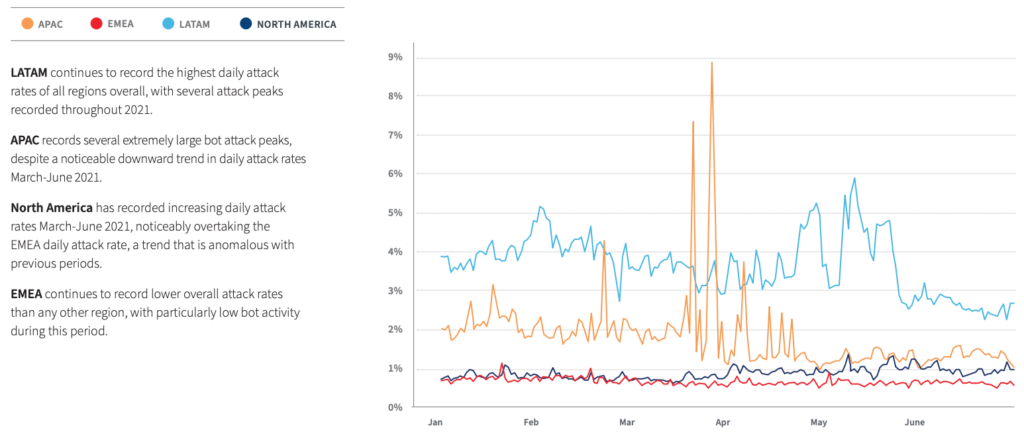

In 2021, a large portion of Southeast Asians switched to becoming avid online shoppers. According to Facebook and Bain and Company’s annual SYNC Southeast Asia report, the share of consumers who say they shop “mostly online” went up to 45% this year, up from 33% in 2020.

The largest increase was observed in Singapore, Malaysia and the Philippines where 53%, 46% and 34% of respondents, respectively, indicated online channels as their most used purchase channels.

% responses citing online as most purchase channels, Source: 2021 SYNC Southeast Asia, Facebook and Bain and Company

Digital payments, virtual banking on the rise

Data gathered from LexisNexis also showed that digital payments continued to soar as consumers shifted further online. New payment options such as buy-now-pay-later (BNPL) services and digital wallets proliferated, helping push adoption.

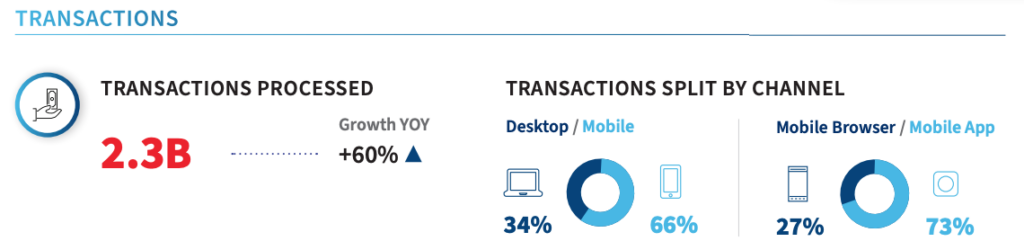

In H1 2021, 2.3 billion online transactions, including account creations, logins, and payments, were processed in APAC by the LexisNexis Digital Identity Network, up 60% YoY.

66% of these transactions were conducted via mobile channels, indicating that consumers continued to shift to mobile in favor of desktop. Data also showed the strong preference for transacting via mobile applications, with 73% of mobile transactions between conducted through apps.

APAC transaction patterns, Source: LexisNexis Risk Solutions Cybercrime Report H1 2021

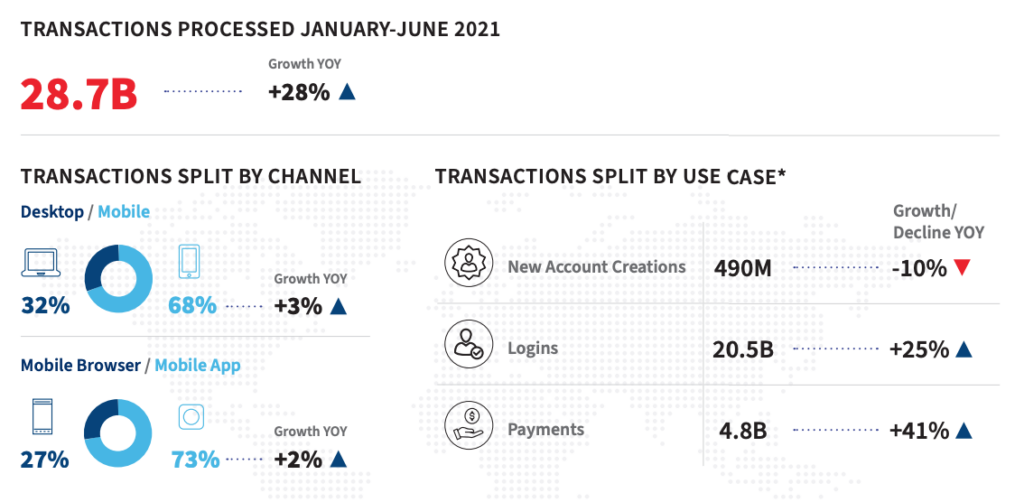

APAC metrics were consistent with trends observed globally. In H1 2021, online transaction volume grew 28% YoY worldwide to reach 28.7 billion. Logins via online channels rose 25% while online payments surged 41%.

The rise of online payments brought with it booming fraud activity. In H1 2021, financial services payment transactions continued to be attacked at a higher rate than any other industry, up 41%, the report says.

Global transaction patterns in numbers, Source: LexisNexis Risk Solutions Cybercrime Report H1 2021

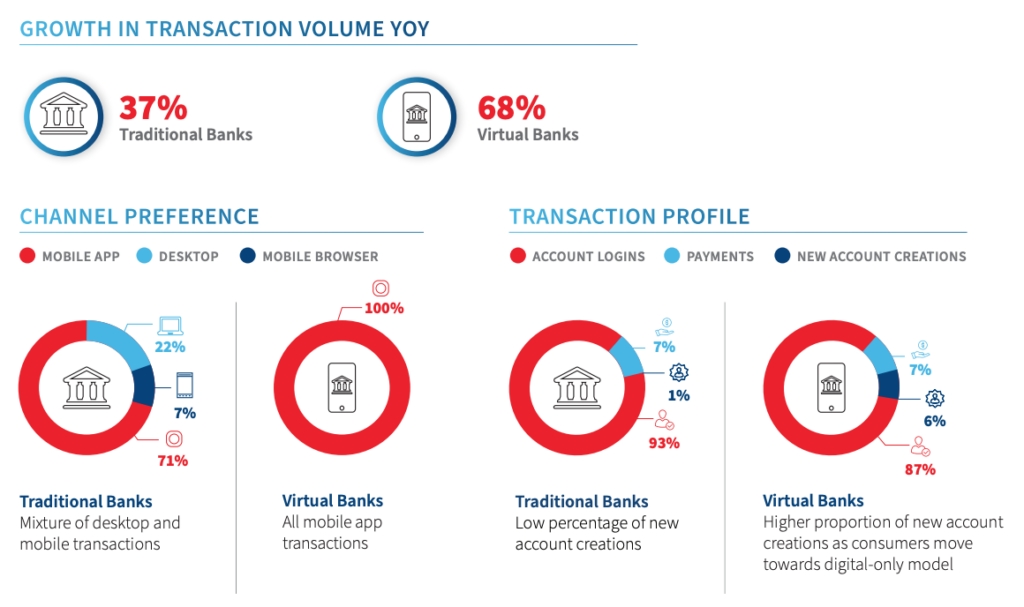

The report also shared metrics from traditional banks versus virtual banks, showing that the latter gained notable traction. In H1 2021, growth in transaction volume at virtual banks went up a massive 68% YoY, against just 37% for incumbent banks. Virtual banks also recorded a higher proportion of new account creations (6%), compared to traditional banks (1%).

Consumer behavior across traditional and virtual banks, Source: LexisNexis Risk Solutions Cybercrime Report H1 2021

In APAC, consumers are flocking onto virtual banks. A separate research by paytech company Banking Payments Context (BPC) and the Fintech Consultancy Group (Fincog) found that in H1 2021, APAC neobanks onboarded 134.8 million new customers, a 113.6% surge in new customer acquisition compared to 2020’s figure of 63.1 million new customers.

The figure brought the total number of APAC neobank in H1 2021 to 437.2 million, up 44.57% from 2020 at 302.4 million.